Standard Chartered Repurchases 891,878 Shares For £9.3 Million: HKEX Filing Details

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered Repurchases Nearly 900,000 Shares for £9.3 Million: HKEX Filing Reveals Details

London, UK – October 26, 2023 – Standard Chartered PLC (STAN.L), the multinational banking and financial services company, announced the repurchase of a substantial number of its own shares, signaling potential confidence in the company's future prospects. According to a filing made with the Hong Kong Stock Exchange (HKEX), the bank bought back 891,878 shares at a total cost of approximately £9.3 million. This strategic move offers valuable insights into Standard Chartered's capital management strategy.

This significant share buyback program highlights several key takeaways for investors and market analysts:

H2: What the Share Buyback Means for Standard Chartered

The £9.3 million share buyback represents a considerable investment by Standard Chartered in its own equity. This action often indicates that the company's leadership believes its shares are currently undervalued. By repurchasing shares, Standard Chartered effectively reduces the number of outstanding shares, potentially increasing earnings per share (EPS) and boosting the stock price. This can be particularly appealing to existing shareholders.

- Sign of Confidence: The buyback signals a strong belief in the bank's long-term growth and profitability. It suggests that management is optimistic about future performance and sees value in investing in its own stock.

- Capital Management Strategy: Repurchasing shares is a core element of many companies' capital management strategies. It provides an alternative use of capital, alongside dividends and investments in business expansion.

- Impact on Share Price: While not a guaranteed outcome, share buybacks often positively influence share prices by increasing demand and potentially reducing the supply of available shares. However, the actual impact can depend on various market factors.

H2: HKEX Filing Details and Implications

The HKEX filing provides crucial details surrounding the transaction. While the exact dates and prices of each transaction aren't always publicly disclosed in their entirety, the total number of shares repurchased and the overall cost offer significant transparency. This level of disclosure is essential for maintaining investor confidence and ensuring compliance with regulatory requirements.

The precise timing of the buyback in relation to recent financial announcements or market conditions could provide further context for analysts. Scrutiny of the filing alongside Standard Chartered's recent financial reports will provide a comprehensive picture of the bank's current financial health and future outlook.

H3: Analyzing Standard Chartered's Financial Performance

Understanding the context of the share buyback requires examining Standard Chartered's recent financial performance. Factors like profitability, revenue growth, and overall market conditions all play a role in interpreting the significance of this move. A detailed analysis of the bank's financial statements is crucial for a thorough understanding of the buyback's implications.

H2: Future Outlook and Investor Sentiment

The share repurchase could influence investor sentiment positively, potentially driving increased investment in Standard Chartered's stock. However, market conditions and overall economic trends will also significantly impact investor decisions. The long-term effects of this buyback will depend on several factors, including Standard Chartered's continued performance and overall market stability.

The repurchase of nearly 900,000 shares underlines Standard Chartered's proactive approach to capital management and its belief in its future prospects. This strategic move will be closely monitored by investors and analysts alike, offering valuable insights into the bank's financial health and growth trajectory. Further updates and analysis will likely follow as Standard Chartered continues to execute its business strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered Repurchases 891,878 Shares For £9.3 Million: HKEX Filing Details. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Increased Production Of Key Semiconductor Material By Ajinomoto

Apr 07, 2025

Increased Production Of Key Semiconductor Material By Ajinomoto

Apr 07, 2025 -

Navigating The Ai Landscape Key Strategies For Success

Apr 07, 2025

Navigating The Ai Landscape Key Strategies For Success

Apr 07, 2025 -

Britney Spears The Untold Story Of Motherhood And Undervalued Mothers

Apr 07, 2025

Britney Spears The Untold Story Of Motherhood And Undervalued Mothers

Apr 07, 2025 -

Indonesia Berduka Pengusaha Sukses Murdaya Poo Wafat

Apr 07, 2025

Indonesia Berduka Pengusaha Sukses Murdaya Poo Wafat

Apr 07, 2025 -

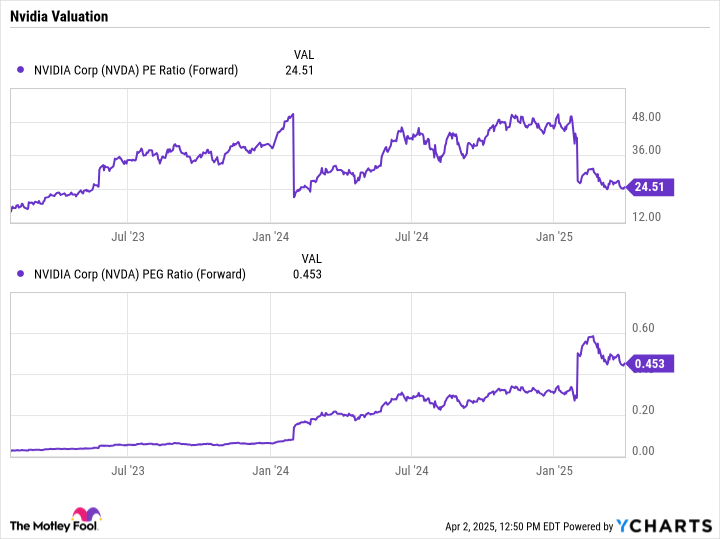

Three Powerful Arguments For Investing In Nvidia Stock

Apr 07, 2025

Three Powerful Arguments For Investing In Nvidia Stock

Apr 07, 2025