Standard Chartered Boosts Capital Efficiency With Share Repurchases

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Strengthens Capital Position with Significant Share Repurchases

London, UK – October 26, 2023 – Standard Chartered plc (STAN.L), a leading international banking group, announced today a substantial share repurchase program aimed at bolstering capital efficiency and returning value to shareholders. This strategic move follows strong financial performance and underscores the bank's confidence in its future prospects. The news sent ripples through the financial markets, impacting both share price and investor sentiment.

The share buyback program, totaling up to $1 billion, represents a significant commitment to enhancing shareholder returns. This initiative demonstrates Standard Chartered's dedication to optimizing its capital allocation strategy and reflects its robust financial position. The repurchase will be executed in accordance with market conditions and applicable regulations.

Boosting Capital Efficiency: A Strategic Move

Standard Chartered's decision to repurchase shares is a calculated strategy designed to improve its return on equity (ROE) and enhance its overall capital efficiency. By reducing the number of outstanding shares, the bank increases the earnings per share (EPS) for its remaining shareholders, thereby boosting their returns. This is particularly relevant given the bank's recent strong performance.

This strategic move also signals Standard Chartered's belief in its long-term growth trajectory. Repurchasing shares demonstrates confidence in the bank’s ability to generate strong future earnings and deliver sustainable value creation for its investors.

Impact on Investors and Market Sentiment

The announcement of the share repurchase program was met with largely positive reactions from investors. The news is likely to bolster confidence in the bank's management and its ability to effectively manage its capital. Analysts are already speculating on the potential impact on the share price, predicting further growth in the short to medium term. The increased EPS is expected to attract more investors, potentially leading to increased trading volume and a stronger share price.

However, some analysts caution against solely focusing on share buybacks as a measure of financial health. They emphasize the importance of considering other factors such as loan growth, asset quality, and overall economic conditions. Nevertheless, the immediate market reaction suggests that the buyback announcement is a positive development for Standard Chartered.

Looking Ahead: Sustained Growth and Value Creation

Standard Chartered's share repurchase program forms a crucial part of its broader strategy for sustainable growth and value creation. The bank remains committed to delivering strong financial performance while adhering to strict regulatory standards and responsible banking practices. This buyback signifies a significant step in returning value to shareholders and strengthens Standard Chartered's position as a leading player in the global banking industry.

Key takeaways:

- Significant Buyback: Standard Chartered is repurchasing up to $1 billion worth of its own shares.

- Enhanced Capital Efficiency: The buyback aims to improve return on equity (ROE) and earnings per share (EPS).

- Positive Market Sentiment: The announcement was well-received by investors, boosting confidence in the bank.

- Long-Term Strategy: The share repurchase is part of a broader strategy for sustainable growth and value creation.

This strategic move positions Standard Chartered for continued success and underlines its commitment to maximizing shareholder value in the years to come. Further updates on the progress of the share repurchase program will be provided in accordance with regulatory requirements.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered Boosts Capital Efficiency With Share Repurchases. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ikn Terdampak Infestasi Tikus Selama Libur Lebaran Penjelasan Resmi

Apr 08, 2025

Ikn Terdampak Infestasi Tikus Selama Libur Lebaran Penjelasan Resmi

Apr 08, 2025 -

Myanmar Earthquake Death Toll Rises To 3 471 Amidst Heavy Rains

Apr 08, 2025

Myanmar Earthquake Death Toll Rises To 3 471 Amidst Heavy Rains

Apr 08, 2025 -

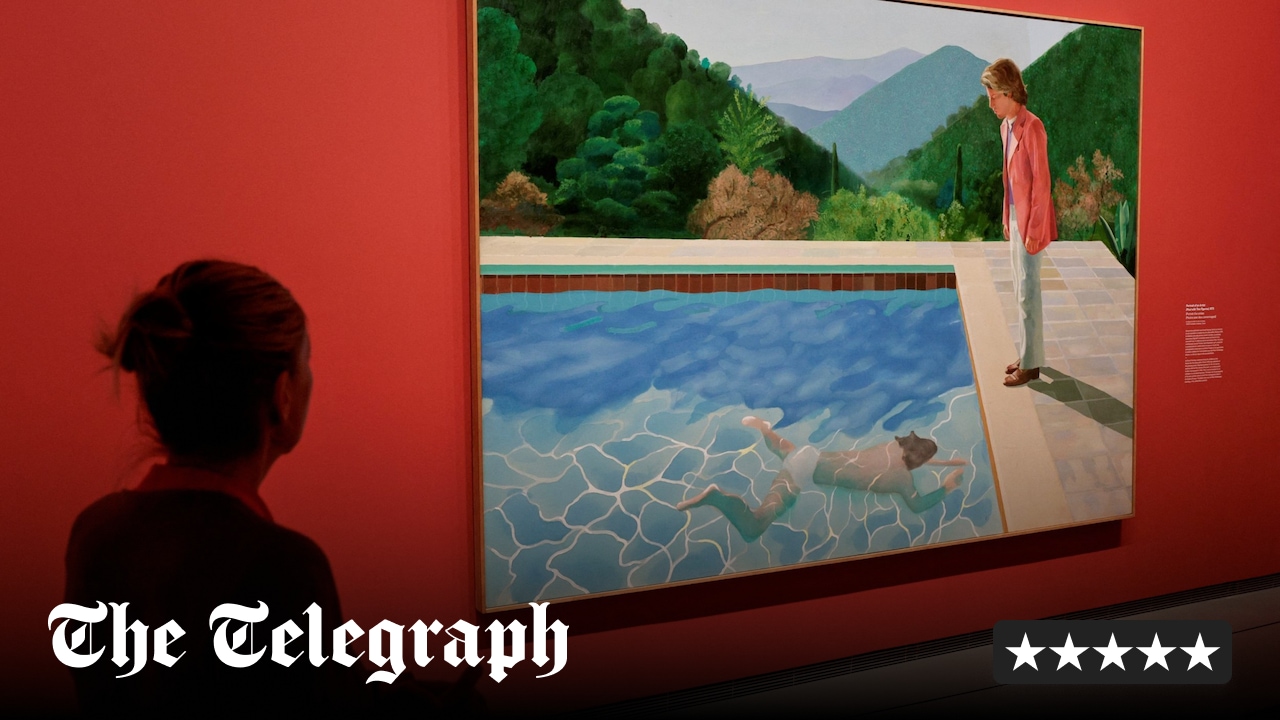

David Hockneys Parisian Masterpiece An Unprecedented Retrospective

Apr 08, 2025

David Hockneys Parisian Masterpiece An Unprecedented Retrospective

Apr 08, 2025 -

Pemain Muda Persib Bandung Siap Menikah Kisah Cinta Dan Karier

Apr 08, 2025

Pemain Muda Persib Bandung Siap Menikah Kisah Cinta Dan Karier

Apr 08, 2025 -

David Hockney At 25 A Retrospective At The Fondation Louis Vuitton

Apr 08, 2025

David Hockney At 25 A Retrospective At The Fondation Louis Vuitton

Apr 08, 2025