Stablecoins: The Key To Stripe's $91.5 Billion Valuation?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stablecoins: The Key to Stripe's $91.5 Billion Valuation?

Stripe, the multinational financial services company, recently saw its valuation skyrocket to a staggering $91.5 billion. While its innovative payment processing platform undoubtedly plays a significant role in this success, the increasing integration of stablecoins into its infrastructure may be a crucial, often overlooked, factor. This article delves into the potential connection between Stripe's growth and its strategic embrace of stablecoins.

Stripe's Rise and the Growing Importance of Stablecoins

Stripe’s meteoric rise is largely attributed to its streamlined and developer-friendly payment processing solutions. Businesses globally rely on Stripe for seamless online transactions, simplifying complex payment flows. However, traditional payment systems are often plagued by high fees, slow processing times, and volatile exchange rates. This is where stablecoins enter the picture.

Stablecoins, cryptocurrencies pegged to a stable asset like the US dollar, offer a compelling alternative. They provide the speed and efficiency of cryptocurrencies while mitigating the volatility associated with other digital assets. This stability is crucial for businesses seeking predictable transaction costs and minimizing currency risk.

How Stablecoins Benefit Stripe and its Clients

Stripe's integration of stablecoins offers several key advantages:

- Reduced Transaction Costs: Stablecoin transactions often involve significantly lower fees compared to traditional payment methods, leading to increased profitability for both Stripe and its clients.

- Faster Processing Speeds: Crypto transactions, including those involving stablecoins, typically settle much faster than traditional bank transfers, improving efficiency and user experience.

- Global Reach: Stablecoins facilitate cross-border payments more easily than traditional systems, opening new markets for businesses and expanding Stripe's global reach.

- Increased Transparency: Blockchain technology underlying stablecoins enhances transparency in transactions, providing a verifiable audit trail.

- Enhanced Security: While not immune to risks, stablecoins, when properly managed, can offer enhanced security features compared to traditional payment systems vulnerable to fraud.

The Strategic Advantage: A Deeper Look

Stripe's strategic adoption of stablecoin technology isn't just about offering another payment option; it's about building a more robust, efficient, and globally accessible financial infrastructure. By offering stablecoin processing, Stripe positions itself as a leader in the evolving fintech landscape, attracting businesses seeking innovative and cost-effective payment solutions. This forward-thinking approach is arguably a significant contributor to its impressive valuation.

Challenges and Future Outlook

While the integration of stablecoins offers numerous benefits, challenges remain. Regulatory uncertainty surrounding stablecoins is a major hurdle, and concerns about their stability and security persist. However, ongoing developments in the stablecoin space and increased regulatory clarity are likely to alleviate these concerns over time.

Conclusion: A Symbiotic Relationship?

While it's impossible to definitively state that stablecoins are the key to Stripe's $91.5 billion valuation, their integration is undoubtedly a significant factor in its continued success. As stablecoin technology matures and regulatory frameworks evolve, we can expect to see even greater integration within payment processing platforms like Stripe, further solidifying their position in the global financial ecosystem. The relationship between Stripe and stablecoins appears symbiotic: Stripe benefits from increased efficiency and global reach, while stablecoins gain wider adoption and legitimacy through integration with a major player in the financial services industry. This synergistic relationship is likely to play an even larger role in shaping the future of finance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stablecoins: The Key To Stripe's $91.5 Billion Valuation?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Compartilhamento De Casas Solucoes Para Curtir Praia E Campo Sem Compra De Imovel

Mar 04, 2025

Compartilhamento De Casas Solucoes Para Curtir Praia E Campo Sem Compra De Imovel

Mar 04, 2025 -

Samsungs Next Tri Fold Screen Size Hinge And 3 More Predicted Features

Mar 04, 2025

Samsungs Next Tri Fold Screen Size Hinge And 3 More Predicted Features

Mar 04, 2025 -

Ethereum Price Rally 10 Jump But Will Eth Break The Descending Channel

Mar 04, 2025

Ethereum Price Rally 10 Jump But Will Eth Break The Descending Channel

Mar 04, 2025 -

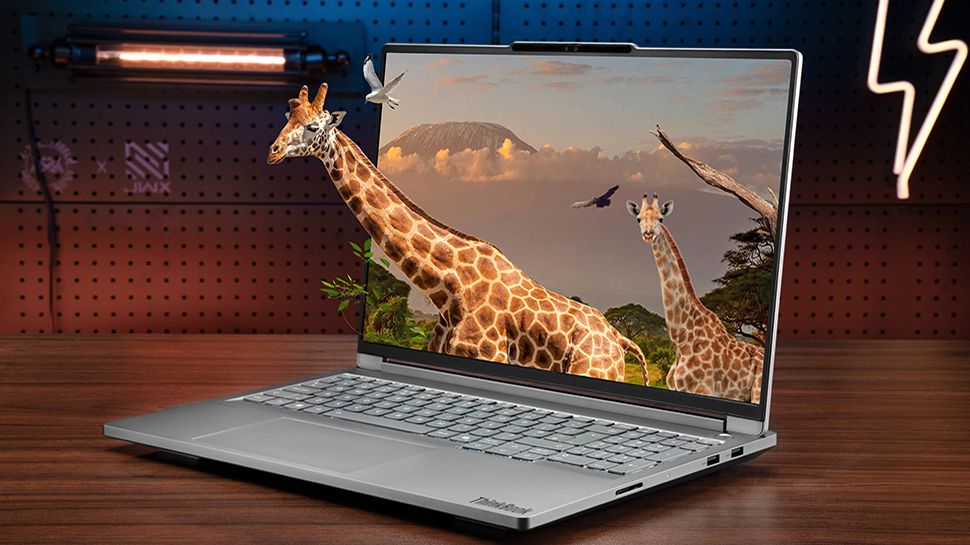

Lenovo Think Book 3 D A Late But Impressive Entry Into Glasses Free 3 D

Mar 04, 2025

Lenovo Think Book 3 D A Late But Impressive Entry Into Glasses Free 3 D

Mar 04, 2025 -

Lenovo Think Book 3 D Review Impressive Tech Questionable Timing

Mar 04, 2025

Lenovo Think Book 3 D Review Impressive Tech Questionable Timing

Mar 04, 2025