Stock Market Crash Today: S&P 500, Nasdaq Tumble As Treasury Yields Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Crash Today: S&P 500, Nasdaq Tumble as Treasury Yields Surge

Wall Street experienced a significant downturn today, with the S&P 500 and Nasdaq Composite suffering steep declines amidst a surge in Treasury yields. The unexpected volatility sent shockwaves through the market, leaving investors scrambling to understand the causes and potential implications of this dramatic plunge.

The market's sharp fall can be largely attributed to the rapid increase in Treasury yields. These yields, which represent the return on government bonds, have been climbing steadily in recent weeks, reflecting concerns about rising inflation and the Federal Reserve's potential monetary policy adjustments. This rise makes bonds more attractive to investors, drawing capital away from the stock market and contributing to the sell-off.

<h3>Understanding the Impact of Rising Treasury Yields</h3>

The inverse relationship between bond yields and stock prices is a key factor in today's market turmoil. As yields rise, the opportunity cost of investing in stocks increases. Investors are incentivized to shift their investments towards safer, higher-yielding bonds, leading to a decrease in demand for stocks and consequently, lower stock prices.

This phenomenon is particularly pronounced in the technology sector, which is heavily reliant on future growth and is therefore more sensitive to interest rate hikes. The Nasdaq Composite, heavily weighted with tech giants, experienced a more significant drop than the broader S&P 500, reflecting this sector-specific vulnerability.

<h3>Key Factors Contributing to the Market Crash</h3>

Several factors contributed to today's market crash beyond the rising Treasury yields:

- Inflationary Pressures: Persistent inflationary pressures continue to fuel concerns about the Federal Reserve's response. Aggressive interest rate hikes aimed at curbing inflation could further dampen economic growth and negatively impact corporate earnings.

- Geopolitical Uncertainty: Ongoing geopolitical instability, particularly the war in Ukraine, adds to the overall market uncertainty, prompting investors to seek safer havens.

- Profit-Taking: After a period of relative market stability, some investors may have decided to take profits, contributing to the selling pressure.

<h3>What This Means for Investors</h3>

The sharp decline in the S&P 500 and Nasdaq raises concerns for investors. While market corrections are a normal part of the economic cycle, the speed and magnitude of today's drop are noteworthy. Investors should:

- Review their investment portfolios: Assess their risk tolerance and consider rebalancing their portfolios if necessary.

- Stay informed: Keep abreast of market developments and economic indicators to make informed investment decisions.

- Consult with a financial advisor: Seek professional guidance to navigate the current market volatility.

<h3>Looking Ahead: Potential Market Recovery</h3>

While the current market situation is undoubtedly concerning, history suggests that market downturns are often followed by periods of recovery. The extent and speed of any recovery will depend on several factors, including the trajectory of inflation, the Federal Reserve's actions, and the resolution of geopolitical uncertainties. Analysts are closely monitoring these factors to predict the future direction of the market. The coming days and weeks will be crucial in determining the long-term impact of today's stock market crash. Continued monitoring of S&P 500 performance, Nasdaq trends, and Treasury yield fluctuations are vital for informed investment strategies.

Disclaimer: This article provides general information and does not constitute financial advice. Investing in the stock market involves inherent risks, and you should consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Crash Today: S&P 500, Nasdaq Tumble As Treasury Yields Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Liam Tappers Growing Family A Baby Girl Joins The Tappers

