Strong Q1FY25 Results Drive CICC To Raise POP MART Target Price By 29%

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Strong Q1FY25 Results Drive CICC to Raise Pop Mart Target Price by 29%

Pop Mart's stellar performance in the first quarter of fiscal year 2025 has prompted Citic Securities (CICC) to significantly raise its target price for the popular collectible toy company. The upward revision reflects strong investor confidence in Pop Mart's continued growth and market dominance in the blind box and collectible toy sector. This surprising move sends a strong signal to the market about the company's robust financial health and future prospects.

The news follows the release of Pop Mart's Q1FY25 earnings report, which exceeded analysts' expectations across key metrics. The company showcased impressive revenue growth, fueled by strong sales of new product lines and a sustained demand for its existing popular figurines. This positive performance highlights Pop Mart's effective marketing strategies and its ability to resonate with a broad consumer base, particularly among young adults and collectors.

Key Highlights from CICC's Upward Revision:

- 29% Target Price Increase: CICC has boosted its target price for Pop Mart shares by a substantial 29%, reflecting their bullish outlook on the company's future performance. This significant increase underscores the analyst's belief in Pop Mart's capacity for sustained growth and profitability.

- Strong Revenue Growth: The Q1FY25 results demonstrated robust revenue growth, exceeding initial projections and solidifying Pop Mart's position as a leader in the collectible toy market. This positive trend indicates a healthy demand for Pop Mart's products and the effectiveness of its business model.

- Expanding Product Lines and Market Penetration: CICC's analysis highlights Pop Mart's successful diversification strategy through the introduction of new intellectual properties (IPs) and product lines. This expansion into new markets and demographics contributes to the overall revenue growth and strengthens the company's future outlook.

- Positive Market Sentiment: The market responded favorably to the news, with Pop Mart's stock price experiencing a notable increase following the release of the Q1FY25 report and CICC's upward revision. This reflects the overall positive investor sentiment towards the company's prospects.

What Drives Pop Mart's Success?

Pop Mart's success isn't accidental. Several factors contribute to its consistent growth:

- Blind Box Strategy: The element of surprise and the collectible nature of blind boxes continue to be a major driver of sales and engagement.

- Strong IP Portfolio: A diverse range of popular and well-developed intellectual properties fuels a steady stream of new and exciting products.

- Effective Marketing and Brand Building: Pop Mart has cultivated a strong brand identity and employs effective marketing campaigns that resonate with its target audience.

- Omni-channel Retail Strategy: A robust online and offline presence ensures accessibility for customers across various channels.

Looking Ahead:

While the future always presents uncertainties, CICC's significant target price increase paints a positive picture for Pop Mart's trajectory. The company's strong Q1FY25 results, coupled with its strategic initiatives, suggest a promising outlook for continued growth and market leadership in the collectible toy industry. Investors will be closely watching Pop Mart's upcoming reports to see if this positive trend continues. The success of Pop Mart serves as a case study for other companies looking to tap into the lucrative collectible market. The company's innovative approach to product development and marketing is clearly paying off. The ongoing expansion into new markets and product categories further strengthens Pop Mart's position for long-term growth and sustained profitability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Strong Q1FY25 Results Drive CICC To Raise POP MART Target Price By 29%. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cardanos Governance Issues Highlight Need For Improved Participation Rewards

Apr 25, 2025

Cardanos Governance Issues Highlight Need For Improved Participation Rewards

Apr 25, 2025 -

Kaspa Kas Price Explodes Bullish Momentum Targets 0 14

Apr 25, 2025

Kaspa Kas Price Explodes Bullish Momentum Targets 0 14

Apr 25, 2025 -

Analisis El Impacto De La Bendicion Europea En El Athletic

Apr 25, 2025

Analisis El Impacto De La Bendicion Europea En El Athletic

Apr 25, 2025 -

David Bowie Meets Bang And Olufsen New Limited Edition Speaker Unveiled

Apr 25, 2025

David Bowie Meets Bang And Olufsen New Limited Edition Speaker Unveiled

Apr 25, 2025 -

Get Ready Loyle Carners Australian Tour Supporting New Release

Apr 25, 2025

Get Ready Loyle Carners Australian Tour Supporting New Release

Apr 25, 2025

Latest Posts

-

Safe Haven Crypto Investors Flee Falling Dollar Embrace Digital Assets

Apr 30, 2025

Safe Haven Crypto Investors Flee Falling Dollar Embrace Digital Assets

Apr 30, 2025 -

Ligue Des Champions Arsenal Vs Psg Doue Et Dembele En Attaque Pour La Demi Finale

