Super Micro Computer, Inc. (SMCI) Stock Soars: Reasons Behind The Tuesday Jump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer, Inc. (SMCI) Stock Soars: Reasons Behind the Tuesday Jump

Super Micro Computer, Inc. (SMCI) experienced a significant stock surge on Tuesday, leaving investors and analysts scrambling to understand the reasons behind this impressive jump. The stock's performance defied the broader market trends, prompting speculation about potential catalysts driving this unexpected rally. This article delves into the possible factors contributing to SMCI's impressive gains, analyzing the company's recent performance and market position.

Understanding the SMCI Surge:

Tuesday's stock price increase for Super Micro Computer wasn't an isolated incident. The company has shown consistent growth over the past year, fueled by strong demand for its server products and a strategic focus on high-growth market segments. However, pinpointing the exact cause of Tuesday's specific surge requires a closer look at several contributing factors:

1. Strong Q4 Earnings Beat: While official reports may still be pending, market whispers suggest that Super Micro's Q4 earnings significantly exceeded analyst expectations. Strong revenue growth, driven by increased demand for high-performance computing (HPC) solutions and artificial intelligence (AI) infrastructure, likely played a major role. This positive earnings surprise often triggers immediate positive market reactions.

2. AI Infrastructure Boom: Super Micro is a significant player in the burgeoning AI server market. The explosive growth of generative AI and large language models (LLMs) is fueling a massive demand for high-performance computing infrastructure, a sector where SMCI is well-positioned. This increased demand translates directly into higher sales and improved financial performance, boosting investor confidence.

3. Strategic Partnerships and Innovation: Super Micro consistently invests in research and development, forging strategic partnerships to maintain its competitive edge. Any announcements regarding new partnerships or innovative product launches could contribute to increased investor optimism and subsequent stock price increases. Rumors of such developments could easily precede official announcements, creating market buzz and driving up the stock price.

4. Positive Analyst Sentiment: A shift in analyst ratings or positive commentary from influential financial analysts could have significantly impacted SMCI's stock price. Positive sentiment from these key players often triggers a ripple effect, influencing other investors and driving up demand.

5. Short Squeeze Potential: While less likely to be the sole driver, a short squeeze cannot be ruled out. If a significant portion of SMCI's stock was held short, a rapid price increase could force short sellers to buy back shares to limit their losses, further accelerating the upward momentum.

Analyzing the Future of SMCI:

While Tuesday's jump offers a positive outlook for SMCI, investors should proceed with caution. It's crucial to perform thorough due diligence before making any investment decisions. The factors driving this surge need further clarification through official company statements and ongoing market analysis.

Key Takeaways for Investors:

- Monitor official announcements: Keep a close eye on Super Micro Computer's official news releases and financial reports for further insights into their Q4 performance and future outlook.

- Analyze market trends: Continue to monitor the broader trends in the HPC and AI markets, as they directly impact SMCI's growth trajectory.

- Consider long-term investment strategies: Instead of reacting solely to short-term stock fluctuations, develop a long-term investment strategy based on a thorough understanding of SMCI's business model and market position.

The surge in Super Micro Computer's stock price on Tuesday highlights the company's strong position within a rapidly expanding market. While the exact reasons behind the jump require further investigation, the potential for continued growth in the AI and HPC sectors suggests a promising outlook for SMCI in the long term. However, investors are advised to maintain a balanced perspective and conduct thorough research before making investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer, Inc. (SMCI) Stock Soars: Reasons Behind The Tuesday Jump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Future Of Ev Analyzing The Strategic Importance Of Teslas Dojo And 4680 Cells

May 15, 2025

The Future Of Ev Analyzing The Strategic Importance Of Teslas Dojo And 4680 Cells

