Standard Chartered Predicts $500,000 Bitcoin: Bond Market Concerns Fuel Crypto Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Predicts $500,000 Bitcoin: Bond Market Concerns Fuel Crypto Surge

Bitcoin's price could skyrocket to a staggering $500,000 in the next few years, according to a bold prediction from Standard Chartered. This prediction, released amidst growing concerns within the bond market, highlights a potential flight to safety driving investors towards alternative assets like Bitcoin. The surge in cryptocurrency interest underscores a complex interplay of macroeconomic factors and evolving investor sentiment.

The global financial landscape is currently experiencing significant turbulence. Rising inflation and increasing interest rates have put immense pressure on the bond market, traditionally considered a safe haven for investors. This instability is prompting a reassessment of risk and a search for alternative investments capable of hedging against inflation and economic uncertainty.

<h3>Why is Standard Chartered so bullish on Bitcoin?</h3>

Standard Chartered's prediction isn't based on mere speculation. Their analysts point to several key factors contributing to their optimistic outlook:

- Inflation Hedge: Bitcoin's limited supply of 21 million coins makes it an attractive hedge against inflation. As fiat currencies lose value, investors are increasingly turning to Bitcoin as a store of value.

- Institutional Adoption: The growing acceptance of Bitcoin by institutional investors, including major corporations and investment firms, signals a shift in market perception and increasing legitimacy.

- Technological Advancements: Ongoing developments in the Bitcoin ecosystem, such as the Lightning Network for faster and cheaper transactions, are further enhancing its utility and appeal.

- Bond Market Instability: The current volatility in the bond market is pushing investors to seek alternative assets with potentially higher returns, even with associated risks. Bitcoin is perceived by some as such an asset.

<h3>The Risks Remain: Navigating Volatility</h3>

While the $500,000 Bitcoin prediction is exciting, it's crucial to acknowledge the inherent volatility of the cryptocurrency market. Investing in Bitcoin carries significant risk, and price fluctuations can be dramatic. Standard Chartered's prediction is a long-term outlook, and the path to reaching such a high price point is unlikely to be linear.

Several factors could impact Bitcoin's price trajectory, including:

- Regulatory Uncertainty: Varying regulatory frameworks across different jurisdictions pose a challenge to Bitcoin's widespread adoption.

- Market Manipulation: The cryptocurrency market is susceptible to manipulation, which can lead to unpredictable price swings.

- Technological Challenges: Scalability and security concerns within the Bitcoin network could influence investor confidence.

<h3>The Bigger Picture: Crypto's Growing Influence</h3>

Standard Chartered's prediction is more than just a price forecast; it reflects a broader trend of growing institutional interest and mainstream acceptance of cryptocurrencies. The potential for Bitcoin to reach such a high valuation underscores its increasing significance in the global financial system. As traditional markets face challenges, alternative assets like Bitcoin are gaining traction as investors search for diversification and resilience.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies carries significant risk, and you should conduct thorough research and seek professional advice before making any investment decisions.

Keywords: Bitcoin, Bitcoin price prediction, Standard Chartered, Cryptocurrency, Bond market, Inflation, Investment, Crypto investment, Bitcoin price, Volatility, Cryptocurrency market, Institutional adoption, Risk, Hedge, Financial markets, Economic uncertainty

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered Predicts $500,000 Bitcoin: Bond Market Concerns Fuel Crypto Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Edman Fits Into The Dodgers Lineup Strategy