May 23, 2025

Liam Tappers Growing Family A Baby Girl Joins The Tappers

May 23, 2025 -

Starlink Under Fire Acma Addresses Mounting Customer Complaints

May 23, 2025

Starlink Under Fire Acma Addresses Mounting Customer Complaints

May 23, 2025 -

Sydney Homeless Kitchen Faces Eviction During Vibrant Vivid Festival

May 23, 2025

Sydney Homeless Kitchen Faces Eviction During Vibrant Vivid Festival

May 23, 2025 -

Is Now The Time To Buy Arb Arbitrum Arb Shows Signs Of A Major Price Increase

May 23, 2025

Is Now The Time To Buy Arb Arbitrum Arb Shows Signs Of A Major Price Increase

May 23, 2025 -

Postecoglous Tottenham A Realistic Look At The Second Seasons Prospects

May 23, 2025

Postecoglous Tottenham A Realistic Look At The Second Seasons Prospects

May 23, 2025

Latest Posts

-

Amanda Bynes Bold New Look Tattoo And Hairstyle Reveal After Only Fans

May 23, 2025

Amanda Bynes Bold New Look Tattoo And Hairstyle Reveal After Only Fans

May 23, 2025 -

Its A Girl Sunrises Presenters Name Welcomes Healthy Daughter

May 23, 2025

Its A Girl Sunrises Presenters Name Welcomes Healthy Daughter

May 23, 2025 -

Former Dbs Ceo Piyush Gupta Responds To Misinformation On Linked In

May 23, 2025

Former Dbs Ceo Piyush Gupta Responds To Misinformation On Linked In

May 23, 2025 -

Representative Ocasio Cortez Speaks Out After Baseball Teams Controversial Video

May 23, 2025

Representative Ocasio Cortez Speaks Out After Baseball Teams Controversial Video

May 23, 2025 -

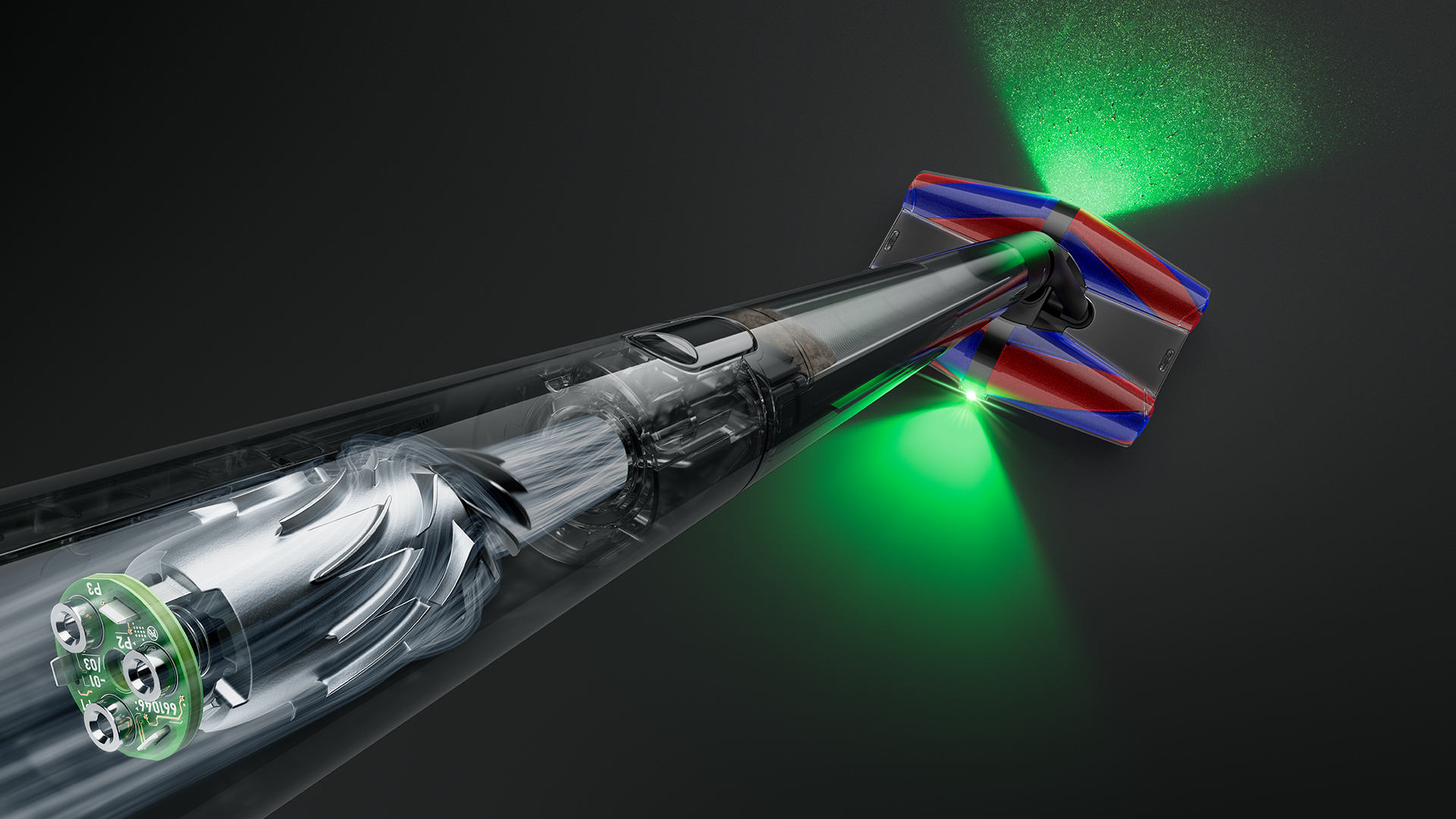

Dysons Groundbreaking Vacuum Thin Profile Superior Performance

May 23, 2025

Dysons Groundbreaking Vacuum Thin Profile Superior Performance

May 23, 2025