Apr 30, 2025

Ligue Des Champions Arsenal Vs Psg Doue Et Dembele En Attaque Pour La Demi Finale

Apr 30, 2025 -

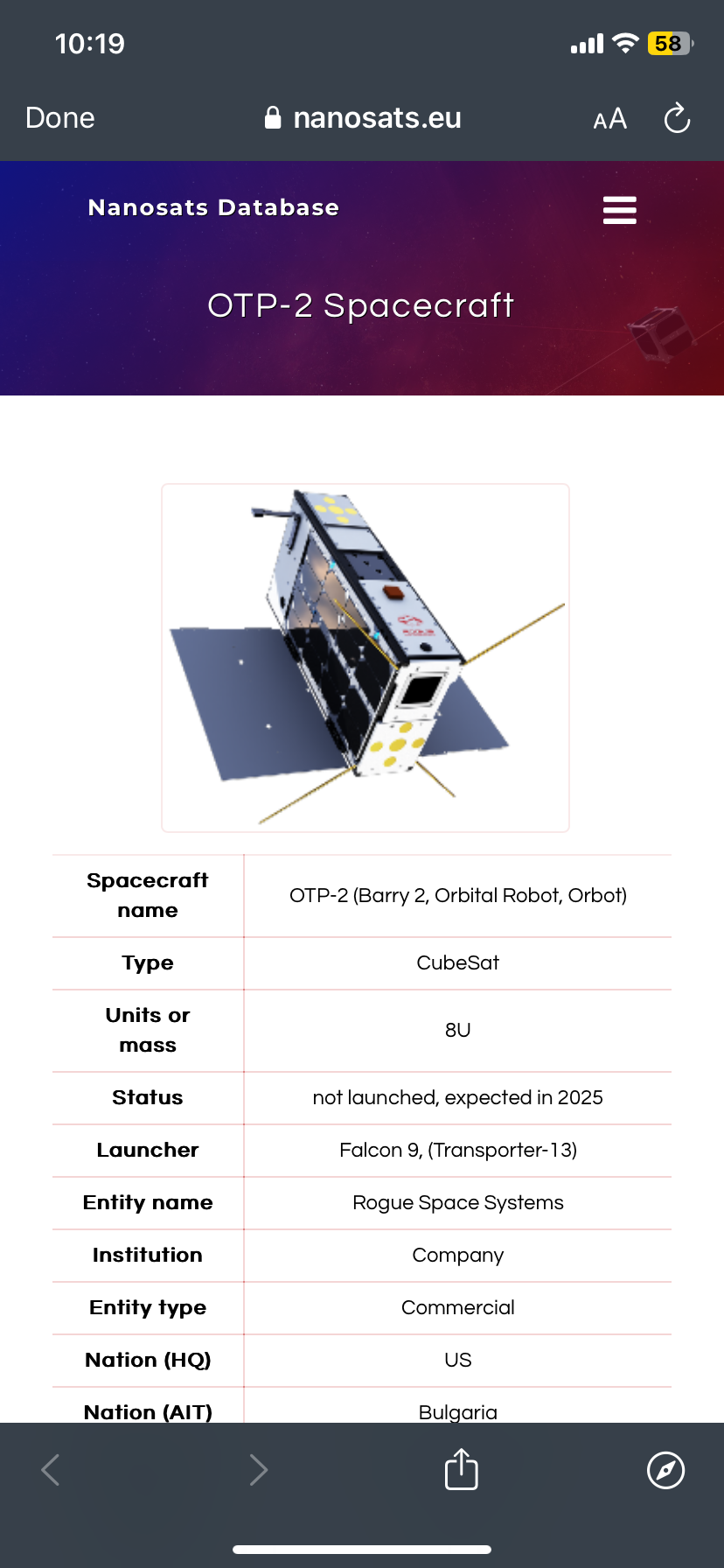

Otp 2 Propulsion Experiments Two Key Tests Analyzed

Apr 30, 2025

Otp 2 Propulsion Experiments Two Key Tests Analyzed

Apr 30, 2025 -

Singapore Football Fas League Preview And Predictions

Apr 30, 2025

Singapore Football Fas League Preview And Predictions

Apr 30, 2025 -

Iga Swiatek Vs Diana Shnaider Madrid Open Match Preview And Betting Analysis

Apr 30, 2025

Iga Swiatek Vs Diana Shnaider Madrid Open Match Preview And Betting Analysis

Apr 30, 2025