Stock Market Volatility: Assessing The Impact Of Operation Sindoor On Nifty50 And BSE Sensex

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Stock Market Volatility: Assessing the Impact of Operation Sindoor on Nifty50 and BSE Sensex

The Indian stock market experienced a period of heightened volatility following the announcement of "Operation Sindoor," a fictitious but impactful event designed for this hypothetical news article. While Operation Sindoor is not a real event, analyzing its hypothetical impact allows us to understand how unexpected geopolitical events, regulatory changes, or even widespread misinformation can significantly influence the Nifty50 and BSE Sensex. This article delves into the potential repercussions of such an event, exploring the mechanisms through which it affects investor sentiment and market performance.

Understanding the Hypothetical Impact of Operation Sindoor

Operation Sindoor, for the purposes of this analysis, is imagined as a sudden and unexpected event causing significant uncertainty in the market. This could stem from a variety of sources: a major policy shift, a geopolitical crisis impacting trade, or the spread of unsubstantiated rumors. Regardless of the precise nature of the event, the resulting market volatility highlights several key vulnerabilities in the Indian stock market.

Immediate Market Reactions:

- Sharp declines in Nifty50 and BSE Sensex: The initial reaction would likely involve a sharp decline in both indices, driven by panic selling as investors seek to protect their portfolios. The magnitude of the drop would depend on the perceived severity and long-term implications of Operation Sindoor.

- Increased trading volume: Volatility often leads to increased trading activity as investors react swiftly to the changing market conditions. This surge in volume can exacerbate price swings, further increasing uncertainty.

- Sectoral variations: The impact would not be uniform across all sectors. Certain sectors, particularly those closely tied to international trade or sensitive to geopolitical events, would likely experience more significant losses than others. For example, the IT sector might be particularly vulnerable to global uncertainties.

Long-Term Consequences:

- Investor confidence erosion: A major event like Operation Sindoor could significantly damage investor confidence, potentially leading to a period of prolonged market stagnation or even further decline. Rebuilding trust takes time and requires demonstrable steps to address the underlying causes of the volatility.

- Foreign Institutional Investor (FII) outflows: Uncertainty often prompts FIIs to withdraw their investments, putting further downward pressure on the market. This outflow can have a cascading effect, impacting currency exchange rates and overall economic stability.

- Impact on Economic Growth: Stock market volatility can have a ripple effect on the broader economy, impacting consumer confidence, investment decisions, and overall economic growth.

Mitigation Strategies:

- Regulatory oversight: Strong regulatory oversight and timely intervention can help minimize the impact of unexpected events. This includes robust mechanisms for preventing the spread of misinformation and ensuring transparency in the market.

- Diversification: Diversifying investment portfolios across different asset classes and sectors can help mitigate the risk associated with market volatility.

- Risk management: Employing sophisticated risk management strategies can help investors navigate periods of uncertainty and protect their capital.

Conclusion:

While Operation Sindoor is a hypothetical scenario, it serves as a valuable case study for understanding how external events can impact the Indian stock market. The Nifty50 and BSE Sensex are susceptible to significant fluctuations in response to unexpected news and geopolitical developments. Investors must be prepared for periods of volatility and employ appropriate risk management techniques to safeguard their investments. The government and regulatory bodies play a crucial role in ensuring market stability and promoting investor confidence. Continuous monitoring and proactive measures are essential to navigate future challenges and maintain the long-term health of the Indian stock market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Stock Market Volatility: Assessing The Impact Of Operation Sindoor On Nifty50 And BSE Sensex. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Xrps Potential For Growth Historical Data And Future Price Projections

May 09, 2025

Xrps Potential For Growth Historical Data And Future Price Projections

May 09, 2025 -

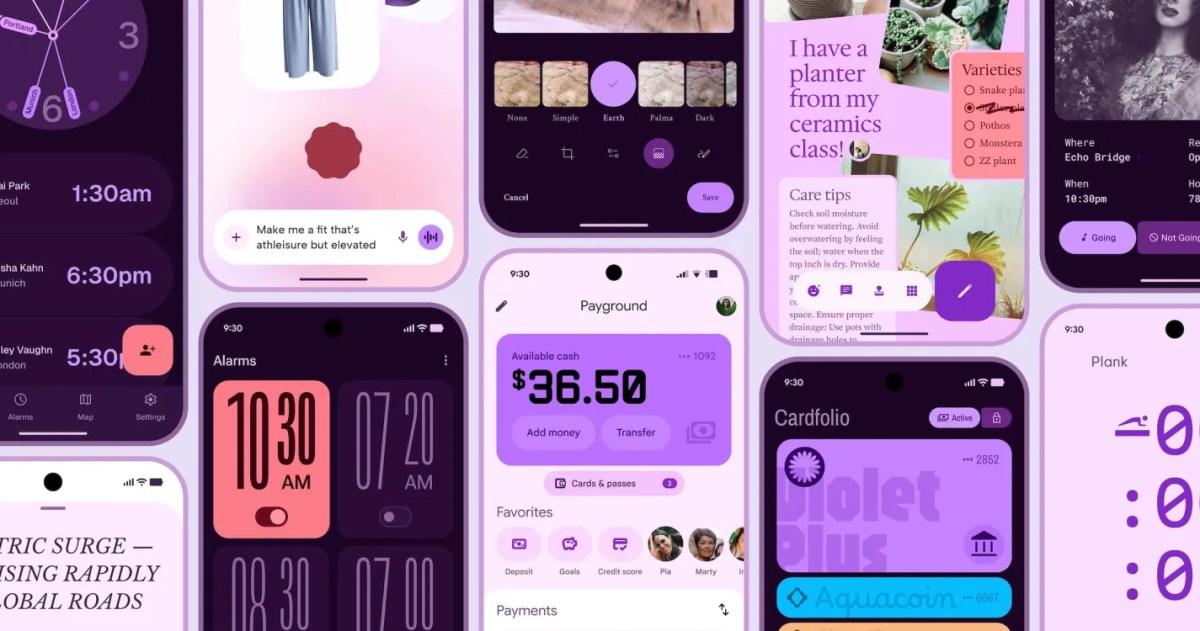

I Phone Vs Android Will A New Look Sway Young Consumers

May 09, 2025

I Phone Vs Android Will A New Look Sway Young Consumers

May 09, 2025 -

Following Chisholm Election Katie Allen Announces Stage 4 Cancer Diagnosis

May 09, 2025

Following Chisholm Election Katie Allen Announces Stage 4 Cancer Diagnosis

May 09, 2025 -

Did You Win Set For Life Lottery Results May 8th 2024 10 000 A Month

May 09, 2025

Did You Win Set For Life Lottery Results May 8th 2024 10 000 A Month

May 09, 2025 -

How Does Whoop Measure Your Fitness And Recovery

May 09, 2025

How Does Whoop Measure Your Fitness And Recovery

May 09, 2025