May 22, 2025

How Edman Fits Into The Dodgers Lineup Strategy

May 22, 2025 -

Dells Ceo On Ai Boosting Productivity And Human Capabilities

May 22, 2025

Dells Ceo On Ai Boosting Productivity And Human Capabilities

May 22, 2025 -

Conference Finals Game 1 Thunders Shai Gilgeous Alexander Outduels Wolves

May 22, 2025

Conference Finals Game 1 Thunders Shai Gilgeous Alexander Outduels Wolves

May 22, 2025 -

Eastern Conference Final Panthers Vs Hurricanes Game 1 Breakdown And Analysis

May 22, 2025

Eastern Conference Final Panthers Vs Hurricanes Game 1 Breakdown And Analysis

May 22, 2025 -

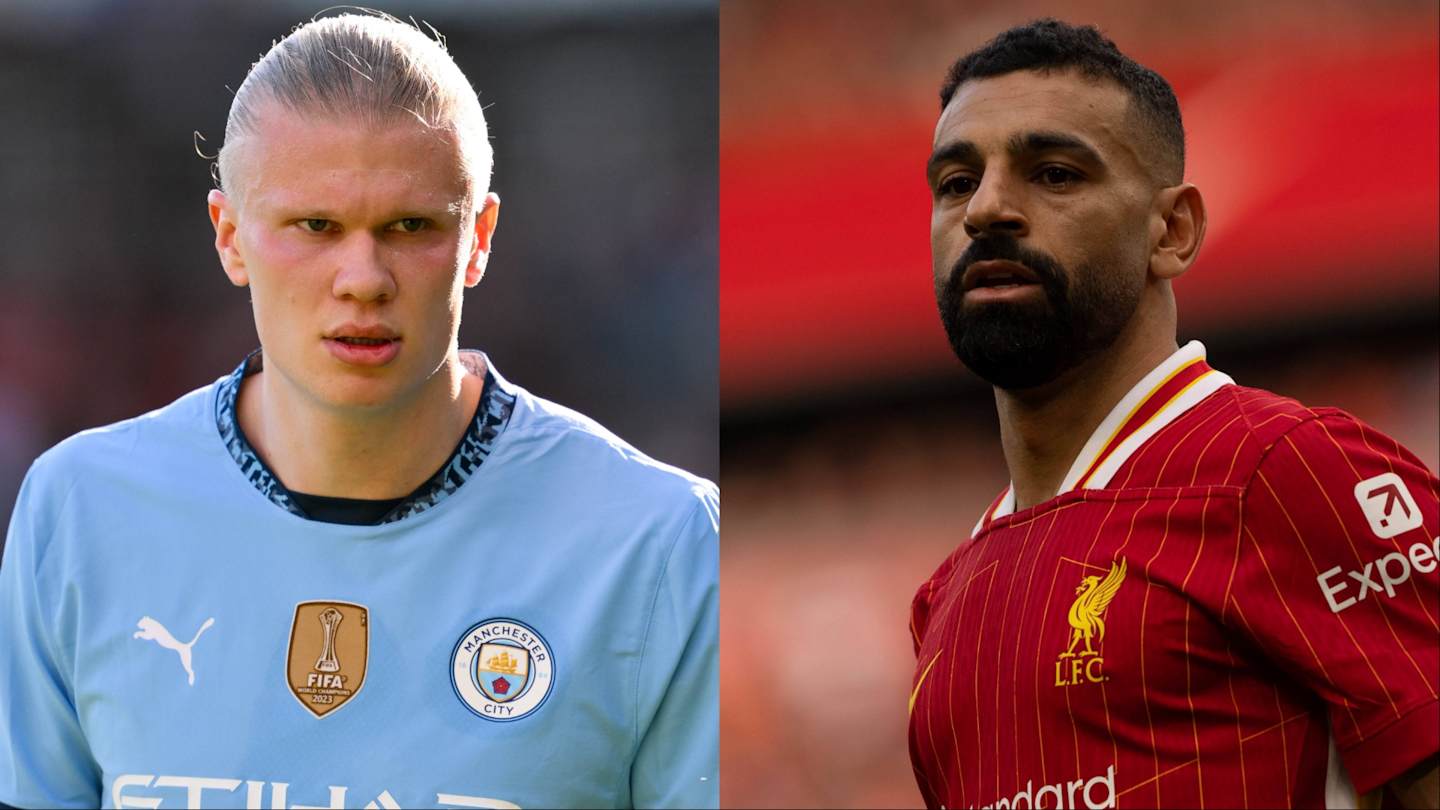

Golden Boot Showdown Tracking The Premier Leagues Top Goalscorers

May 22, 2025

Golden Boot Showdown Tracking The Premier Leagues Top Goalscorers

May 22, 2025