Strive's Public Debut: Reshaping Corporate Bitcoin Adoption And Key Performance Indicators

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Strive's Public Debut: Reshaping Corporate Bitcoin Adoption and Key Performance Indicators

Strive Asset Management, a pioneer in ESG (Environmental, Social, and Governance) investing, recently made headlines with its public debut, focusing on a novel strategy: integrating Bitcoin into its investment portfolios. This move is not just another cryptocurrency play; it signifies a potential paradigm shift in how corporations view and adopt Bitcoin, impacting key performance indicators (KPIs) across various sectors. The implications are far-reaching, impacting everything from risk management to long-term growth strategies.

A Bold Step in Corporate Bitcoin Integration

Strive's public listing and its unique investment approach immediately captured the attention of the financial world. While Bitcoin's volatility remains a concern, Strive argues that its strategic allocation within a diversified portfolio can offer significant benefits, including:

- Inflation Hedge: Bitcoin's limited supply and decentralized nature position it as a potential hedge against inflation, a crucial consideration in today's economic climate.

- Diversification Benefits: Adding Bitcoin to a traditional investment portfolio can enhance diversification, potentially reducing overall portfolio risk.

- Long-Term Growth Potential: Strive sees Bitcoin's long-term growth potential as a compelling reason for inclusion, viewing it as a burgeoning digital asset with substantial future value.

Impact on Key Performance Indicators (KPIs)

The integration of Bitcoin into corporate investment strategies is expected to influence several key performance indicators:

- Return on Investment (ROI): The most immediate impact will be on ROI. While volatile, Bitcoin's potential for significant returns could significantly boost overall portfolio performance. However, accurate prediction remains challenging due to the inherent volatility of cryptocurrencies.

- Risk Management: Incorporating Bitcoin introduces a new dimension to risk management. Strive's strategy likely involves careful allocation to mitigate volatility. This strategic approach necessitates advanced risk assessment models and a deep understanding of the crypto market.

- ESG Considerations: Interestingly, Strive's approach combines Bitcoin with its commitment to ESG principles. This highlights the evolving understanding of sustainable investing, incorporating new asset classes within a responsible framework.

Reshaping the Corporate Landscape

Strive's public debut and focus on Bitcoin integration are poised to influence corporate adoption of cryptocurrencies. This is likely to be a gradual process, with companies carefully considering the risks and benefits before integrating Bitcoin into their investment portfolios. However, Strive's success could act as a catalyst, encouraging others to explore similar strategies.

Challenges and Future Outlook

Despite the potential benefits, challenges remain. Regulatory uncertainty surrounding cryptocurrencies is a significant factor, as is the inherent volatility of Bitcoin. The long-term success of Strive's strategy will depend on navigating these challenges effectively.

The future of corporate Bitcoin adoption remains to be seen. However, Strive's bold move signals a potential shift in the financial landscape, pushing the boundaries of traditional investment strategies and forcing corporations to re-evaluate their approach to digital assets and their impact on key performance indicators. The company's performance will be closely watched as a benchmark for future corporate cryptocurrency integration strategies. This public debut is not just about Strive's financial success; it's about shaping the future of corporate finance in the digital age.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Strive's Public Debut: Reshaping Corporate Bitcoin Adoption And Key Performance Indicators. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Max Muncy On Arenado Trade Talks The Dodgers Third Baseman Speaks Out

May 10, 2025

Max Muncy On Arenado Trade Talks The Dodgers Third Baseman Speaks Out

May 10, 2025 -

Is Russell Westbrook A Net Positive For The Denver Nuggets In The Playoffs Renck Weighs In

May 10, 2025

Is Russell Westbrook A Net Positive For The Denver Nuggets In The Playoffs Renck Weighs In

