Super Micro Computer, Inc. (SMCI) Tuesday Stock Jump: Analysis And Insights

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer, Inc. (SMCI) Soars on Tuesday: A Deep Dive into the Stock Jump

Super Micro Computer, Inc. (SMCI) experienced a significant stock price surge on Tuesday, leaving investors buzzing and analysts scrambling for explanations. The unexpected jump sparked considerable interest, prompting many to question the underlying drivers behind this impressive market performance. This article delves into the potential reasons for SMCI's Tuesday rally, providing a comprehensive analysis and insights for investors.

Understanding the Tuesday Stock Jump:

SMCI's share price saw a notable increase on Tuesday, defying recent market trends and exceeding analysts' expectations. While no single, explicitly stated event triggered the surge, several contributing factors likely played a role. These include:

-

Strong Q4 Earnings Beat (Potential): While official earnings reports weren't released on Tuesday, market speculation often precedes official announcements. Whispers of a potential strong Q4 earnings beat, exceeding analyst predictions, could have fueled anticipatory buying. Investors often react positively to better-than-expected financial performance.

-

Positive Industry Sentiment: The broader technology sector, particularly within data center infrastructure and cloud computing, has shown positive momentum recently. SMCI, a key player in these sectors, often benefits from overall industry tailwinds. Positive news or announcements from competitors or related companies can indirectly boost SMCI's stock.

-

Increased Institutional Investor Interest: A surge in buying activity by institutional investors could also contribute to a sudden price jump. Large investment firms often make significant purchases based on proprietary research and long-term growth forecasts. Increased institutional holding could signal a bullish outlook for SMCI's future.

-

Short Squeeze: It's possible that a short squeeze contributed to the price increase. If a significant portion of SMCI's shares were shorted (betting on a price decline), a sudden surge in demand could force short-sellers to buy back shares to limit their losses, further driving up the price.

Analyzing SMCI's Long-Term Prospects:

Beyond the immediate Tuesday jump, investors should consider SMCI's long-term potential. The company is a major player in the rapidly growing markets of:

-

High-Performance Computing (HPC): SMCI provides crucial hardware for HPC applications, a market experiencing significant growth fueled by AI, machine learning, and scientific research.

-

Artificial Intelligence (AI) Infrastructure: The increasing demand for AI necessitates robust and scalable infrastructure. SMCI's server solutions are well-positioned to capitalize on this burgeoning market.

-

Cloud Computing: As cloud computing continues its expansion, the need for reliable and efficient server hardware remains paramount. SMCI is a key supplier to major cloud providers.

Risks and Considerations:

While the Tuesday jump is encouraging, investors should remain aware of potential risks:

-

Supply Chain Disruptions: Global supply chain issues could impact SMCI's production and delivery capabilities, potentially affecting its financial performance.

-

Competition: The server market is highly competitive, with established players vying for market share. Intense competition could pressure SMCI's profit margins.

-

Economic Slowdown: A broader economic slowdown could reduce demand for IT infrastructure, impacting SMCI's sales.

Conclusion:

SMCI's Tuesday stock jump presents a compelling case study in market dynamics. While the exact reasons remain partly speculative until official announcements are made, the confluence of potential positive factors – strong earnings expectations, positive industry sentiment, and potential institutional buying – likely contributed to the surge. Investors should conduct thorough due diligence, considering both the potential upside and inherent risks before making any investment decisions related to SMCI. Further analysis, including official Q4 earnings reports and future market trends, will offer a clearer picture of the company's long-term trajectory.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer, Inc. (SMCI) Tuesday Stock Jump: Analysis And Insights. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Review Ryzen 7 Gaming Rig Built Into A Foldable Keyboard

