Stock Market Update: Bond Yield Surge And US-China Trade Tensions Impact Dow, S&P 500, Nasdaq

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Update: Bond Yield Surge and US-China Trade Tensions Hammer Dow, S&P 500, Nasdaq

The US stock market experienced a significant downturn today, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all closing lower. This sharp decline is primarily attributed to a surge in bond yields and escalating tensions in US-China trade relations. Investors are grappling with uncertainty, leading to a risk-off sentiment that heavily impacted market performance.

Bond Yields Rise, Signaling Inflationary Pressures:

The yield on the benchmark 10-year Treasury note climbed to its highest level in several months. This rise indicates growing concerns about inflation. Higher bond yields make bonds more attractive to investors, diverting capital away from the stock market. This outflow of investment further exacerbates the downward pressure on stock prices. Economists are closely monitoring these yields, as sustained increases could signal a more aggressive approach from the Federal Reserve regarding interest rate hikes.

US-China Trade War Intensifies:

Adding fuel to the market's fire, renewed tensions between the US and China are causing significant uncertainty. Recent pronouncements from both governments suggest a hardening of stances on trade, reigniting fears of a protracted trade war. This uncertainty makes it difficult for businesses to plan for the future, impacting investment decisions and corporate profits, key factors driving stock valuations. Specific concerns include potential new tariffs and restrictions on technology exports, impacting sectors heavily reliant on international trade.

Sector-Specific Impacts:

The tech-heavy Nasdaq Composite was particularly hard hit, reflecting investor anxieties surrounding the potential impact of increased trade restrictions on technology companies. Meanwhile, the energy sector also experienced a decline, potentially linked to global economic uncertainty and concerns about future oil demand. Conversely, some defensive sectors, like consumer staples, saw relatively smaller losses as investors sought refuge in more stable assets.

What to Watch For:

- Federal Reserve Policy: The next announcement from the Federal Reserve regarding interest rates will be closely scrutinized. Any indication of a more aggressive approach to combating inflation could further impact stock market performance.

- US-China Trade Negotiations: Any developments in US-China trade talks will be crucial in determining market sentiment. A de-escalation of tensions could provide a much-needed boost to investor confidence.

- Inflation Data: Upcoming inflation data releases will be closely monitored to gauge the effectiveness of current monetary policy and provide a clearer picture of the inflationary environment.

Investor Sentiment and Market Outlook:

Market analysts express varied opinions regarding the future trajectory of the market. Some believe the current downturn represents a temporary correction, while others caution about the potential for a more sustained period of volatility. The interplay between rising bond yields, trade tensions, and the Federal Reserve's policy response will be key determinants of the market's short-term and long-term performance. Investors are advised to exercise caution and carefully assess their portfolios given the current climate of uncertainty. Diversification and a long-term investment strategy remain crucial during periods of market volatility.

Keywords: Stock Market, Dow Jones, S&P 500, Nasdaq, Bond Yields, Treasury Notes, Inflation, US-China Trade War, Trade Tensions, Market Volatility, Investor Sentiment, Federal Reserve, Interest Rates, Economic Uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Update: Bond Yield Surge And US-China Trade Tensions Impact Dow, S&P 500, Nasdaq. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paolo Ardoino Tethers Willingness To Operate In Untapped Markets

Apr 12, 2025

Paolo Ardoino Tethers Willingness To Operate In Untapped Markets

Apr 12, 2025 -

From Shaw To Jaiswal The Emotional Impact Of Ipl 2025 Failures

Apr 12, 2025

From Shaw To Jaiswal The Emotional Impact Of Ipl 2025 Failures

Apr 12, 2025 -

Addressing The Deepfake Crisis Congress Reintroduces The No Fakes Act Bolstered By Industry Leaders

Apr 12, 2025

Addressing The Deepfake Crisis Congress Reintroduces The No Fakes Act Bolstered By Industry Leaders

