Stock Market Shock: Trump Tariffs Cause Sharp Drop In European Trading

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Shock: Trump Tariffs Trigger Sharp Drop in European Trading

The European stock market experienced a significant downturn today, triggered by the renewed imposition of steel and aluminum tariffs by the Trump administration. This unexpected move sent shockwaves through the trading floor, leaving investors reeling and analysts scrambling to assess the potential long-term impact. The announcement, which came without warning, wiped billions off the value of European equities, highlighting the precariousness of the global economic climate and the enduring influence of US trade policy on international markets.

A Sudden Blow to European Businesses:

The reintroduction of tariffs, previously suspended under a trade agreement, immediately impacted European steel and aluminum producers. Shares in major companies within these sectors plummeted, leading to a broader sell-off across the market. Analysts point to the immediate and substantial effect on these industries as a primary driver of the overall market decline. The uncertainty surrounding future trade relations with the US adds further pressure, creating a climate of apprehension amongst investors.

Market Volatility and Investor Sentiment:

The market reacted swiftly and aggressively to the news. The FTSE 100, Germany's DAX, and France's CAC 40 all experienced sharp declines, reflecting the widespread concern across Europe. This volatility underscores the interconnectedness of global financial markets and the significant influence of US trade decisions on international economic stability. Investor sentiment plummeted, with a clear flight to safety observed as investors sought refuge in less risky assets.

Political Fallout and Future Implications:

The move has already ignited a fierce political debate. European Union officials have condemned the action, vowing to respond with retaliatory measures. This escalating trade war threatens to further destabilize the global economy and disrupt established supply chains. The uncertainty surrounding potential countermeasures adds another layer of complexity to the situation, making accurate predictions about future market performance exceedingly difficult.

- Key Impacts:

- Sharp decline in European stock markets.

- Significant losses for steel and aluminum producers.

- Increased market volatility and investor uncertainty.

- Heightened political tensions between the US and EU.

- Potential for further retaliatory measures and economic disruption.

Analyzing the Long-Term Effects:

Economists are warning of potentially severe long-term consequences. Disrupted supply chains, reduced trade volumes, and increased prices for consumers are just some of the potential outcomes. The ripple effects could extend far beyond the steel and aluminum industries, impacting various sectors and potentially triggering a broader economic slowdown. The situation demands close monitoring, with experts urging governments and businesses to prepare for further economic turbulence.

What Investors Should Do:

In light of this dramatic market shift, investors are advised to carefully review their portfolios and consider diversifying their holdings to mitigate risk. Seeking professional financial advice is highly recommended during periods of increased market volatility. Staying informed about evolving trade developments and geopolitical events is crucial for making informed investment decisions. The current situation emphasizes the importance of a long-term investment strategy and a thorough understanding of market risks.

The re-imposition of tariffs marks a significant escalation in trade tensions and serves as a stark reminder of the fragility of the global economic system. The coming days and weeks will be critical in determining the full extent of the damage and the trajectory of the global economy. The situation warrants close observation, and only time will reveal the lasting impact of this unexpected trade policy shift.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Shock: Trump Tariffs Cause Sharp Drop In European Trading. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Matic Slams Onana Man Utd Goalkeeper Among Worst In History

Apr 10, 2025

Matic Slams Onana Man Utd Goalkeeper Among Worst In History

Apr 10, 2025 -

River Valley Fire Aftermath Scdf And Ura Investigate Building Safety Compliance

Apr 10, 2025

River Valley Fire Aftermath Scdf And Ura Investigate Building Safety Compliance

Apr 10, 2025 -

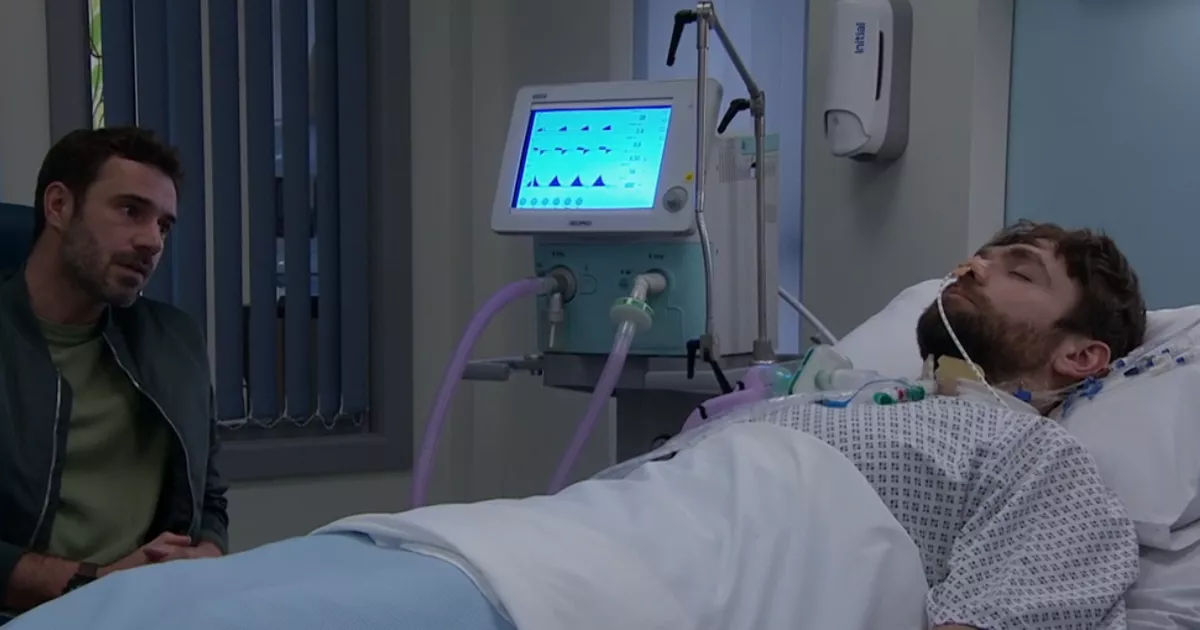

Revealed The Unexpected Identity Of John Sugdens Patient In Emmerdale

Apr 10, 2025

Revealed The Unexpected Identity Of John Sugdens Patient In Emmerdale

Apr 10, 2025 -

150 Bet365 Bonus For The Masters And Nba Code Ls Bonus Inside

Apr 10, 2025

150 Bet365 Bonus For The Masters And Nba Code Ls Bonus Inside

Apr 10, 2025 -

Merz Aesthetics Announces Salma Hayek Pinault As Ultherapy Prime Ambassador

Apr 10, 2025

Merz Aesthetics Announces Salma Hayek Pinault As Ultherapy Prime Ambassador

Apr 10, 2025