Stock Market Losses Intensify Tariff Debate: Trump's Offer To Talk

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

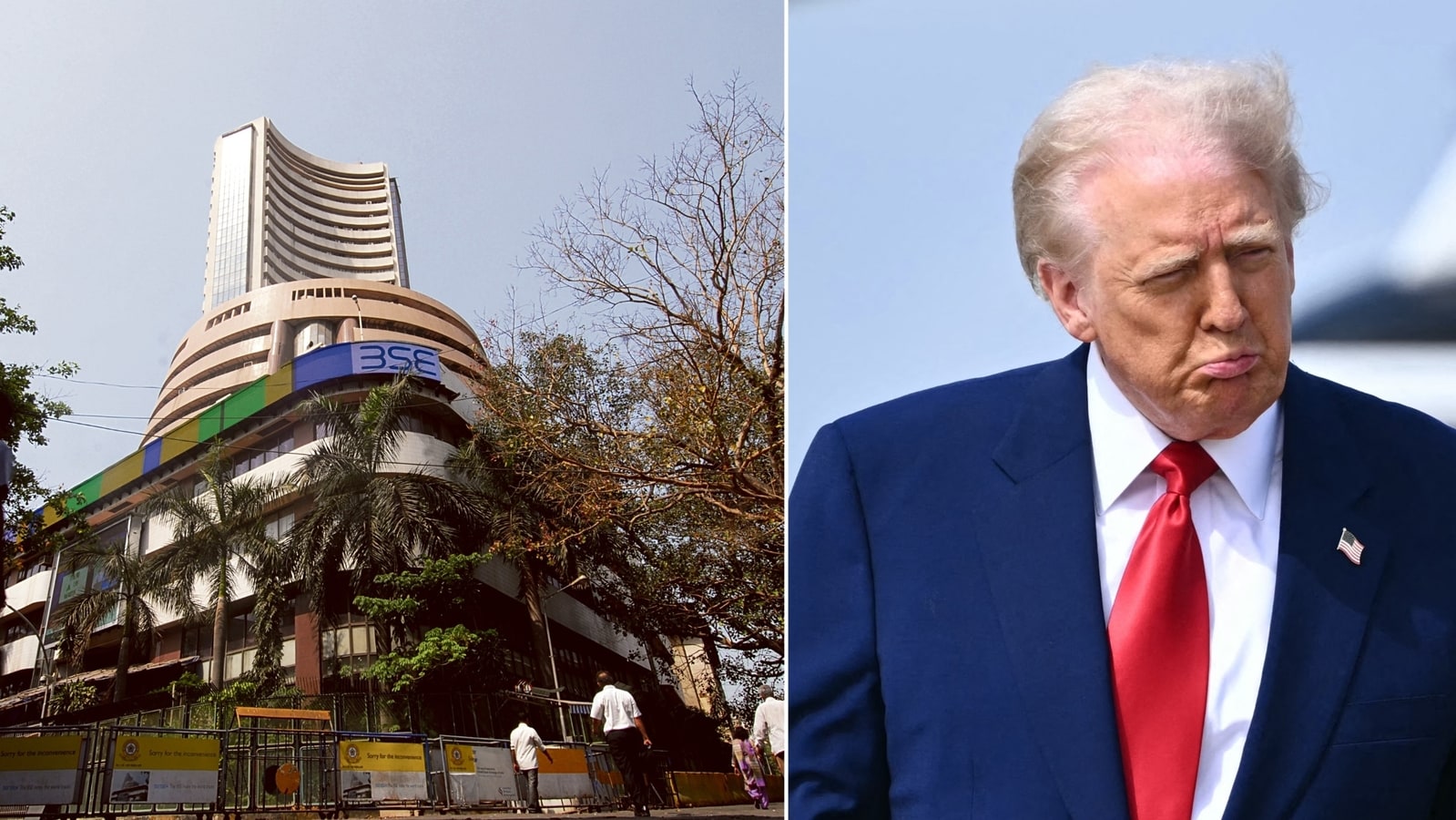

Stock Market Losses Intensify Tariff Debate: Trump's Offer to Talk Fails to Soothe Investors

The ongoing trade war between the US and China continues to roil global markets, with fresh stock market losses intensifying the already heated debate surrounding tariffs. President Trump's recent offer to negotiate with China, while seemingly conciliatory, has failed to quell investor anxieties, leaving many wondering if a resolution is even in sight. The Dow Jones Industrial Average plummeted [insert percentage and points] today, mirroring similar drops in other major global indices.

