Standard Chartered: Revised Share Capital And Voting Rights Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered: Revised Share Capital and Voting Rights Explained

Standard Chartered PLC, a leading international banking group, recently announced changes to its share capital and voting rights structure. This move, while complex, has significant implications for shareholders and the bank's future strategic direction. Understanding these changes is crucial for anyone invested in or following Standard Chartered. This article provides a clear and concise explanation of the revisions, breaking down the key details and their potential impact.

What are the Key Changes?

The core revision involves a restructuring of Standard Chartered's share capital, aiming to optimize its capital structure and enhance its governance framework. While the specifics are detailed in the official company announcements, the key takeaway is a shift in the balance of voting rights, potentially impacting shareholder influence. This often involves a change in the number of shares outstanding and the allocation of voting rights associated with those shares.

Understanding Share Capital:

Share capital represents the total investment made by shareholders in a company. It's typically divided into shares, each representing a fraction of ownership. Changes to share capital can occur through various actions, including share buybacks, issuing new shares, or, as in this case, a restructuring aimed at altering the voting rights distribution amongst shareholders.

The Impact of Revised Voting Rights:

The changes to voting rights are a crucial aspect of Standard Chartered's restructuring. These adjustments can influence the decision-making power of different shareholder groups. For example, a revised structure might:

- Increase the voting power of certain institutional investors: This could lead to a more concentrated ownership structure, potentially affecting the bank's strategic direction and future decisions.

- Dilute the voting power of smaller shareholders: This could reduce the influence of individual investors on major corporate decisions.

- Improve corporate governance: The changes could be designed to enhance corporate governance by aligning shareholder interests with long-term value creation.

Why the Changes?

Standard Chartered's rationale for these revisions likely stems from several factors, including:

- Strategic Goals: The restructuring might be aimed at supporting specific strategic initiatives, such as attracting long-term investors or facilitating mergers and acquisitions.

- Capital Optimization: Restructuring share capital can improve the bank's financial position and enhance its overall efficiency.

- Regulatory Compliance: The changes might be necessary to comply with evolving regulatory requirements concerning banking and corporate governance.

What Does This Mean for Investors?

The impact on individual investors will vary depending on their existing shareholding. It's crucial for all shareholders to carefully review the official company announcements and consult with their financial advisors to understand the implications of these changes on their specific portfolio. Understanding the revised voting rights is particularly important when participating in shareholder meetings or expressing opinions on critical company decisions.

Looking Ahead:

Standard Chartered's revised share capital and voting rights structure represent a significant development. The long-term effects will depend on how the revised framework functions in practice. Continuous monitoring of the bank’s performance and announcements related to the restructuring will be crucial for investors and market analysts alike. This situation highlights the importance of staying informed about corporate actions and their implications for your investments.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered: Revised Share Capital And Voting Rights Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Compartilhamento De Imoveis Como Investir Em Cotas De Casas De Praia E Campo

Apr 07, 2025

Compartilhamento De Imoveis Como Investir Em Cotas De Casas De Praia E Campo

Apr 07, 2025 -

Australias Economy Navigating Global Trade War Risks

Apr 07, 2025

Australias Economy Navigating Global Trade War Risks

Apr 07, 2025 -

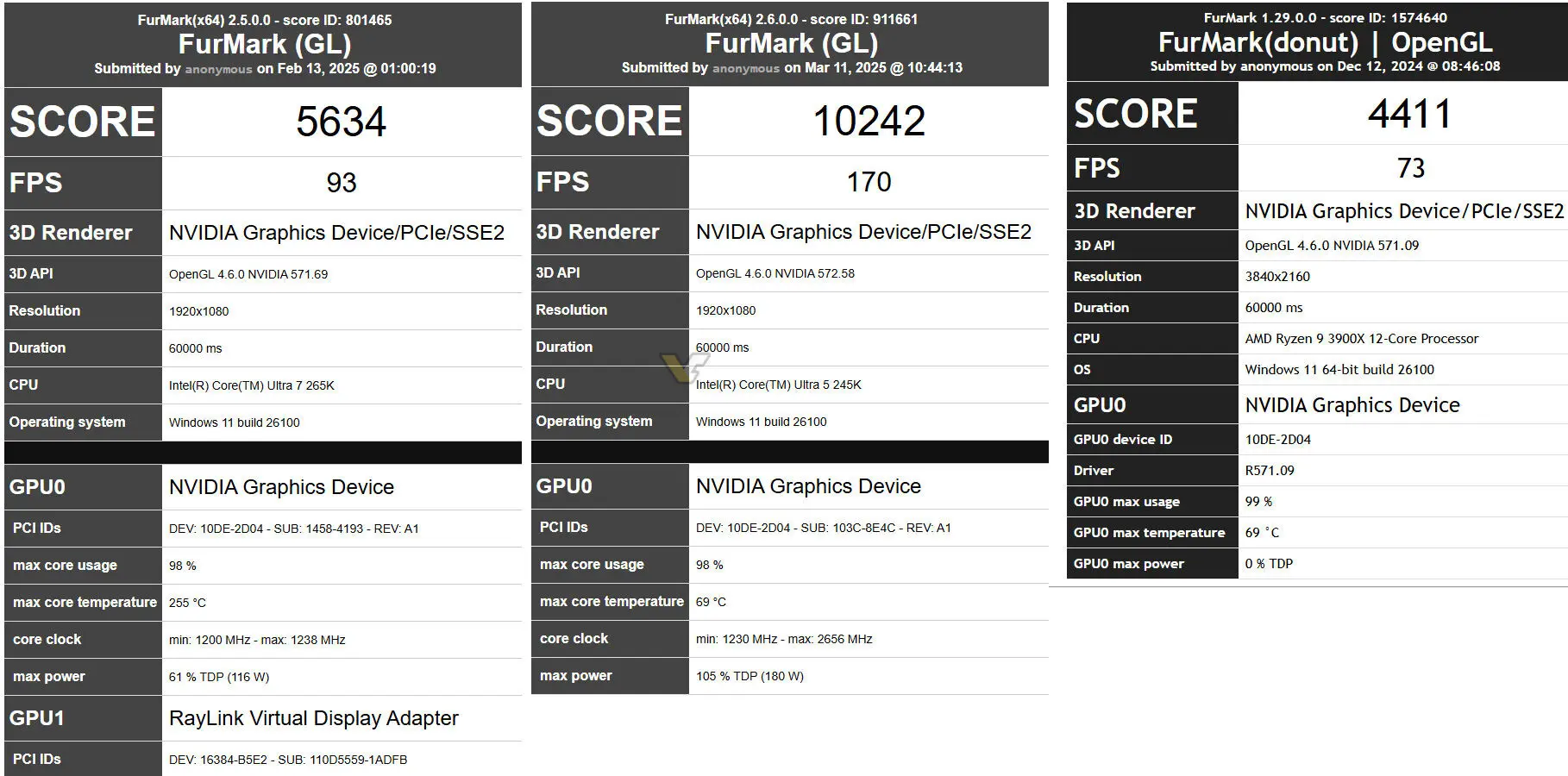

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W

Apr 07, 2025

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W

Apr 07, 2025 -

Last Minute Benzema Equalizer Al Ahli And Opposing Team Name Share Points

Apr 07, 2025

Last Minute Benzema Equalizer Al Ahli And Opposing Team Name Share Points

Apr 07, 2025 -

Fresh Threat To Real Madrids Champions League Dynasty A Wilson Analysis

Apr 07, 2025

Fresh Threat To Real Madrids Champions League Dynasty A Wilson Analysis

Apr 07, 2025