Strive's Public Debut: Reshaping Corporate Bitcoin Strategies And Key Performance Indicators

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Strive's Public Debut: Reshaping Corporate Bitcoin Strategies and Key Performance Indicators

Strive Asset Management's highly anticipated public debut has sent ripples through the corporate world, particularly impacting how companies approach Bitcoin investment and evaluate its impact on key performance indicators (KPIs). The firm, known for its ESG (environmental, social, and governance) focused investment strategies, is now offering a unique blend of traditional finance acumen with a forward-thinking approach to digital assets, challenging established norms and forcing a reevaluation of Bitcoin's role in corporate portfolios.

This launch isn't just another Bitcoin fund; it represents a significant shift in how institutional investors are considering Bitcoin's potential. Strive's strategy, focused on transparency and long-term value creation, offers a compelling alternative to the often-volatile and speculative nature associated with cryptocurrency investments. This could be a game-changer for corporations hesitant to embrace Bitcoin due to its perceived risks.

Redefining Corporate Bitcoin Strategies

Traditionally, corporate Bitcoin strategies have been limited, often involving small-scale allocations or experimental ventures. However, Strive's entry introduces a more sophisticated approach, emphasizing:

- Long-Term Investment: Unlike short-term trading strategies, Strive focuses on holding Bitcoin as a long-term asset, mitigating the impact of short-term price fluctuations.

- ESG Integration: By incorporating ESG principles into their Bitcoin strategy, Strive addresses concerns about Bitcoin's energy consumption and promotes responsible investment practices. This is crucial for corporations increasingly focused on sustainable investing.

- Transparency and Reporting: Strive provides detailed reporting and transparency, enabling corporations to accurately assess the performance of their Bitcoin holdings and integrate this data into their overall financial reporting. This is a vital aspect missing in many previous Bitcoin investment approaches.

- Risk Management: A well-defined risk management framework is built into Strive's strategy, helping corporations navigate the inherent volatility of Bitcoin while mitigating potential downsides.

Impact on Key Performance Indicators (KPIs)

The integration of Bitcoin into corporate portfolios impacts several KPIs, requiring a nuanced understanding of its performance and risks. Strive's approach allows corporations to:

- Diversify Portfolios: Bitcoin's low correlation with traditional asset classes offers an opportunity for portfolio diversification, potentially reducing overall risk and enhancing returns.

- Enhance Return on Investment (ROI): While Bitcoin's price is volatile, its long-term growth potential can significantly contribute to increased ROI when incorporated into a well-structured investment strategy.

- Improve Financial Reporting: Strive's transparent reporting mechanisms allow corporations to accurately reflect Bitcoin's performance in their financial statements, improving the accuracy and comprehensiveness of their overall financial reporting.

The Future of Corporate Bitcoin Adoption

Strive's public debut signals a significant turning point in corporate Bitcoin adoption. Its focus on transparency, long-term value creation, and ESG integration addresses many of the concerns that have historically hindered broader acceptance. By offering a robust, well-defined, and responsibly managed approach, Strive is paving the way for more corporations to strategically incorporate Bitcoin into their investment strategies, potentially reshaping the financial landscape in the process. This isn't just about Bitcoin; it’s about embracing innovation and adapting to the evolving world of finance. The future of corporate Bitcoin strategies is looking increasingly bright, thanks to pioneering firms like Strive Asset Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Strive's Public Debut: Reshaping Corporate Bitcoin Strategies And Key Performance Indicators. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Celtics Knicks Game 3 Analysis Predictions And Best Bets For May 10th

May 10, 2025

Celtics Knicks Game 3 Analysis Predictions And Best Bets For May 10th

May 10, 2025 -

Post Blowout Nuggets Pledge Fiercer Competition

May 10, 2025

Post Blowout Nuggets Pledge Fiercer Competition

May 10, 2025 -

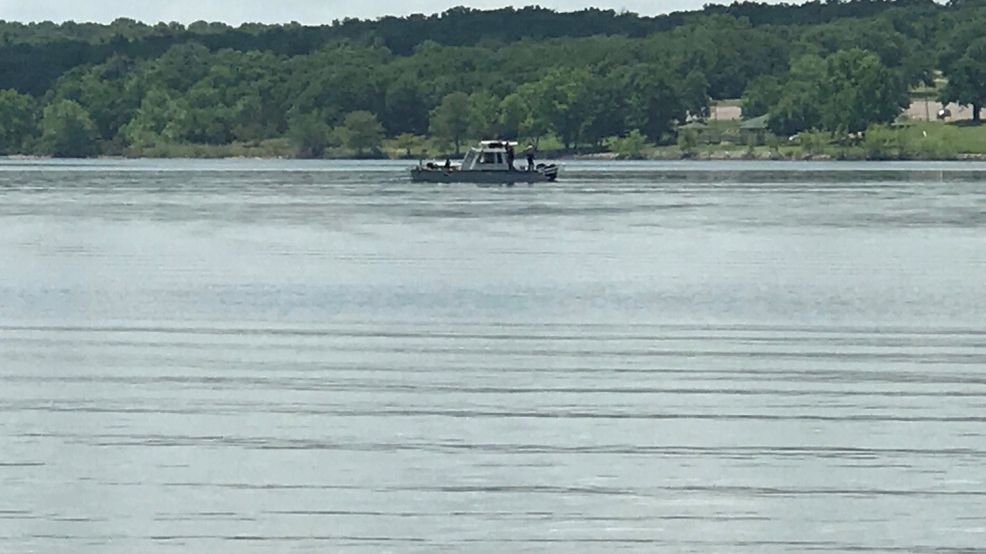

Popular Oklahoma Lakes Face Closures Amidst Federal Hiring Freeze

May 10, 2025

Popular Oklahoma Lakes Face Closures Amidst Federal Hiring Freeze

May 10, 2025 -

Automated Malware Removal A Vaccine Like Approach From Security Researchers

May 10, 2025

Automated Malware Removal A Vaccine Like Approach From Security Researchers

May 10, 2025 -

41 Point Rout Opals Clinch Trans Tasman Netball Series Against New Zealand

May 10, 2025

41 Point Rout Opals Clinch Trans Tasman Netball Series Against New Zealand

May 10, 2025

Latest Posts

-

Top 10 Mothers Day Gift Ideas For 2025 Show Your Love

May 11, 2025

Top 10 Mothers Day Gift Ideas For 2025 Show Your Love

May 11, 2025 -

Oklahoma City Thunders Achilles Heel An Nba Legends Unfiltered Opinion

May 11, 2025

Oklahoma City Thunders Achilles Heel An Nba Legends Unfiltered Opinion

May 11, 2025 -

Aaron Gordon Accuses Thunder Of Excessive Physicality Blasts Refs For Missing Jokic Fouls

May 11, 2025

Aaron Gordon Accuses Thunder Of Excessive Physicality Blasts Refs For Missing Jokic Fouls

May 11, 2025 -

Federal Hiring Freeze Leaves Oklahoma Lake Visitors High And Dry This Summer

May 11, 2025

Federal Hiring Freeze Leaves Oklahoma Lake Visitors High And Dry This Summer

May 11, 2025 -

Score Big Savings Mothers Day 2025 Restaurant Deals

May 11, 2025

Score Big Savings Mothers Day 2025 Restaurant Deals

May 11, 2025