Still Waiting On Stimulus Money In PA? Guide To Claiming 2nd And 3rd Payments.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Still Waiting on Stimulus Money in PA? Guide to Claiming 2nd and 3rd Payments

Millions of Americans received economic impact payments (stimulus checks) during the COVID-19 pandemic, but many Pennsylvanians are still waiting for their second and third payments. If you're one of them, don't despair. This guide will walk you through the process of claiming your missing stimulus money. We'll cover eligibility requirements, common reasons for delays, and the steps you need to take to get your payment.

Understanding the Stimulus Payments

The Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 and the Consolidated Appropriations Act of 2021 provided three rounds of stimulus payments to eligible Americans. These payments aimed to provide financial relief during the economic downturn caused by the pandemic. However, the process wasn't seamless for everyone. Many factors, including processing delays and incorrect information on tax returns, contributed to outstanding payments.

Who is Eligible for Stimulus Payments?

Eligibility for the stimulus payments was based on factors such as:

- Adjusted Gross Income (AGI): Income limits varied across the three stimulus payments.

- Filing Status: Whether you filed as single, married filing jointly, head of household, etc., impacted eligibility.

- Citizenship Status: You generally needed to be a U.S. citizen or resident alien.

- Dependents: Having qualifying children or other dependents could affect your payment amount.

If you believe you meet these requirements but haven't received your payment, you need to take action.

Why Haven't I Received My Stimulus Payment?

Several reasons might explain why you haven't received your second or third stimulus payment:

- Incorrect Information: The IRS may have used outdated information from your tax return.

- Processing Delays: The sheer volume of payments led to significant processing delays.

- Direct Deposit Issues: Problems with your bank account information could have prevented direct deposit.

- Non-Filers: If you didn't file a tax return, you may need to use the IRS' Non-Filers tool.

How to Claim Your Missing Stimulus Payment in Pennsylvania

The first step is to check the IRS's Get My Payment tool. This online tool allows you to track the status of your payment and provides information on when and how you received it. If the tool shows that your payment is missing, you'll need to take further action.

1. Verify Your Information: Double-check that your address and bank account information are current and accurate with the IRS. Inaccurate information is a primary reason for payment delays.

2. Use the IRS' Non-Filers Tool: If you didn't file taxes in 2019 or 2020, you'll need to use the IRS' Non-Filers tool to provide your information and claim your payment.

3. File a Tax Return: Filing a 2020 or 2021 tax return (if you haven't already) is crucial. This allows the IRS to verify your eligibility and process your payment. The Recovery Rebate Credit can be claimed on your tax return.

4. Contact the IRS Directly: If you've tried all the above steps and still haven't received your payment, contact the IRS directly. Their website offers various contact options, including phone numbers and online forms. Be prepared to wait; call volumes are often high.

5. Seek Professional Assistance: Consider seeking assistance from a tax professional if you're struggling to navigate the process. They can help you identify any issues and guide you through the necessary steps.

Key Takeaways for Pennsylvania Residents

Claiming your missing stimulus payment requires patience and persistence. Thoroughly check your information, utilize the IRS' online tools, and don't hesitate to contact the IRS if necessary. Remember, timely filing of your tax return is critical for receiving any outstanding payments. Don't give up; your stimulus money may still be waiting for you. This guide provides a roadmap, but individual circumstances may vary. Always refer to the official IRS website for the most up-to-date information and guidance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Still Waiting On Stimulus Money In PA? Guide To Claiming 2nd And 3rd Payments.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

King Charles And Cabinet Reshuffle Albanese Faces Crucial Decisions In Federal Politics

May 09, 2025

King Charles And Cabinet Reshuffle Albanese Faces Crucial Decisions In Federal Politics

May 09, 2025 -

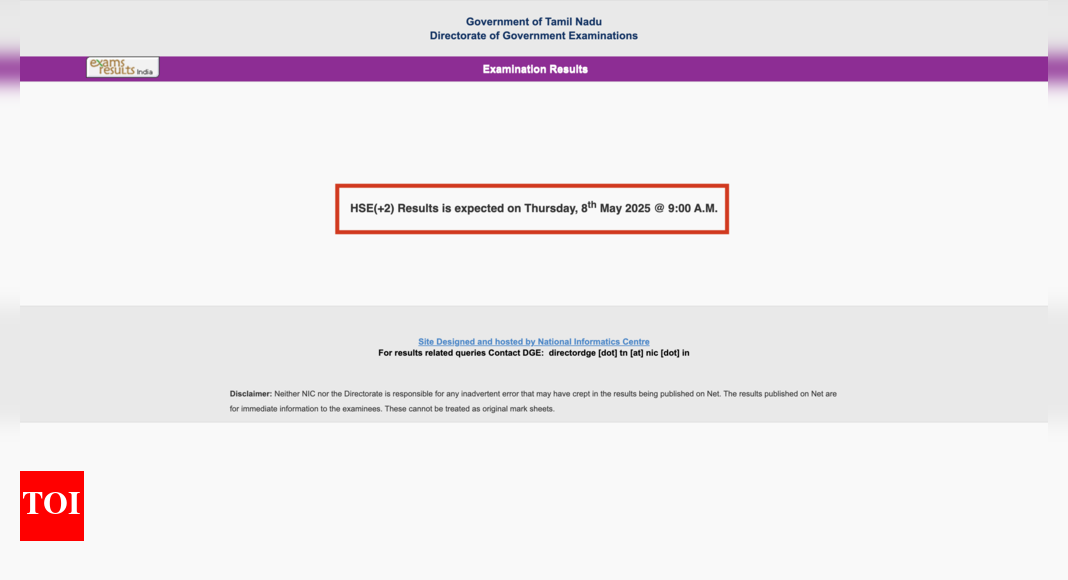

Tn Board 12th Result 2024 Dge Tn Gov In Check Your Hsc Public Exam Score Online

May 09, 2025

Tn Board 12th Result 2024 Dge Tn Gov In Check Your Hsc Public Exam Score Online

May 09, 2025 -

20 Anos Del Exito Shakira Conmemora Un Hito En Su Carrera Musical

May 09, 2025

20 Anos Del Exito Shakira Conmemora Un Hito En Su Carrera Musical

May 09, 2025 -

Action Explodes In The Old Guard 2 Trailer Featuring Theron And Thurman

May 09, 2025

Action Explodes In The Old Guard 2 Trailer Featuring Theron And Thurman

May 09, 2025 -

Essential Features Of Leading Uk Online Gambling Platforms

May 09, 2025

Essential Features Of Leading Uk Online Gambling Platforms

May 09, 2025