Stock Market Crash: Rs 20.16 Lakh Crore Wiped Out Amidst Trump Tariff Fallout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Crash: Rs 20.16 Lakh Crore Wiped Out Amidst Trump Tariff Fallout

India's stock market experienced a significant downturn, witnessing a staggering Rs 20.16 lakh crore wipeout in a single day, primarily attributed to the escalating US-China trade war and anxieties surrounding potential Trump tariffs. The dramatic fall sent shockwaves through the Indian financial landscape, leaving investors reeling and sparking concerns about the broader economic impact.

This unprecedented loss highlights the vulnerability of emerging markets to global economic uncertainties and the far-reaching consequences of escalating trade tensions. The market's reaction underscores the interconnectedness of global finance and the ripple effect of major geopolitical events.

Understanding the Market Meltdown

The sharp decline wasn't a singular event but rather a culmination of factors:

-

Trump Tariff Fears: President Trump's imposition of tariffs on Chinese goods, and the subsequent retaliatory measures from China, created a climate of uncertainty and fear. This uncertainty directly impacted investor confidence, leading to widespread selling. The potential for further escalation and its impact on global trade fueled the panic.

-

Global Economic Slowdown: Concerns about a global economic slowdown, further exacerbated by the trade war, also contributed to the market's plunge. Analysts point to weakening global growth indicators and reduced business investment as key contributing factors.

-

Indian Rupee Depreciation: The weakening of the Indian Rupee against the US dollar added to the pressure on the stock market. This made Indian exports more expensive and imports cheaper, potentially impacting the country's trade balance and further dampening investor sentiment.

-

Foreign Institutional Investor (FII) Outflows: Significant outflows of investments by Foreign Institutional Investors (FIIs) played a crucial role in the market's downturn. FIIs, often considered key drivers of Indian market performance, reduced their holdings, adding to the selling pressure.

Impact and Implications

The Rs 20.16 lakh crore loss represents a substantial blow to investor wealth and raises concerns about the overall health of the Indian economy. The immediate impact is felt by individual investors, mutual fund holders, and pension funds. However, the longer-term consequences could be more significant, potentially affecting:

-

Economic Growth: Reduced investor confidence can lead to decreased investment in businesses, hindering economic growth.

-

Job Creation: A slowdown in investment can translate into reduced job creation, impacting employment levels.

-

Government Policies: The government may need to implement measures to stabilize the market and bolster investor confidence, potentially impacting fiscal policies.

Looking Ahead: Navigating the Uncertainty

The future of the Indian stock market remains uncertain, heavily dependent on the resolution of the US-China trade dispute and the overall global economic climate. Experts advise investors to adopt a cautious approach, diversifying their portfolios and carefully evaluating investment decisions in this volatile environment. Government intervention and policy changes will play a vital role in mitigating the negative impact and restoring investor confidence. The coming weeks and months will be crucial in determining the extent of the recovery and the long-term effects of this significant market downturn. Staying informed about global economic developments and consulting with financial advisors is crucial for investors navigating these uncertain times. The Indian stock market’s resilience will be tested, and its future trajectory hinges on both domestic and international factors.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Crash: Rs 20.16 Lakh Crore Wiped Out Amidst Trump Tariff Fallout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

3 Ton Stonehenge Components A Possible Connection To Earlier Megalithic Structures

Apr 08, 2025

3 Ton Stonehenge Components A Possible Connection To Earlier Megalithic Structures

Apr 08, 2025 -

Controversy Follows As Former Nhl Player Takes Cambridge Redhawks Coaching Job

Apr 08, 2025

Controversy Follows As Former Nhl Player Takes Cambridge Redhawks Coaching Job

Apr 08, 2025 -

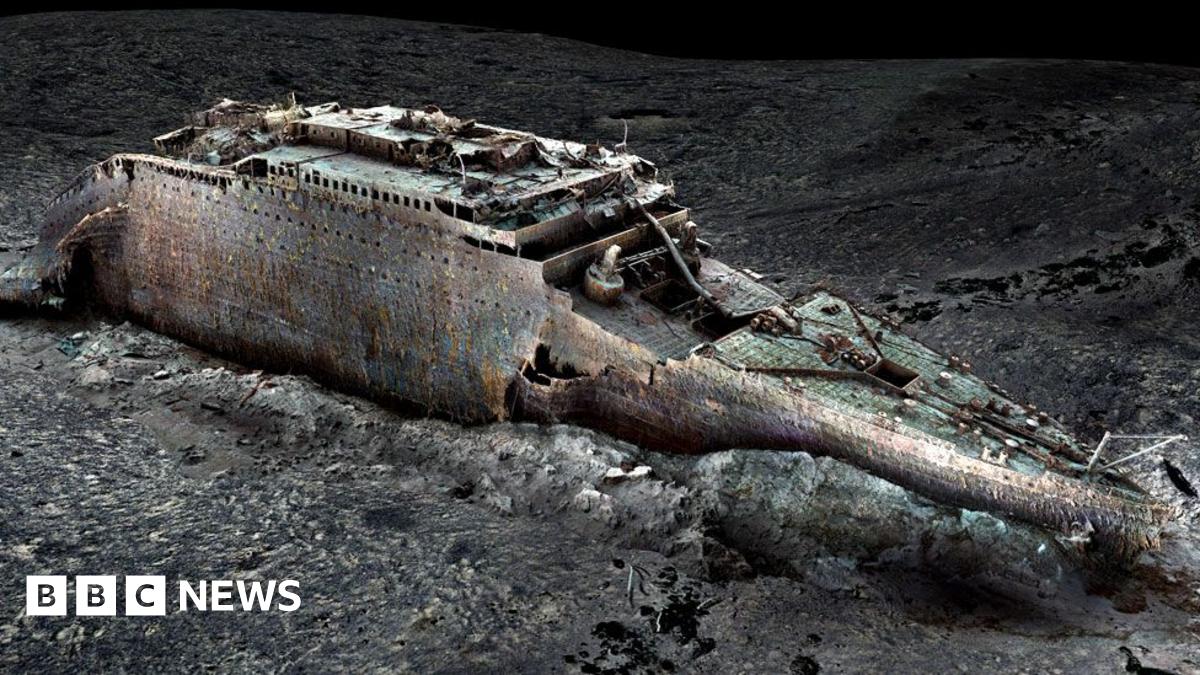

Revolutionary Sonar Scan Provides Unprecedented Look At Titanics Demise

Apr 08, 2025

Revolutionary Sonar Scan Provides Unprecedented Look At Titanics Demise

Apr 08, 2025 -

Severe Weather Prompts Augusta National To Close Gates

Apr 08, 2025

Severe Weather Prompts Augusta National To Close Gates

Apr 08, 2025 -

Domestic Dispute Turns Violent Woman Accused Of Stabbing Ex Landlord

Apr 08, 2025

Domestic Dispute Turns Violent Woman Accused Of Stabbing Ex Landlord

Apr 08, 2025