Stock Market Rollercoaster: Dow, S&P 500, Nasdaq React To Rising Bond Yields And US-China Trade Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Rollercoaster: Dow, S&P 500, Nasdaq React to Rising Bond Yields and US-China Trade Tensions

The US stock market experienced a turbulent week, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all exhibiting significant volatility in response to rising bond yields and escalating US-China trade tensions. Investors are grappling with uncertainty as these interconnected factors threaten to derail the ongoing economic recovery.

Rising Bond Yields Fuel Market Uncertainty

The yield on the benchmark 10-year Treasury note climbed to its highest level in several months, signaling growing investor confidence in the economic outlook but also raising concerns about inflation and potential interest rate hikes by the Federal Reserve. Higher bond yields make bonds more attractive relative to stocks, potentially diverting investment capital away from the equity market. This shift in investor sentiment contributed significantly to the market's downturn. Experts believe the speed of the yield increase, rather than the increase itself, is causing the most concern for investors. The sudden shift reflects a change in market expectations, adding to the overall volatility.

US-China Trade Tensions Reignite Fears

Adding fuel to the fire are renewed tensions in the US-China trade relationship. Recent pronouncements and actions from both governments have reignited fears of a potential trade war, casting a long shadow over global economic growth and corporate profits. Uncertainty surrounding future trade policies is forcing businesses to postpone investments and hiring, impacting overall economic confidence and investor sentiment. This unpredictability is a major factor in the market's recent volatility.

Which Sectors Were Hit Hardest?

The tech-heavy Nasdaq Composite was particularly hard hit, experiencing sharper declines than the Dow and S&P 500. This is partly attributed to the sector's sensitivity to interest rate changes and its reliance on global trade. Growth stocks, often valued on future earnings, are particularly vulnerable to rising interest rates, which discount the value of those future earnings. The energy sector also saw significant fluctuations, reflecting the sensitivity of commodity prices to global economic conditions.

What Should Investors Do?

The current market volatility presents a challenge for investors. Experts advise maintaining a long-term perspective and avoiding knee-jerk reactions. A diversified investment portfolio, carefully aligned with individual risk tolerance and financial goals, is crucial during periods of uncertainty. Thorough due diligence and professional financial advice are recommended before making significant investment decisions.

Key Takeaways:

- Rising bond yields: Higher yields are impacting investor confidence and diverting capital from the stock market.

- US-China trade tensions: Uncertainty surrounding trade policies is creating instability and hindering economic growth.

- Sectoral impact: Tech and energy sectors have been particularly vulnerable to recent market fluctuations.

- Investor advice: Maintain a long-term perspective, diversify your portfolio, and seek professional financial advice.

The coming weeks will be crucial in determining the direction of the stock market. Close monitoring of economic indicators, trade developments, and Federal Reserve policy will be essential for navigating this period of uncertainty. Investors should stay informed and adapt their strategies accordingly to mitigate risk and potentially capitalize on emerging opportunities.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Rollercoaster: Dow, S&P 500, Nasdaq React To Rising Bond Yields And US-China Trade Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

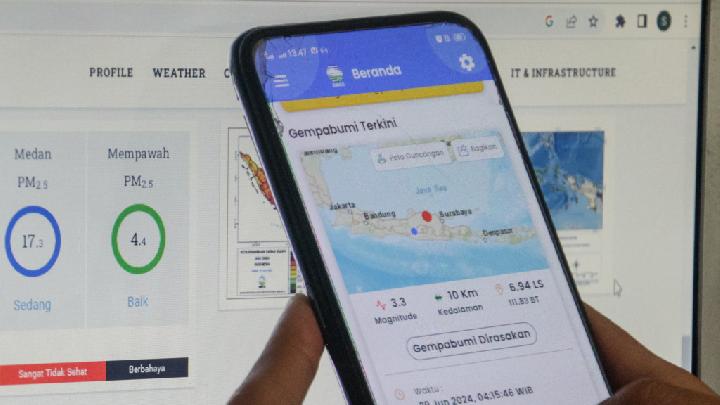

Bmkg 5 9 Magnitude Earthquake In Indian Ocean No Tsunami Risk Predicted

Apr 11, 2025

Bmkg 5 9 Magnitude Earthquake In Indian Ocean No Tsunami Risk Predicted

Apr 11, 2025 -

Google Cloud Next 2025 Recap Of Day Twos Biggest News

Apr 11, 2025

Google Cloud Next 2025 Recap Of Day Twos Biggest News

Apr 11, 2025 -

Important Notice Changes To Sky Streaming On Amazon Fire Tv Stick

Apr 11, 2025

Important Notice Changes To Sky Streaming On Amazon Fire Tv Stick

Apr 11, 2025 -

Karakter Edwin Bagaimana Morgan Oey Gambarkan Luka Generasi

Apr 11, 2025

Karakter Edwin Bagaimana Morgan Oey Gambarkan Luka Generasi

Apr 11, 2025 -

Charlie Kirks April 10th Purdue Appearance What To Expect

Apr 11, 2025

Charlie Kirks April 10th Purdue Appearance What To Expect

Apr 11, 2025