Stock Market Shock: Trump Tariffs Trigger Sharp Drop In European Trading

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Shock: Trump Tariffs Trigger Sharp Drop in European Trading

European markets plunged into turmoil today following President Trump's announcement of sweeping new tariffs on European goods. The unexpected escalation of trade tensions sent shockwaves across the continent, triggering a sharp decline in major stock indices and leaving investors scrambling to assess the potential long-term impact. The dramatic drop underscores the escalating global trade war and raises serious concerns about economic growth in Europe and beyond.

This sudden market downturn marks a significant escalation in the ongoing trade dispute between the United States and the European Union. The newly imposed tariffs, targeting a wide range of European products including automobiles, agricultural goods, and manufactured products, caught many analysts off guard. The speed and scale of the announcement left little time for markets to adjust, resulting in a swift and dramatic sell-off.

The Impact on European Indices

The impact was immediate and widespread. Major European indices experienced sharp declines:

- DAX (Germany): Down 3.5%

- CAC 40 (France): Down 3.2%

- FTSE 100 (UK): Down 2.8%

These figures represent some of the worst daily losses seen in several months, highlighting the significant market anxiety generated by the Trump administration's decision. Smaller indices across the continent also suffered substantial losses, reflecting the pervasive impact of the tariffs across various sectors.

Sector-Specific Impacts

The automotive sector was particularly hard hit, with shares of major European car manufacturers plummeting. The new tariffs directly target imported vehicles, threatening profitability and potentially leading to job losses within the industry. Agricultural producers also faced significant losses, as tariffs on European agricultural exports to the US threaten market access and revenue streams.

Beyond the immediate market reaction, there are concerns about the long-term implications of this trade war. The uncertainty surrounding future trade relations between the US and Europe is likely to discourage investment and hinder economic growth. Businesses are hesitant to commit to long-term projects in the face of unpredictable trade policies, creating a climate of uncertainty that dampens economic activity.

Analyst Reactions and Future Outlook

Analysts are expressing grave concerns about the potential for further escalation. Many warn that this move could trigger retaliatory tariffs from the EU, leading to a full-blown trade war with potentially devastating consequences for the global economy. The lack of clear communication and the seemingly unpredictable nature of the Trump administration's trade policy are adding to the instability. The uncertainty surrounding future trade relations is the biggest concern for investors.

The coming days and weeks will be crucial in determining the trajectory of the global economy. The reaction of the European Union to these tariffs, and any subsequent retaliatory measures, will be closely watched by investors worldwide. The long-term consequences of this trade war remain uncertain, but the immediate impact on European markets is undeniably severe. This event serves as a stark reminder of the interconnected nature of the global economy and the significant impact of protectionist trade policies. Further updates will follow as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Shock: Trump Tariffs Trigger Sharp Drop In European Trading. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nemanja Matics Scathing Onana Verdict A New Low For Man United Goalkeepers

Apr 10, 2025

Nemanja Matics Scathing Onana Verdict A New Low For Man United Goalkeepers

Apr 10, 2025 -

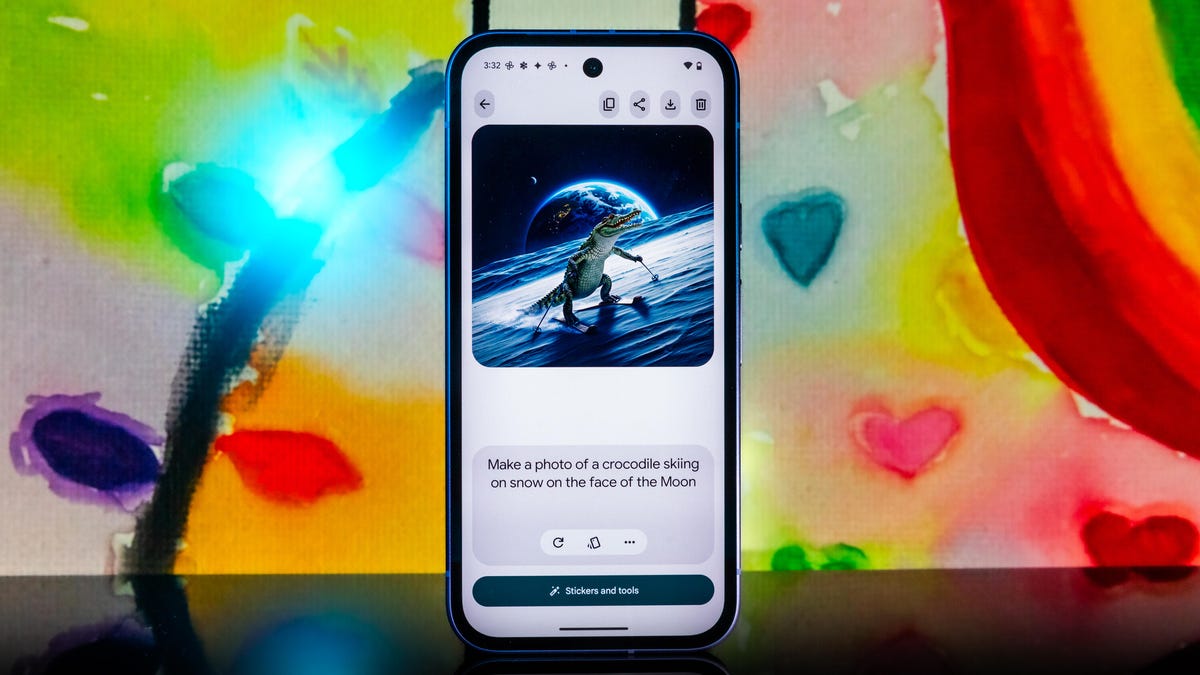

Pixel 9a Is Googles Budget Friendly Phone Worth The Hype

Apr 10, 2025

Pixel 9a Is Googles Budget Friendly Phone Worth The Hype

Apr 10, 2025 -

Warszawa Planuj Podroz Marsze Smolenskie I Mecz Powoduja Duze Utrudnienia

Apr 10, 2025

Warszawa Planuj Podroz Marsze Smolenskie I Mecz Powoduja Duze Utrudnienia

Apr 10, 2025 -

The De Minaur Clay Court Grind A Deep Dive Into His 2024 Season

Apr 10, 2025

The De Minaur Clay Court Grind A Deep Dive Into His 2024 Season

Apr 10, 2025 -

Seeds Tumble As Alcaraz Prepares For Fils Showdown In Monte Carlo

Apr 10, 2025

Seeds Tumble As Alcaraz Prepares For Fils Showdown In Monte Carlo

Apr 10, 2025