Stock Market Crash Fears Grow As Dow Futures Tumble

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

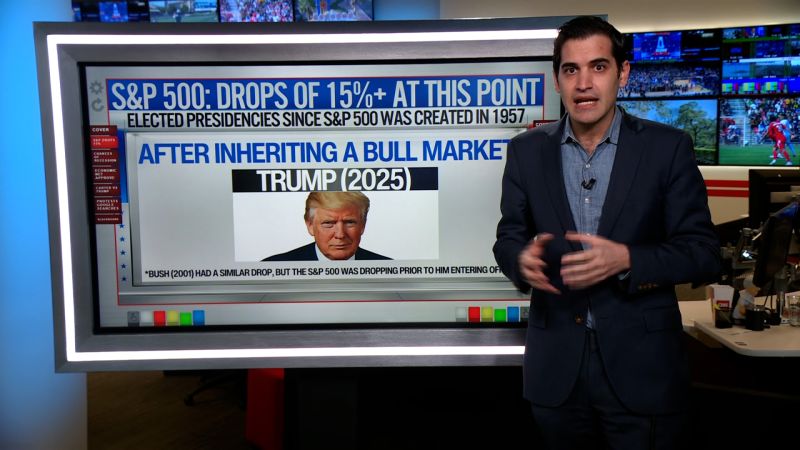

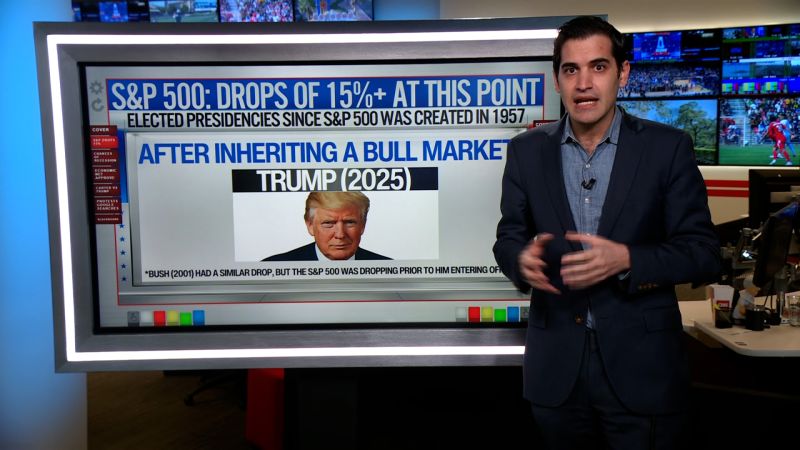

Stock Market Crash Fears Grow as Dow Futures Tumble

Wall Street jitters intensify as pre-market trading paints a grim picture.

The specter of a stock market crash is looming large as Dow futures plummet, fueling anxieties among investors already grappling with persistent inflation and rising interest rates. The dramatic downturn in pre-market trading has sent shockwaves through the financial world, raising serious concerns about the stability of the market and the potential for a significant correction.

This morning's plunge in Dow futures follows a week of volatile trading, marked by significant losses across major indices. The uncertainty surrounding future Federal Reserve policy, coupled with ongoing geopolitical tensions and persistent economic headwinds, has created a perfect storm for investor apprehension. The fear isn't just about a minor dip; many analysts are openly discussing the possibility of a full-blown market crash.

What's Driving the Fear?

Several factors are contributing to the growing fear of a stock market crash:

-

Inflation and Interest Rates: Stubbornly high inflation continues to pressure the Federal Reserve to maintain its aggressive interest rate hiking policy. Higher rates increase borrowing costs for businesses and consumers, slowing economic growth and potentially triggering a recession. This directly impacts corporate earnings, a key driver of stock prices.

-

Geopolitical Instability: The ongoing war in Ukraine, coupled with escalating tensions in other regions, introduces significant geopolitical risk. This uncertainty can lead to capital flight and increased volatility in the market.

-

Recessionary Fears: Many economists are predicting a recession in the near future. The combination of high inflation, rising interest rates, and slowing economic growth significantly increases the likelihood of a recession, which historically leads to substantial stock market declines.

-

Corporate Earnings Reports: Disappointing corporate earnings reports are adding to the negative sentiment. Companies are struggling with rising costs and slowing demand, impacting their profitability and investor confidence.

What Should Investors Do?

The current market volatility leaves many investors wondering what steps to take. There's no one-size-fits-all answer, and professional financial advice is crucial. However, some general strategies to consider include:

-

Diversification: A well-diversified portfolio can help mitigate risk during market downturns. Spreading investments across different asset classes can lessen the impact of losses in any single sector.

-

Risk Assessment: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly. Those with a lower risk tolerance might consider shifting towards more conservative investments.

-

Long-Term Perspective: It's crucial to maintain a long-term perspective. Market fluctuations are normal, and historical data shows that markets tend to recover over time. Panic selling during a downturn can often lead to greater losses.

-

Seek Professional Advice: Consulting with a qualified financial advisor can provide personalized guidance based on individual circumstances and financial goals.

The Road Ahead

The coming days and weeks will be crucial in determining the direction of the market. Close monitoring of economic indicators, Federal Reserve announcements, and geopolitical developments is essential. While the prospect of a stock market crash is undeniably concerning, a measured and informed approach is crucial for navigating this turbulent period. Investors should avoid impulsive decisions driven by fear and instead focus on a well-defined long-term investment strategy. The current volatility underscores the importance of diligent financial planning and professional guidance in managing investment risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Crash Fears Grow As Dow Futures Tumble. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

1 Billion Eu Fine For X Musks Platform And Tech Giants Under Dma Scrutiny

Apr 07, 2025

1 Billion Eu Fine For X Musks Platform And Tech Giants Under Dma Scrutiny

Apr 07, 2025 -

Cara Mendapatkan Dana Kaget Dari Aplikasi Dana Panduan Lengkap

Apr 07, 2025

Cara Mendapatkan Dana Kaget Dari Aplikasi Dana Panduan Lengkap

Apr 07, 2025 -

Australia Faces Substantial Growth Risks Amid Global Trade Tensions

Apr 07, 2025

Australia Faces Substantial Growth Risks Amid Global Trade Tensions

Apr 07, 2025 -

Snl Veteran Kenan Thompson Discusses His Desire For A Permanent Role

Apr 07, 2025

Snl Veteran Kenan Thompson Discusses His Desire For A Permanent Role

Apr 07, 2025 -

Trailblazing Rugby League Star Honored Raiders Spearhead Memorials

Apr 07, 2025

Trailblazing Rugby League Star Honored Raiders Spearhead Memorials

Apr 07, 2025