Stock Market Crash: Dow Futures Plummet, S&P 500 Nears Bear Territory

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Crash: Dow Futures Plummet, S&P 500 Nears Bear Territory

Fear grips Wall Street as a dramatic sell-off sends shockwaves through global markets. Investors are bracing for a potential full-blown market crash as Dow futures plunge and the S&P 500 teeters on the brink of a bear market. The dramatic downturn follows weeks of escalating concerns over inflation, rising interest rates, and a looming recession.

This sudden and sharp decline has left many wondering: what triggered this market turmoil, and what does it mean for investors?

What Caused the Stock Market Plunge?

Several interconnected factors contributed to today's market freefall. The primary culprits include:

-

Inflationary Pressures: Persistently high inflation continues to erode consumer purchasing power and fuels concerns about the Federal Reserve's aggressive interest rate hikes. The market is anxiously awaiting the next Fed announcement for clues on the future trajectory of monetary policy. Higher interest rates increase borrowing costs for businesses, hindering growth and potentially leading to a recession.

-

Rising Interest Rates: The Federal Reserve's ongoing efforts to combat inflation by raising interest rates are impacting investor sentiment. Higher rates make bonds more attractive, leading investors to shift funds away from the stock market, thus driving down prices.

-

Recession Fears: Economic indicators are pointing towards a potential recession, fueling anxieties among investors. Concerns about corporate earnings and future economic growth are exacerbating the sell-off. Data showing slowing economic growth in several key sectors has only amplified these fears.

-

Geopolitical Uncertainty: The ongoing war in Ukraine and escalating geopolitical tensions globally add to the market's instability. Uncertainty about the future impacts of these events on global supply chains and economic stability is contributing to the downward pressure.

S&P 500 Nears Bear Market Territory: What Does It Mean?

A bear market is generally defined as a 20% decline from a recent peak. With the S&P 500 currently nearing this threshold, investors are on high alert. This signifies a significant market downturn and heightened volatility. While bear markets can be painful, they are a normal part of the economic cycle, though the speed and severity of this downturn is causing considerable concern.

What Should Investors Do?

The current market volatility presents a challenging environment for investors. However, it's crucial to avoid panic selling. Here are some key considerations:

-

Review Your Investment Strategy: This is a prime time to reassess your risk tolerance and long-term investment goals. Consult with a financial advisor to ensure your portfolio aligns with your objectives.

-

Diversify Your Holdings: A well-diversified portfolio can help mitigate risk during market downturns. Spreading your investments across different asset classes can lessen the impact of any single sector's performance.

-

Avoid Emotional Decision-Making: Panic selling often leads to poor investment decisions. Sticking to a long-term investment strategy is crucial, particularly during periods of market uncertainty.

-

Consider Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This helps mitigate the risk of investing a lump sum at a market peak.

Conclusion: Navigating the Storm

The current stock market crash underscores the importance of careful planning and a well-defined investment strategy. While the near-term outlook remains uncertain, maintaining a long-term perspective and avoiding rash decisions is paramount. Staying informed about market trends and seeking professional financial advice can help investors navigate these turbulent times and protect their investments. The situation remains fluid, and close monitoring of economic indicators and market news is essential for all investors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Crash: Dow Futures Plummet, S&P 500 Nears Bear Territory. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

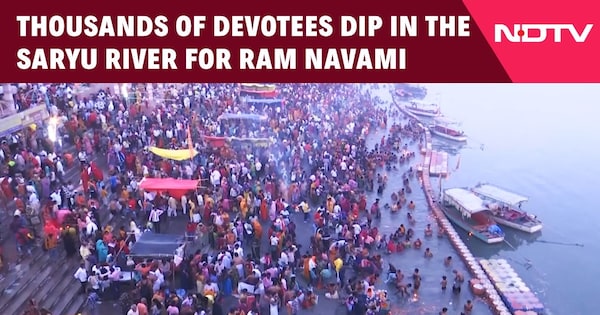

Saryu River Overflowing Huge Turnout For Ram Navami Holy Dip

Apr 07, 2025

Saryu River Overflowing Huge Turnout For Ram Navami Holy Dip

Apr 07, 2025 -

English Premier League Dominates Real Madrid And Psgs Champions League Quarterfinal Challenges

Apr 07, 2025

English Premier League Dominates Real Madrid And Psgs Champions League Quarterfinal Challenges

Apr 07, 2025 -

Hong Kong Market Leads Asia Pacific Sell Off As Trade War Uncertainty Intensifies

Apr 07, 2025

Hong Kong Market Leads Asia Pacific Sell Off As Trade War Uncertainty Intensifies

Apr 07, 2025 -

Hyperscalers Embrace Arm The Future Of Data Center Computing

Apr 07, 2025

Hyperscalers Embrace Arm The Future Of Data Center Computing

Apr 07, 2025 -

Jiri Lehecka Vs Sebastian Korda Prediction Atp Monte Carlo Masters 2025

Apr 07, 2025

Jiri Lehecka Vs Sebastian Korda Prediction Atp Monte Carlo Masters 2025

Apr 07, 2025