Market Volatility Driven by Tariff Uncertainty:

The current market volatility is largely attributed to the uncertainty surrounding the escalating tariff war. President Trump's administration has imposed tariffs on billions of dollars worth of Chinese goods, prompting retaliatory measures from Beijing. This tit-for-tat exchange has created a climate of fear and uncertainty, impacting businesses, consumers, and investors alike. The fear isn't just about immediate costs; it's about the long-term implications for global supply chains and economic growth.

Trump's Offer: A Glimmer of Hope or a Tactical Maneuver?

President Trump's recent offer to engage in talks with Chinese President Xi Jinping has been met with cautious optimism. While some analysts view it as a genuine attempt to de-escalate the conflict, others remain skeptical, suggesting it could be a strategic maneuver aimed at bolstering his political standing ahead of the 2020 elections. The lack of concrete details regarding the proposed negotiations has further fueled investor apprehension.

- Key Concerns Remain: Even with the offer to talk, several key concerns remain unresolved:

- The scope of the negotiations: Will the talks address all existing tariffs, or only a select few?

- The timeline for resolution: How long will it take to reach a mutually acceptable agreement?

- Enforcement mechanisms: What guarantees are in place to ensure compliance with any future agreement?

Impact on Businesses and Consumers:

The ongoing trade war is already having a tangible impact on businesses and consumers. Companies are facing higher costs for imported goods, leading to price increases for consumers. Supply chains are being disrupted, and some businesses are relocating production to avoid tariffs. These consequences are likely to worsen if the trade dispute remains unresolved.

Looking Ahead: What to Expect

The coming weeks will be crucial in determining the future trajectory of the trade war. The success or failure of any negotiations between the US and China will significantly impact global markets. Investors are closely monitoring developments, looking for signs of a potential breakthrough or further escalation. The market's reaction to any news will likely remain volatile until a clearer picture emerges. Experts suggest diversifying investments and closely following economic indicators to mitigate risk during this period of uncertainty. The situation remains fluid and requires constant monitoring.

Keywords: Stock Market, Tariff Debate, Trade War, China, US, Trump, Xi Jinping, Dow Jones, Market Volatility, Economic Growth, Global Supply Chains, Investor Sentiment, Negotiation, Trade Dispute

This article aims to provide a comprehensive and up-to-date overview of the situation, appealing to both a general audience and those actively involved in the financial markets. Remember to replace "[insert percentage and points]" with the actual figures at the time of publication.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Losses Intensify Tariff Debate: Trump's Offer To Talk. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indian Stock Market Down Today Analysis Of The Sensex And Nifty Drop

Apr 08, 2025

Indian Stock Market Down Today Analysis Of The Sensex And Nifty Drop

Apr 08, 2025 -

Houston Rockets 106 96 Win A Strong Statement Against Golden State

Apr 08, 2025

Houston Rockets 106 96 Win A Strong Statement Against Golden State

Apr 08, 2025 -

Can Myanmar Overcome Civil War And Earthquake Devastation

Apr 08, 2025

Can Myanmar Overcome Civil War And Earthquake Devastation

Apr 08, 2025 -

Is Rachel Reeves Economic Policy Driving Uk Emigration To Italy

Apr 08, 2025

Is Rachel Reeves Economic Policy Driving Uk Emigration To Italy

Apr 08, 2025 -

Price Drop Alert Amazons Compact Echo Show Challenges Googles Dominance

Apr 08, 2025

Price Drop Alert Amazons Compact Echo Show Challenges Googles Dominance

Apr 08, 2025