Stock Market Volatility: 2 Stocks To Watch Closely

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Volatility: 2 Stocks to Watch Closely

The stock market's recent rollercoaster ride has left many investors feeling uneasy. Sharp swings and unpredictable movements are the new normal, making it crucial to carefully select investments that can weather the storm. While no stock is entirely immune to volatility, some are more susceptible than others. Today, we'll delve into two stocks currently exhibiting significant volatility and warranting close monitoring: Technology giant, Meta Platforms (META), and Energy producer, ExxonMobil (XOM).

Understanding Current Market Volatility

Several factors contribute to the current market instability. Inflation remains a persistent concern, impacting consumer spending and corporate profits. Geopolitical tensions, rising interest rates, and ongoing supply chain disruptions further exacerbate the uncertainty. This environment demands a cautious approach, requiring investors to carefully analyze individual company performance against the broader macroeconomic backdrop.

Meta Platforms (META): A Tech Giant Facing Headwinds

Meta, formerly known as Facebook, has been a major player in the tech sector for years. However, recent challenges, including increased competition, privacy concerns, and a slowdown in advertising revenue, have significantly impacted its stock price.

-

Challenges: The rise of TikTok and other social media platforms has intensified competition, eating into Meta's user base and advertising revenue. Privacy changes implemented by Apple have also reduced the effectiveness of targeted advertising, a key revenue driver for Meta. The metaverse project, while ambitious, remains a significant investment with uncertain returns.

-

Why Watch Closely: Meta's performance is a barometer for the broader tech sector. Its struggles reflect the challenges facing many tech companies navigating a changing digital landscape. Investors should closely monitor its efforts to diversify revenue streams and adapt to evolving user behavior. Any signs of a turnaround could significantly impact its stock price. Analyzing quarterly earnings reports and investor calls is crucial for gauging its future trajectory.

-

Potential Opportunities: Despite the challenges, Meta boasts a massive user base and strong brand recognition. Successful navigation of its current hurdles could lead to a substantial recovery in its stock price. This makes it a high-risk, high-reward stock to watch.

ExxonMobil (XOM): An Energy Giant Navigating Global Uncertainty

ExxonMobil, a leading energy producer, is experiencing volatility driven by fluctuating oil and gas prices. Global energy demand remains high, but concerns about recession and potential shifts toward renewable energy sources create uncertainty.

-

Challenges: Geopolitical events continue to significantly impact energy prices. The ongoing war in Ukraine and its ripple effects on global energy markets create volatility. Furthermore, the transition to renewable energy sources represents a long-term challenge to the traditional energy sector.

-

Why Watch Closely: ExxonMobil's stock price is highly sensitive to changes in oil and gas prices, making it a volatile investment. Investors need to carefully consider the long-term implications of the global energy transition. Monitoring geopolitical developments and shifts in global energy demand is essential for evaluating ExxonMobil's future prospects.

-

Potential Opportunities: High energy demand and potential supply shortages could boost ExxonMobil's profitability. Furthermore, the company is investing in renewable energy initiatives, potentially mitigating future risks associated with the energy transition. Careful analysis of its diversification strategies will be key to assessing its long-term investment potential.

Conclusion: Navigating Volatility Requires Diligence

Both Meta and ExxonMobil represent intriguing yet volatile investment options in the current market. Careful due diligence, a thorough understanding of the companies' respective challenges and opportunities, and a long-term investment strategy are paramount for navigating the unpredictable market landscape. Remember to consult with a financial advisor before making any investment decisions. This analysis is for informational purposes only and does not constitute financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Volatility: 2 Stocks To Watch Closely. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

April 2025s Must See Movies Now Streaming On Max

Apr 07, 2025

April 2025s Must See Movies Now Streaming On Max

Apr 07, 2025 -

2025 Japanese Grand Prix Live F1 Race Updates Start Time In Uk Suzuka Circuit Grid

Apr 07, 2025

2025 Japanese Grand Prix Live F1 Race Updates Start Time In Uk Suzuka Circuit Grid

Apr 07, 2025 -

Bth Mbashr Hsry Brshlwnt Dd Ryal Bytys Aldwry Alisbany

Apr 07, 2025

Bth Mbashr Hsry Brshlwnt Dd Ryal Bytys Aldwry Alisbany

Apr 07, 2025 -

Mixed Results For Usmnt In Milan Pulisics Success Musahs Setback

Apr 07, 2025

Mixed Results For Usmnt In Milan Pulisics Success Musahs Setback

Apr 07, 2025 -

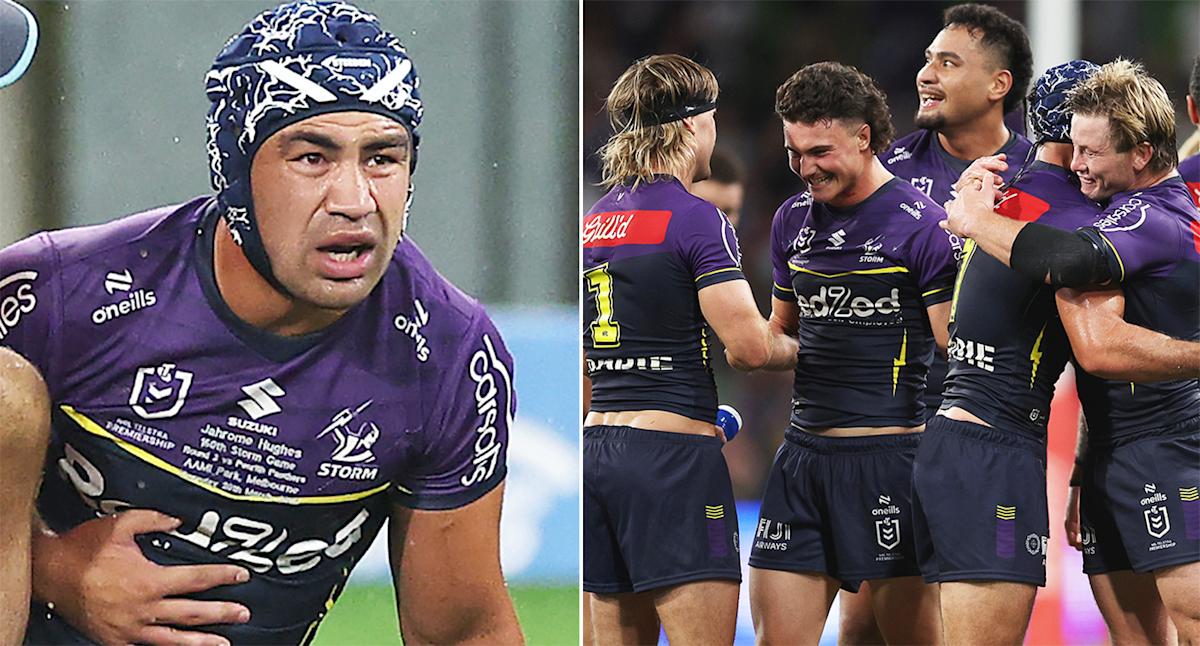

Melbourne Storms Season In Jeopardy After Playmaker Injury

Apr 07, 2025

Melbourne Storms Season In Jeopardy After Playmaker Injury

Apr 07, 2025