Standard Chartered's Bold Bitcoin Prediction: $500,000 As Government Bonds Lose Favor

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Standard Chartered's Bold Bitcoin Prediction: $500,000 as Government Bonds Lose Favor

Standard Chartered, a leading global bank, has made a daring prediction: Bitcoin could surge to a staggering $500,000 within the next few years. This bold forecast comes amidst growing concerns about the stability of government bonds and a shift in investor sentiment towards alternative assets like cryptocurrencies. The bank's analysts believe that Bitcoin's scarcity and increasing institutional adoption will propel its price to unprecedented heights.

The report, released earlier this week, highlights a confluence of factors contributing to their bullish outlook. These include:

-

Decreased Confidence in Government Bonds: Rising inflation and increasing global uncertainty have eroded investor confidence in traditional safe-haven assets like government bonds. This has led to a search for alternative stores of value, with Bitcoin increasingly viewed as a viable option. The report specifically points to the potential for declining yields on government bonds as a key driver for Bitcoin's price appreciation.

-

Institutional Adoption Continues to Grow: Major financial institutions are increasingly embracing Bitcoin, integrating it into their investment strategies and offering related services. This growing legitimacy within the traditional financial system lends credibility to Bitcoin and fosters wider adoption. The report cites examples of several large firms actively investing in and utilizing Bitcoin.

-

Bitcoin's Scarcity Remains a Key Factor: Unlike fiat currencies, Bitcoin has a fixed supply of 21 million coins. This inherent scarcity, coupled with growing demand, is expected to drive its price upwards. The report emphasizes the deflationary nature of Bitcoin as a major contributor to its long-term price appreciation potential.

-

Technological Advancements: Ongoing developments in Bitcoin's underlying technology, including the Lightning Network for faster and cheaper transactions, are improving its usability and scalability. These improvements enhance Bitcoin's attractiveness as a medium of exchange and a store of value.

Navigating the Volatility: Risks and Considerations

While Standard Chartered's prediction is bullish, it's crucial to acknowledge the inherent volatility of the cryptocurrency market. Bitcoin's price has historically been subject to significant swings, and investors should proceed with caution. The report acknowledges these risks, advising investors to carefully consider their risk tolerance before investing in Bitcoin.

What This Means for Investors

This bold prediction from a major financial institution signals a growing acceptance of Bitcoin within the mainstream financial world. However, investors should conduct thorough research and understand the risks involved before allocating any significant portion of their portfolio to Bitcoin. Diversification remains a crucial element of any successful investment strategy.

The Future of Bitcoin: Beyond $500,000?

While $500,000 is a significant target, some analysts believe Bitcoin's price could potentially exceed this figure in the long term. The ongoing adoption by institutions, coupled with its limited supply and growing utility, could continue to fuel its price appreciation. However, regulatory uncertainty and unforeseen technological challenges could also impact its trajectory.

Standard Chartered's prediction serves as a powerful reminder of the evolving landscape of finance and the growing influence of cryptocurrencies. As the world grapples with economic uncertainty and the limitations of traditional assets, Bitcoin's role as an alternative store of value is likely to remain a significant topic of discussion and debate. The coming years will be crucial in determining whether this audacious forecast becomes reality.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Standard Chartered's Bold Bitcoin Prediction: $500,000 As Government Bonds Lose Favor. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hollywoods Wake Up Call Ai And The Future Of Grand Theft Auto Vi

May 22, 2025

Hollywoods Wake Up Call Ai And The Future Of Grand Theft Auto Vi

May 22, 2025 -

Analysis Why Warren Buffett Decreased His Apple Stock Holdings

May 22, 2025

Analysis Why Warren Buffett Decreased His Apple Stock Holdings

May 22, 2025 -

Google I O 2025 Live Blog Breaking News On Android Ai And More

May 22, 2025

Google I O 2025 Live Blog Breaking News On Android Ai And More

May 22, 2025 -

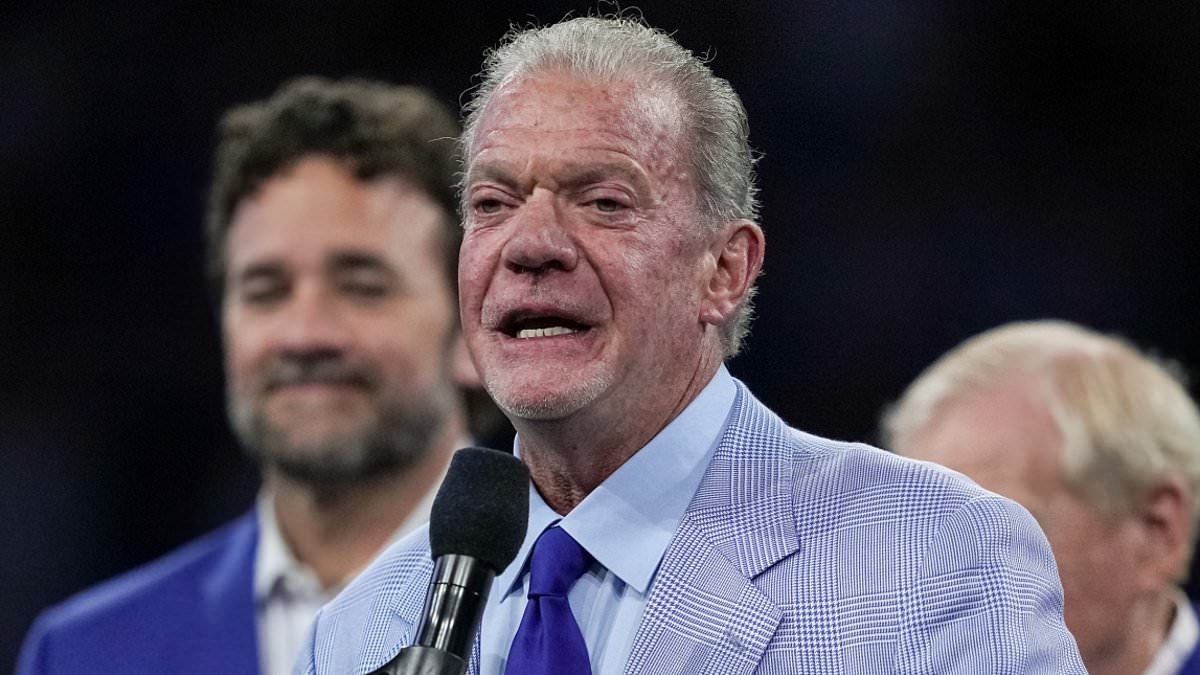

Jim Irsay Dead At 65 Indianapolis Colts Owner Dies

May 22, 2025

Jim Irsay Dead At 65 Indianapolis Colts Owner Dies

May 22, 2025 -

Edmonton Oilers Vs Dallas Stars Game Highlights Stats And Analysis

May 22, 2025

Edmonton Oilers Vs Dallas Stars Game Highlights Stats And Analysis

May 22, 2025