Stock Market Crash Fears Rise As Dow Futures Tumble

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Crash Fears Rise as Dow Futures Tumble

Wall Street Jitters Intensify Amidst Growing Economic Uncertainty

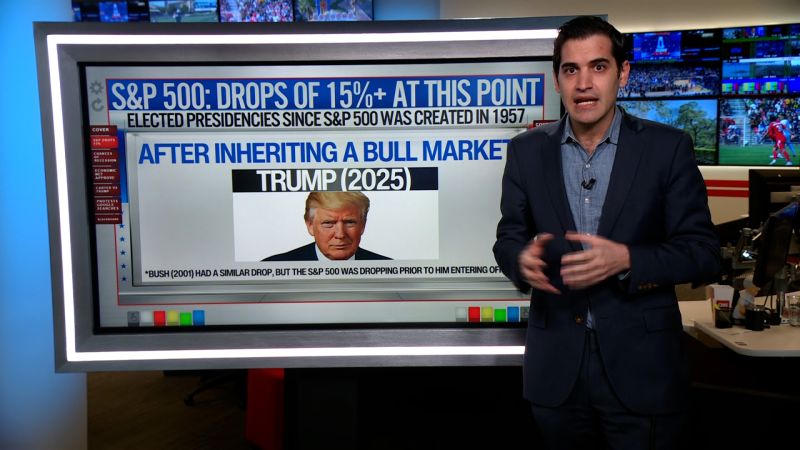

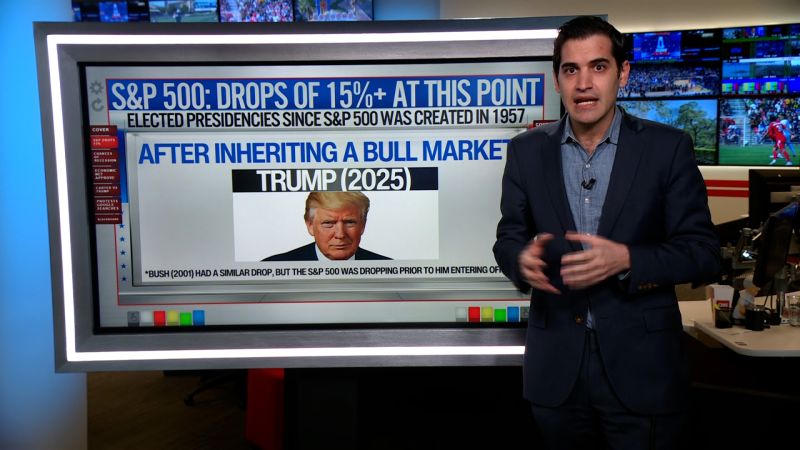

The global stock market is facing a period of intense uncertainty, with fears of a potential crash rising sharply following a significant tumble in Dow futures. This unsettling development has sent ripples of anxiety through investor circles, prompting concerns about the overall health of the global economy. The dramatic drop in pre-market trading is raising questions about the sustainability of recent market gains and fueling speculation about what might trigger a more significant correction.

What Triggered the Dow Futures Plunge?

While pinpointing a single cause for the Dow futures decline is difficult, several contributing factors are at play. Analysts point to a confluence of events, including:

-

Inflation Concerns: Persistent inflation remains a major headwind for the market. Despite recent efforts by central banks to curb price increases, stubbornly high inflation figures continue to raise concerns about future interest rate hikes. Higher interest rates typically dampen economic growth and reduce corporate profitability, impacting stock valuations.

-

Geopolitical Instability: Ongoing geopolitical tensions, including the war in Ukraine and escalating trade disputes, contribute to market volatility. These uncertainties create an environment of risk aversion, prompting investors to seek safer havens for their capital.

-

Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes, aimed at combating inflation, are putting pressure on businesses and consumers. Higher borrowing costs can stifle economic activity and lead to reduced corporate earnings, negatively impacting stock prices.

-

Tech Sector Weakness: The tech sector, a significant driver of market performance in recent years, has shown signs of weakness. Concerns about slowing growth and increased competition are weighing on tech stocks, contributing to the overall market downturn.

H2: Is a Stock Market Crash Imminent?

While the recent Dow futures drop has undoubtedly sparked fears of a market crash, it's crucial to avoid panic. Predicting market movements with certainty is impossible. However, several indicators suggest caution:

-

Inverted Yield Curve: The inverted yield curve, a historically reliable predictor of recessions, remains a significant concern. This anomaly, where short-term interest rates exceed long-term rates, often precedes economic downturns.

-

Consumer Sentiment: Weakening consumer sentiment suggests reduced spending and potential economic slowdown, further impacting corporate profitability and stock prices.

-

High Valuations: Some sectors still exhibit relatively high valuations, leaving them vulnerable to corrections if growth expectations fail to materialize.

H3: What Should Investors Do?

The current market volatility calls for a cautious and strategic approach. Investors should:

-

Diversify their portfolios: Reducing reliance on any single asset class can help mitigate risks.

-

Reassess risk tolerance: Investors should review their investment strategies and ensure they align with their risk appetite in the current uncertain climate.

-

Consider long-term horizons: Focusing on long-term investment goals can help navigate short-term market fluctuations.

-

Consult with a financial advisor: Seeking professional guidance can provide personalized advice tailored to individual circumstances.

Conclusion:

The recent tumble in Dow futures underscores the significant challenges facing the global economy and the stock market. While a crash isn't guaranteed, investors must remain vigilant, adopt a cautious approach, and carefully manage their portfolios in light of the prevailing uncertainties. The situation demands close monitoring of economic indicators and a proactive strategy to navigate the potential volatility ahead. Staying informed and adapting to market conditions will be crucial in mitigating risks and potentially capitalizing on emerging opportunities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Crash Fears Rise As Dow Futures Tumble. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analisis Pembagian Grup Esl Sps Mobile Masters Mlbb 2025 Prediksi Juara

Apr 07, 2025

Analisis Pembagian Grup Esl Sps Mobile Masters Mlbb 2025 Prediksi Juara

Apr 07, 2025 -

Destruicao No Rio Grande Do Sul Chuvas Deixam 75 Mortos E Mais De 1 2 Milhoes Afetados

Apr 07, 2025

Destruicao No Rio Grande Do Sul Chuvas Deixam 75 Mortos E Mais De 1 2 Milhoes Afetados

Apr 07, 2025 -

25 000 Tesla By 2025 Factory Changes Fuel Price Drop Predictions

Apr 07, 2025

25 000 Tesla By 2025 Factory Changes Fuel Price Drop Predictions

Apr 07, 2025 -

Ai Surpasses Human Skill Efficient Diamond Acquisition In Minecraft

Apr 07, 2025

Ai Surpasses Human Skill Efficient Diamond Acquisition In Minecraft

Apr 07, 2025 -

Japanese Grand Prix Starting Grid A Complete Guide To Driver Positions

Apr 07, 2025

Japanese Grand Prix Starting Grid A Complete Guide To Driver Positions

Apr 07, 2025