May 15, 2025 -

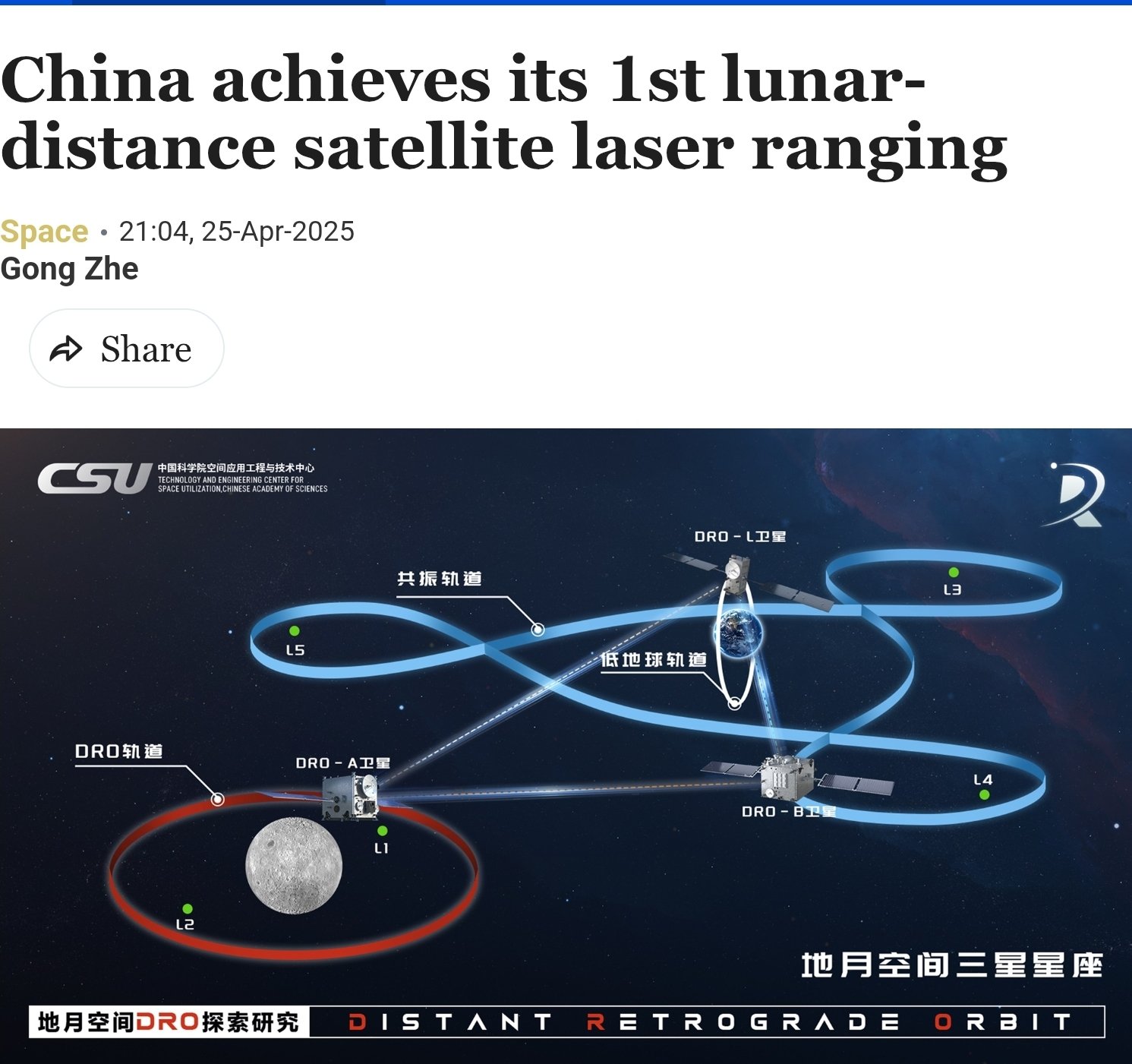

China Achieves Lunar Orbit Tracking With Advanced Satellite Laser Ranging

May 15, 2025

China Achieves Lunar Orbit Tracking With Advanced Satellite Laser Ranging

May 15, 2025 -

Analyzing The New Superman Teaser Trailer 2 Key Details Revealed

May 15, 2025

Analyzing The New Superman Teaser Trailer 2 Key Details Revealed

May 15, 2025 -

Solve Todays Wordle Hints And Answer For 1425 May 14th

May 15, 2025

Solve Todays Wordle Hints And Answer For 1425 May 14th

May 15, 2025 -

Nfl 2025 International Games Which Teams Are Playing Abroad

May 15, 2025

Nfl 2025 International Games Which Teams Are Playing Abroad

May 15, 2025

Latest Posts

-

Andors Creator Tony Gilroy On The Finales Significance And Its Rogue One Connections

May 15, 2025

Andors Creator Tony Gilroy On The Finales Significance And Its Rogue One Connections

May 15, 2025 -

Is Ondo Poised For A Rally 2025 Price Prediction And Market Analysis

May 15, 2025

Is Ondo Poised For A Rally 2025 Price Prediction And Market Analysis

May 15, 2025 -

Ahead Of Millers Milestone Hardwick Unveils Crucial Tigers Lineup Adjustments

May 15, 2025

Ahead Of Millers Milestone Hardwick Unveils Crucial Tigers Lineup Adjustments

May 15, 2025 -

Kelly Brooks Daily Diet Post Marathon Weight Loss

May 15, 2025

Kelly Brooks Daily Diet Post Marathon Weight Loss

May 15, 2025 -

Tenerife To Uk Ryanair Flight Mums Regretful Travel Choice

May 15, 2025

Tenerife To Uk Ryanair Flight Mums Regretful Travel Choice

May 15, 2025