Standard Chartered Executes Share Repurchase Program

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Executes Share Repurchase Program, Boosting Investor Confidence

Standard Chartered PLC, a leading international banking group, has announced the successful execution of its share repurchase program, signaling a positive outlook and bolstering investor confidence. The move reflects the bank's strong financial position and commitment to returning value to shareholders. This strategic decision follows a period of robust financial performance, demonstrating the bank's resilience and growth trajectory in a challenging global economic climate.

Details of the Share Repurchase Program:

The share repurchase program, authorized by the board earlier this year, involved the repurchase of a significant number of Standard Chartered's own shares. While the exact number of shares repurchased and the total cost haven't been publicly disclosed in complete detail, the bank confirmed the successful completion of the program within the pre-defined parameters. This suggests a substantial investment in buybacks, demonstrating a belief in the company's future prospects. The program likely aimed to increase earnings per share (EPS) and potentially reduce the number of outstanding shares, thereby increasing the value of each remaining share. Further details on the specific timing and execution of the buybacks are anticipated to be revealed in the bank's upcoming financial reports.

Impact on Shareholders and Investors:

This action is generally viewed positively by shareholders. Share buyback programs can lead to several benefits for investors, including:

- Increased Earnings Per Share (EPS): By reducing the number of outstanding shares, the same earnings are distributed among fewer shares, resulting in a higher EPS. This often translates to a higher share price, benefiting existing shareholders.

- Enhanced Shareholder Value: Share repurchases signal confidence from management in the company's future prospects. This can lead to increased investor confidence and a potentially higher share price.

- Improved Return on Equity (ROE): Reducing the number of outstanding shares can boost the return on equity, a key metric for assessing a company's profitability.

Strategic Implications for Standard Chartered:

The execution of this share repurchase program underlines Standard Chartered's robust financial health and strategic planning. It suggests that the bank has sufficient capital to invest in its growth and simultaneously return value to shareholders. This demonstrates a proactive approach to capital allocation, a crucial aspect of effective financial management for any publicly traded company. The move underscores the bank's confidence in its ability to navigate ongoing global economic uncertainties and maintain its strong market position.

Looking Ahead:

The completion of the share repurchase program marks a significant milestone for Standard Chartered. Investors will be keenly watching the bank’s future performance and any further announcements regarding capital allocation strategies. The market reaction to this news will likely provide further insights into investor sentiment and the perceived impact of this strategic decision on the bank's long-term value. Further analysis from financial analysts will offer a deeper understanding of the strategic implications of this move for Standard Chartered’s overall business strategy.

Keywords: Standard Chartered, Share Repurchase, Buyback Program, Stock Repurchase, Investor Confidence, EPS, ROE, Shareholder Value, Financial Performance, Banking, International Banking, Capital Allocation, Global Economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered Executes Share Repurchase Program. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Melbourne Storm Devastated Key Playmaker Out For Three Months

Apr 07, 2025

Melbourne Storm Devastated Key Playmaker Out For Three Months

Apr 07, 2025 -

Knights Offense Struggles Coach Expresses Concern

Apr 07, 2025

Knights Offense Struggles Coach Expresses Concern

Apr 07, 2025 -

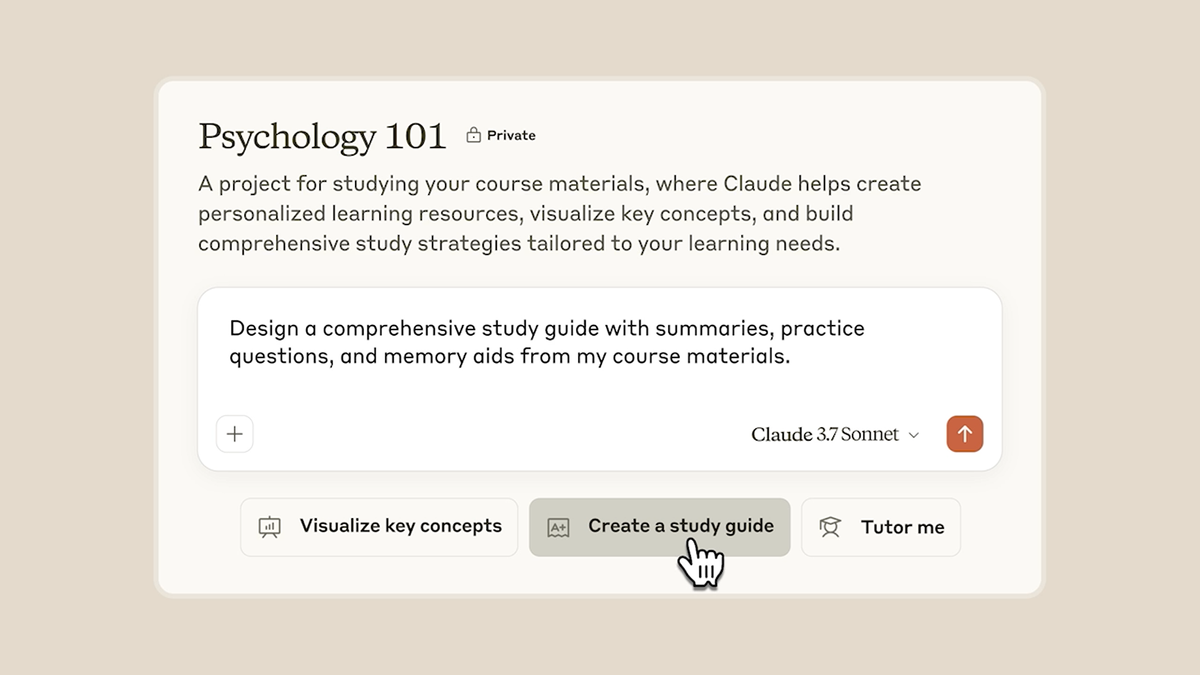

Study Smarter Not Harder Claudes College Study Guide

Apr 07, 2025

Study Smarter Not Harder Claudes College Study Guide

Apr 07, 2025 -

Clippers Mavericks Game Observed Comment Targets Nico Harrison

Apr 07, 2025

Clippers Mavericks Game Observed Comment Targets Nico Harrison

Apr 07, 2025 -

Analise Semanal Copom Ipca Dados Da China E O Cenario Industrial Brasileiro

Apr 07, 2025

Analise Semanal Copom Ipca Dados Da China E O Cenario Industrial Brasileiro

Apr 07, 2025