Strong Q1 Results For DBS: Profit Beats Forecasts, Reserves Bolstered

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

DBS Bank Q1 2024: Strong Profit Beats Expectations, Reserves Strengthened

Singapore, [Date of Publication] – DBS Bank, Southeast Asia's largest lender, has announced stellar first-quarter 2024 results, exceeding analyst forecasts and showcasing the bank's resilience in a challenging global economic climate. The impressive performance underscores DBS's strong franchise and strategic positioning within the rapidly growing Asian market.

The bank reported a net profit of [Insert Net Profit Figure], significantly surpassing the [Insert Figure]% increase predicted by analysts. This robust performance was driven by a combination of factors, including strong growth in key business segments and effective cost management.

Key Highlights of DBS Q1 2024 Results:

- Net profit surge: The reported net profit represents a substantial increase compared to the same period last year ([Insert Percentage Increase] increase YoY), exceeding market expectations. This underlines the bank's ability to navigate economic uncertainty and deliver strong returns for its shareholders.

- Resilient loan growth: DBS witnessed healthy loan growth across various sectors, indicating strong demand and continued economic activity in the region. This growth was particularly noticeable in [mention specific sectors showing strong growth, e.g., corporate banking, wealth management].

- Enhanced net interest margin (NIM): The bank benefited from a widening net interest margin, reflecting the impact of rising interest rates. This positive trend is expected to continue in the near future, further boosting profitability.

- Strengthened reserves: DBS significantly bolstered its reserves, showcasing a proactive approach to managing potential risks associated with the current global economic environment. This prudent strategy underscores the bank's commitment to financial stability and long-term sustainability.

- Improved capital ratios: The bank's capital ratios remain comfortably above regulatory requirements, reflecting a strong financial position and capacity to withstand potential economic shocks.

Factors Contributing to DBS's Success:

The exceptional Q1 results are attributable to several key factors:

- Strategic focus on Asia: DBS's deep understanding of the Asian market and its strategic focus on high-growth economies within the region have proven to be a key differentiator.

- Digital transformation: The bank's continued investment in digital technologies has enhanced operational efficiency and improved customer experience.

- Strong risk management: DBS's robust risk management framework has enabled the bank to navigate economic uncertainties effectively and minimize potential losses.

- Effective cost control: The bank's commitment to cost optimization has ensured profitability despite macroeconomic headwinds.

Outlook and Future Prospects:

While acknowledging the ongoing global economic uncertainties, DBS remains optimistic about its future prospects. The bank's strong financial position, strategic initiatives, and experienced management team position it favorably to capitalize on growth opportunities in the Asian market. The bank anticipates continued growth across its key business segments, driven by robust economic activity in the region and the ongoing digital transformation initiatives.

Keywords: DBS Bank, Q1 2024 results, Southeast Asia, net profit, loan growth, net interest margin (NIM), reserves, capital ratios, financial performance, Asian economy, banking sector, economic outlook, wealth management, corporate banking.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Strong Q1 Results For DBS: Profit Beats Forecasts, Reserves Bolstered. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Jaylin Williams Earning More Minutes For The Okc Thunder

May 08, 2025

Is Jaylin Williams Earning More Minutes For The Okc Thunder

May 08, 2025 -

The Power Of The Pen Writing As Therapy For Neurological Conditions

May 08, 2025

The Power Of The Pen Writing As Therapy For Neurological Conditions

May 08, 2025 -

Rockies Bryants Back Surgery Confirmed Implications For 2024 Season Discussed

May 08, 2025

Rockies Bryants Back Surgery Confirmed Implications For 2024 Season Discussed

May 08, 2025 -

Leafs Vs Panthers Live Stream Free Nhl Playoffs Online

May 08, 2025

Leafs Vs Panthers Live Stream Free Nhl Playoffs Online

May 08, 2025 -

Nhl Playoffs Game 7 Results Round 1 Wrap Up And The Hockey News Live Discussion

May 08, 2025

Nhl Playoffs Game 7 Results Round 1 Wrap Up And The Hockey News Live Discussion

May 08, 2025

Latest Posts

-

Reserve Bank Holds Rates Steady In April Impact On Australian Households

May 08, 2025

Reserve Bank Holds Rates Steady In April Impact On Australian Households

May 08, 2025 -

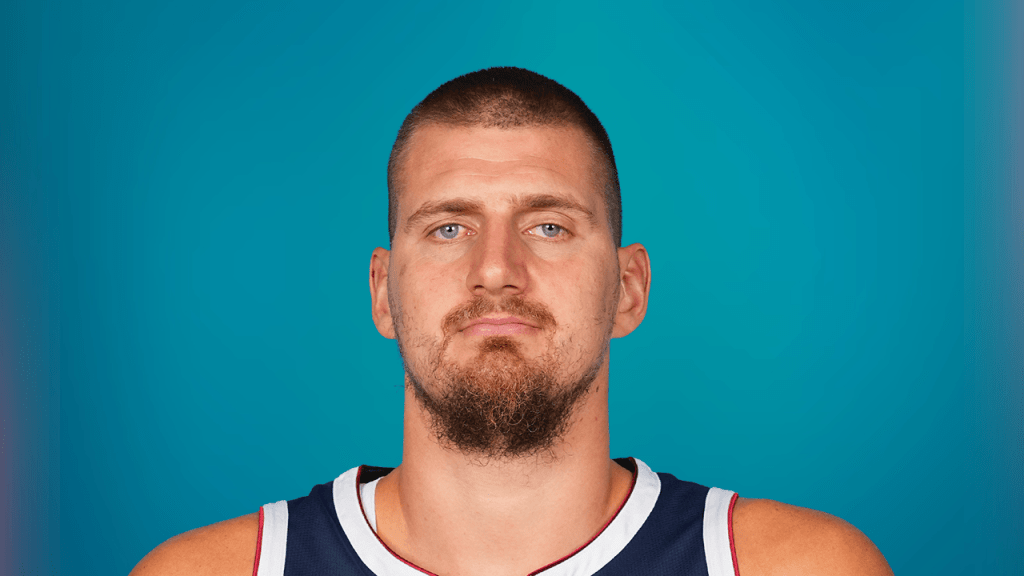

Nba Star Nikola Jokic Addresses Free Throw Merchant Chants During Game

May 08, 2025

Nba Star Nikola Jokic Addresses Free Throw Merchant Chants During Game

May 08, 2025 -

Celtics Edge Knicks 91 90 In Tense May 7th Matchup

May 08, 2025

Celtics Edge Knicks 91 90 In Tense May 7th Matchup

May 08, 2025 -

Miami Heats 2024 Outlook Hinges On Wiggins Performance

May 08, 2025

Miami Heats 2024 Outlook Hinges On Wiggins Performance

May 08, 2025 -

Masked Singers Mad Scientist Monster Identity Finally Revealed

May 08, 2025

Masked Singers Mad Scientist Monster Identity Finally Revealed

May 08, 2025