Apr 12, 2025 -

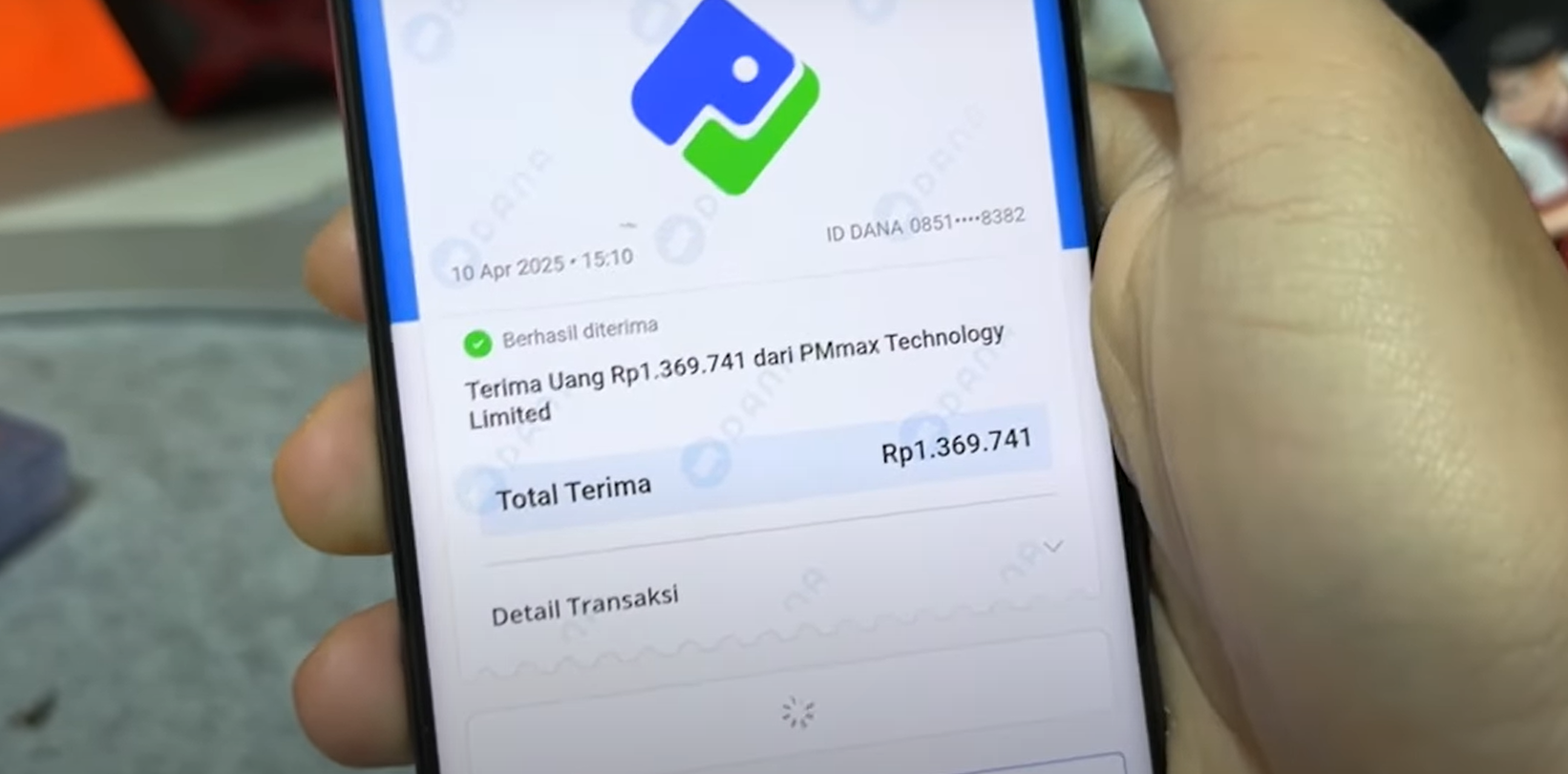

Dengarkan Musik Dapat Uang Jutaan Aplikasi Penghasil Dana Yang Lagi Hits

Apr 12, 2025

Dengarkan Musik Dapat Uang Jutaan Aplikasi Penghasil Dana Yang Lagi Hits

Apr 12, 2025 -

From Rivalries To Revelation The Story Of Mars Cartography

Apr 12, 2025

From Rivalries To Revelation The Story Of Mars Cartography

Apr 12, 2025