Stock Market Update: Dow, S&P 500, And Nasdaq Futures Jump Amid Trump-Fed Conflict

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Update: Dow, S&P 500, and Nasdaq Futures Surge Amid Trump-Fed Conflict

Wall Street experienced a dramatic upswing in pre-market trading today, with futures contracts for the Dow Jones Industrial Average, S&P 500, and Nasdaq all showing significant gains. This unexpected surge comes amidst escalating tensions between President Trump and the Federal Reserve, creating a volatile yet intriguing market landscape. The conflict has ignited speculation and uncertainty, pushing investors to reassess their strategies.

The market's reaction is a complex interplay of several factors, primarily fueled by the ongoing public disagreement between the President and the central bank regarding interest rate policy. President Trump's repeated criticisms of Federal Reserve Chairman Jerome Powell's decisions have injected considerable uncertainty into the market, causing significant volatility in recent weeks.

<h3>Understanding the Trump-Fed Conflict</h3>

The core of the conflict centers around the Federal Reserve's approach to interest rate adjustments. President Trump has openly expressed his displeasure with rate hikes, arguing that they hinder economic growth and harm his re-election chances. He has even called for negative interest rates, a highly unconventional monetary policy. Conversely, the Federal Reserve maintains its independence, emphasizing its commitment to controlling inflation and maintaining long-term economic stability. This clash of perspectives has led to considerable market uncertainty, with investors struggling to predict the future trajectory of interest rates and their impact on corporate earnings and valuations.

<h3>Market Response: A Rally Amidst Uncertainty?</h3>

While the reasons behind today's market jump are multifaceted, several factors likely contributed:

- Short-covering: Some analysts believe the recent surge is due to investors covering their short positions. Short-selling involves betting against a stock's price, and significant losses can incentivize investors to buy back the stock to limit further losses.

- Bargain hunting: The recent market downturn, partly fueled by the Trump-Fed conflict, might have created opportunities for bargain hunting. Savvy investors might be seeing this as a buying opportunity, anticipating a market rebound.

- Hope for a resolution: Despite the ongoing conflict, there's a lingering hope for a compromise or de-escalation. Any sign of reduced tension between the President and the Federal Reserve could lead to increased investor confidence.

- Positive economic data: Although overshadowed by the political drama, positive economic indicators released recently could also be contributing to the market's optimistic outlook.

<h3>What to Watch For</h3>

The current market situation remains precarious. While today's surge is encouraging, it's crucial to avoid reading too much into short-term movements. Investors should closely monitor:

- Federal Reserve announcements: Future statements and actions by the Federal Reserve will be critical in determining market direction.

- President Trump's rhetoric: The President's continued public commentary on the Federal Reserve will continue to influence market sentiment.

- Economic data: Upcoming economic indicators will provide further insights into the health of the economy and guide future investment decisions.

<h3>Conclusion: Navigating Volatility</h3>

The stock market's reaction to the Trump-Fed conflict highlights the intricate relationship between politics and finance. While today's market jump offers a brief respite from recent volatility, investors should adopt a cautious approach. Thorough research, diversified portfolios, and a long-term investment strategy are essential for navigating these turbulent times. This situation underscores the importance of staying informed and adapting to the constantly evolving dynamics of the market. The ongoing conflict serves as a reminder of the unpredictable nature of the market and the need for well-informed decision-making.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Update: Dow, S&P 500, And Nasdaq Futures Jump Amid Trump-Fed Conflict. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Los Angeles Kings Overcome 4 Goal Deficit To Defeat Edmonton Oilers

Apr 22, 2025

Los Angeles Kings Overcome 4 Goal Deficit To Defeat Edmonton Oilers

Apr 22, 2025 -

Slaters Downfall A Domestic Violence Scandal And The Fall From Grace

Apr 22, 2025

Slaters Downfall A Domestic Violence Scandal And The Fall From Grace

Apr 22, 2025 -

Uk Auto Market Booms As Chinese Ev Makers Circumvent Us Tariffs

Apr 22, 2025

Uk Auto Market Booms As Chinese Ev Makers Circumvent Us Tariffs

Apr 22, 2025 -

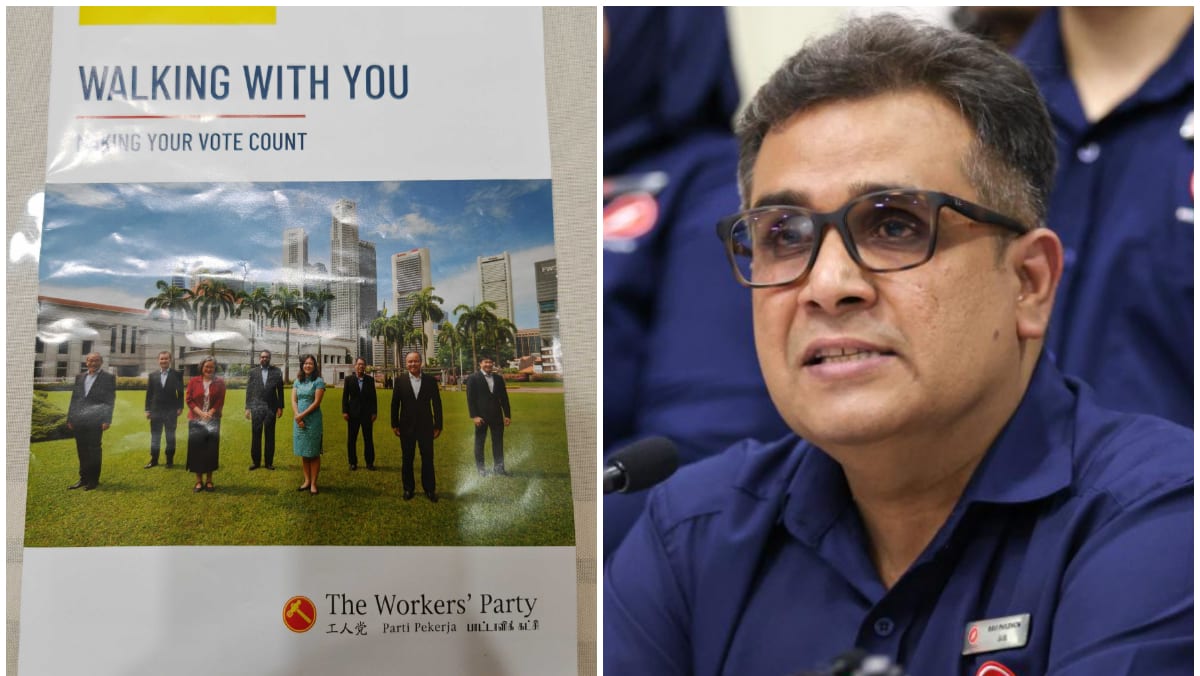

Workers Party To Contest Jalan Kayu Smc In Ge 2025 After Red Dot Uniteds Decision

Apr 22, 2025

Workers Party To Contest Jalan Kayu Smc In Ge 2025 After Red Dot Uniteds Decision

Apr 22, 2025 -

Galvins Nsw Cup Demise A Humbling 500 Fan Outing

Apr 22, 2025

Galvins Nsw Cup Demise A Humbling 500 Fan Outing

Apr 22, 2025