May 10, 2025 -

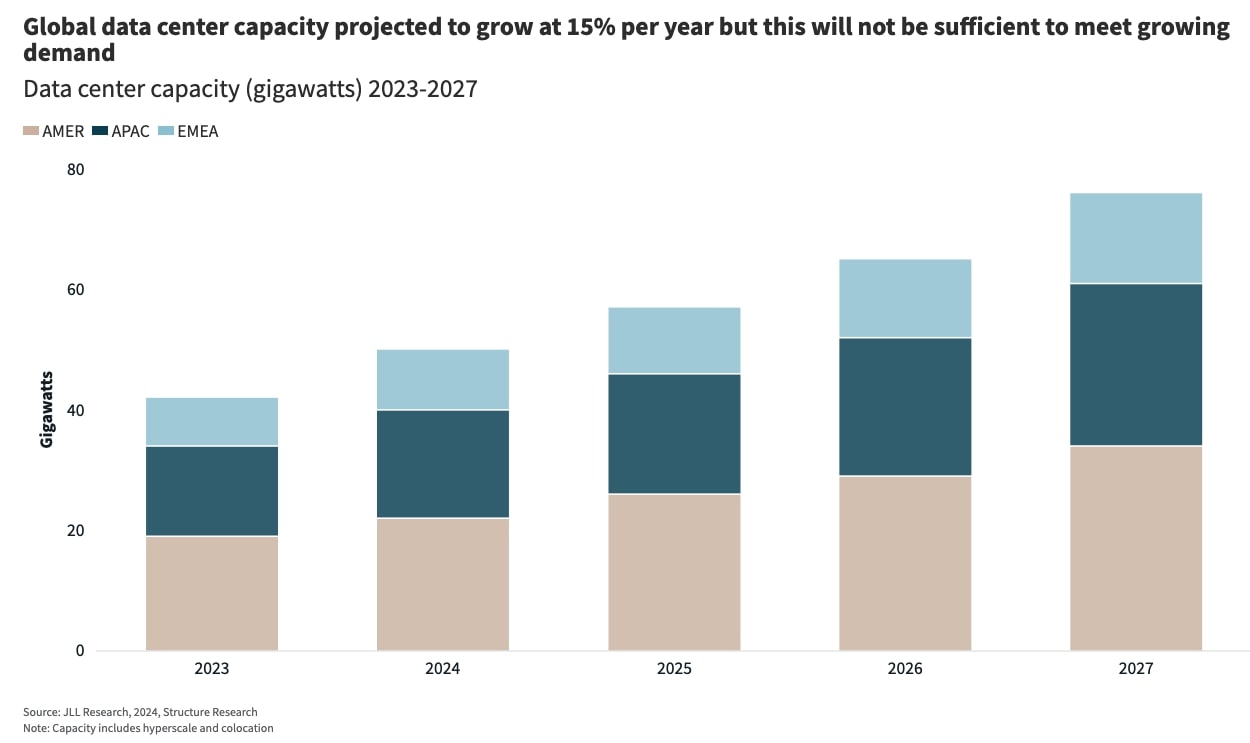

Navigating The Shift Ai Data Center Market Growth Amidst Tech Giant Strategies

May 10, 2025

Navigating The Shift Ai Data Center Market Growth Amidst Tech Giant Strategies

May 10, 2025 -

Chet Holmgren On Physicality In Game 3 Almanzas Analysis

May 10, 2025

Chet Holmgren On Physicality In Game 3 Almanzas Analysis

May 10, 2025 -

Cryptocurrency Security Breach 357 Million In Losses Reported

May 10, 2025

Cryptocurrency Security Breach 357 Million In Losses Reported

May 10, 2025

Latest Posts

-

Deceptive Photo Sparks Debate Among Hollywood A Listers

May 10, 2025

Deceptive Photo Sparks Debate Among Hollywood A Listers

May 10, 2025 -

Public Outcry Over Denver Airport Officials 165 000 Madrid Trip

May 10, 2025

Public Outcry Over Denver Airport Officials 165 000 Madrid Trip

May 10, 2025 -

Bring It Nuggets Respond To Blowout Loss With Renewed Determination

May 10, 2025

Bring It Nuggets Respond To Blowout Loss With Renewed Determination

May 10, 2025 -

Funding Cuts Trump Suggests Raising Taxes On The Rich

May 10, 2025

Funding Cuts Trump Suggests Raising Taxes On The Rich

May 10, 2025 -

Fortune 500 Data Breach Spy Cloud Finds 94 Exposed Employee Data Via Phishing

May 10, 2025

Fortune 500 Data Breach Spy Cloud Finds 94 Exposed Employee Data Via Phishing

May 10, 2025