Standard Chartered Predicts Bitcoin Surge To $500,000: Government Holdings Fuel Rally

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Predicts Bitcoin Surge to $500,000: Government Holdings Fuel Rally

Bitcoin's price could skyrocket to a staggering $500,000 in the next few years, according to a bold prediction from Standard Chartered, a leading global bank. This bullish forecast hinges on a fascinating development: increasing government adoption of Bitcoin as a strategic reserve asset. The report suggests that this institutional interest, coupled with growing scarcity due to Bitcoin's capped supply, will be the primary driver of this monumental price surge.

The financial institution's analysts believe that governments, recognizing Bitcoin's potential as a hedge against inflation and a tool for diversifying their portfolios, will increasingly allocate funds to the cryptocurrency. This strategic shift, they argue, will create significant upward pressure on the price, potentially catapulting Bitcoin far beyond its current trading levels.

Government Adoption: The Key Catalyst

Standard Chartered's report highlights several key reasons why government adoption is pivotal to Bitcoin's future price appreciation:

- Inflation Hedge: With global inflation remaining stubbornly high, governments are seeking assets that can protect their reserves from devaluation. Bitcoin's limited supply and decentralized nature make it an attractive alternative to traditional fiat currencies.

- Geopolitical Diversification: Holding Bitcoin allows countries to diversify their reserves away from traditional powerhouses like the US dollar, reducing reliance on potentially volatile geopolitical landscapes.

- Technological Advancement: The underlying technology of Bitcoin, blockchain, offers potential benefits for various government services, from secure record-keeping to efficient cross-border payments.

Challenges and Considerations

While the prediction is audacious, the report acknowledges potential challenges that could impact Bitcoin's price trajectory:

- Regulatory Uncertainty: Varying regulatory landscapes across different jurisdictions could hinder widespread government adoption. Clearer and more consistent regulations are crucial for fostering institutional confidence.

- Market Volatility: Bitcoin's inherent volatility remains a concern. Significant price swings could deter some governments from investing heavily in the cryptocurrency.

- Environmental Concerns: The energy consumption associated with Bitcoin mining remains a subject of ongoing debate and a potential barrier to widespread acceptance.

The Road to $500,000: A Gradual Ascent or Meteoric Rise?

Standard Chartered doesn't specify a precise timeline for Bitcoin reaching the half-million-dollar mark. However, the analysts believe that the predicted price surge will likely be a gradual process, driven by increasing government adoption and sustained institutional interest. The report suggests that this process could take several years to fully unfold.

This bold prediction from a major financial institution is significant. It signals a growing acceptance of Bitcoin's potential within the mainstream financial world and highlights the evolving relationship between governments and cryptocurrencies. Whether Bitcoin will truly reach $500,000 remains to be seen, but Standard Chartered's analysis underscores the increasing influence of government involvement in shaping Bitcoin's future.

Keywords: Bitcoin, Cryptocurrency, Standard Chartered, Price Prediction, Government Adoption, $500,000, Bitcoin price, Cryptocurrency investment, Blockchain, Inflation Hedge, Geopolitical Diversification, Bitcoin future, Crypto regulation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered Predicts Bitcoin Surge To $500,000: Government Holdings Fuel Rally. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pacers Shock Knicks In Ot Thriller Haliburtons Buzzer Beater Seals Game 1 Victory

May 22, 2025

Pacers Shock Knicks In Ot Thriller Haliburtons Buzzer Beater Seals Game 1 Victory

May 22, 2025 -

17

May 22, 2025

17

May 22, 2025 -

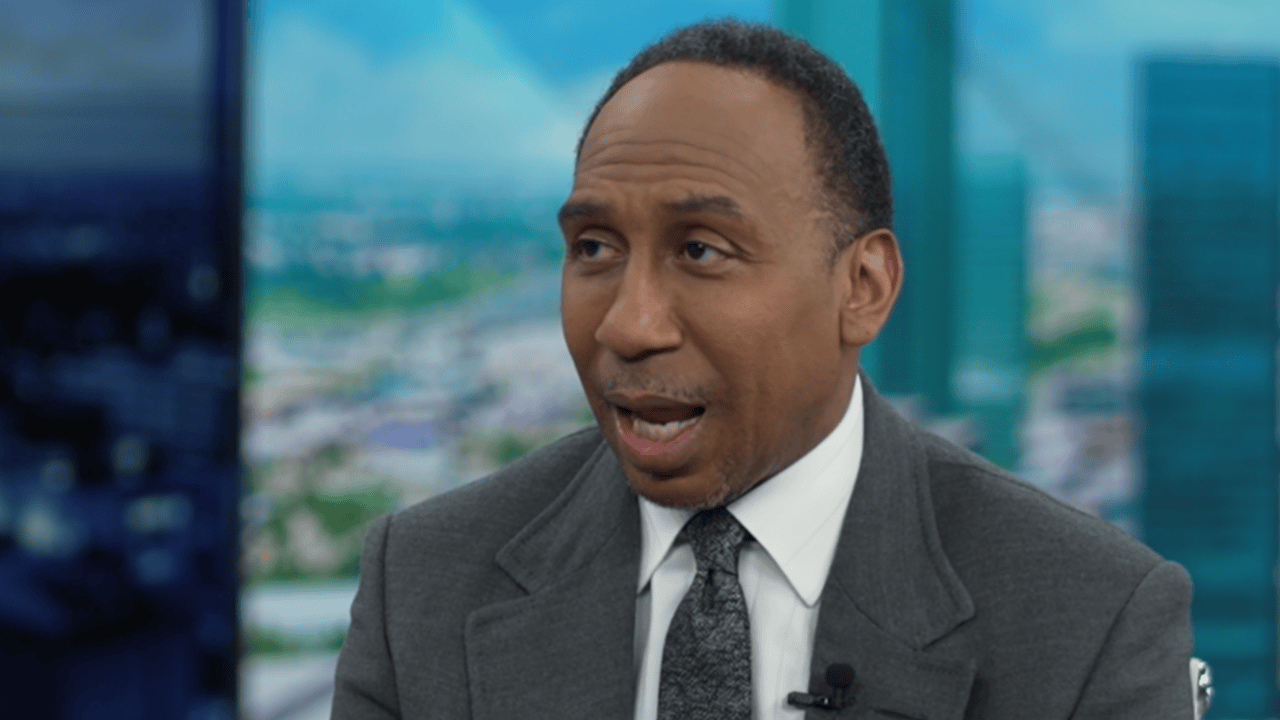

Can The Okc Thunder Win It All Stephen A Smith Weighs In On Prestis Rebuild

May 22, 2025

Can The Okc Thunder Win It All Stephen A Smith Weighs In On Prestis Rebuild

May 22, 2025 -

Next Big Future Com Reports Updates On Teslas Robotaxi Optimus And Dojo 2

May 22, 2025

Next Big Future Com Reports Updates On Teslas Robotaxi Optimus And Dojo 2

May 22, 2025 -

Robert Tesla Video Possible Catalyst For Luminar Ceos Exit

May 22, 2025

Robert Tesla Video Possible Catalyst For Luminar Ceos Exit

May 22, 2025