May 14, 2025

Review Ryzen 7 Gaming Rig Built Into A Foldable Keyboard

May 14, 2025 -

Steve Irwin Gala Bindi Irwins Absence Explained

May 14, 2025

Steve Irwin Gala Bindi Irwins Absence Explained

May 14, 2025 -

Get Your Cbse Class 10th And 12th Results 2025 Direct Link And Information

May 14, 2025

Get Your Cbse Class 10th And 12th Results 2025 Direct Link And Information

May 14, 2025 -

Live Score Follow Jack Draper Vs Corentin Moutet At The Italian Open

May 14, 2025

Live Score Follow Jack Draper Vs Corentin Moutet At The Italian Open

May 14, 2025 -

Singapore Health Ministry Addresses Recent Increase In Covid 19 Cases

May 14, 2025

Singapore Health Ministry Addresses Recent Increase In Covid 19 Cases

May 14, 2025

Latest Posts

-

Phoenix Triumphs Hard Earned Victory Sends Them To Round Of 32

May 14, 2025

Phoenix Triumphs Hard Earned Victory Sends Them To Round Of 32

May 14, 2025 -

Appendicitis Bindi Irwins Urgent Surgery And What You Need To Know

May 14, 2025

Appendicitis Bindi Irwins Urgent Surgery And What You Need To Know

May 14, 2025 -

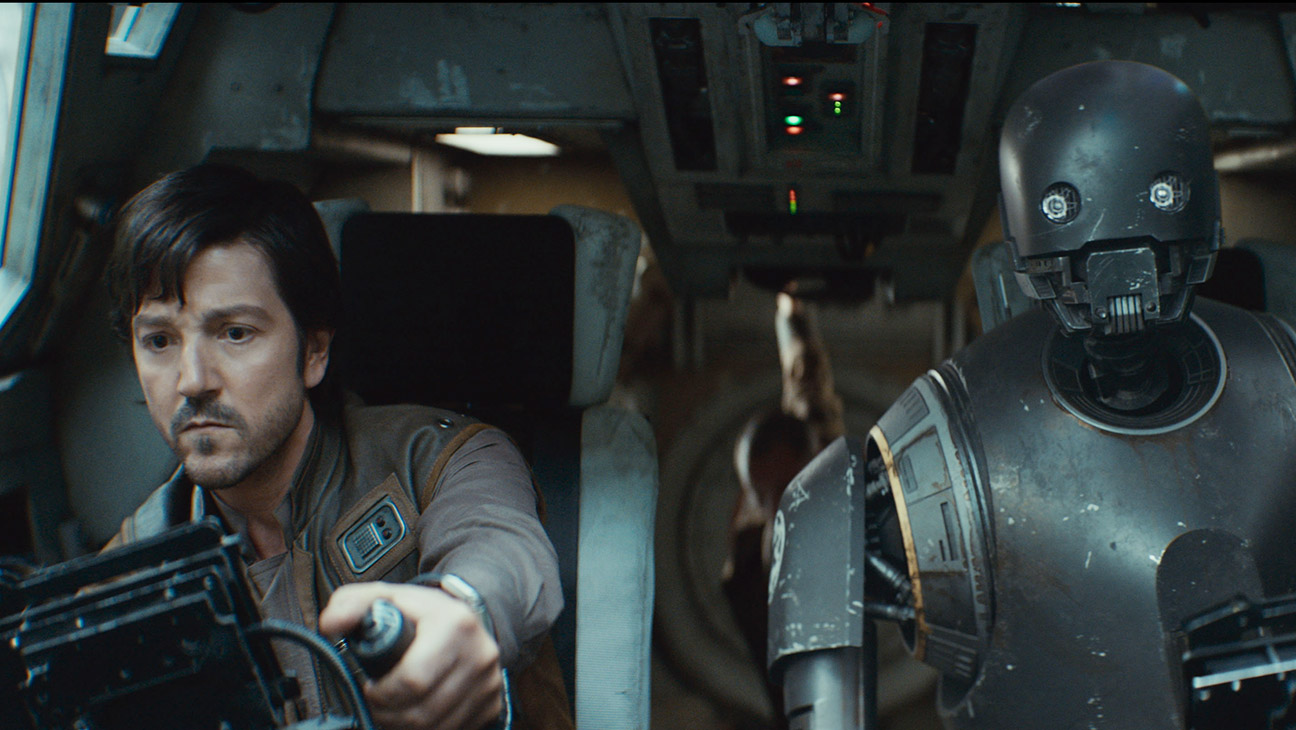

Andors Creator Tony Gilroy Explains The Series Finales Impact And Rogue One Ties

May 14, 2025

Andors Creator Tony Gilroy Explains The Series Finales Impact And Rogue One Ties

May 14, 2025 -

Ftcs Antitrust Case Against Meta Understanding The Arguments Surrounding Whats App And Instagram

May 14, 2025

Ftcs Antitrust Case Against Meta Understanding The Arguments Surrounding Whats App And Instagram

May 14, 2025 -

Trauma And Transformation Understanding Doom Patrols Complex Characters

May 14, 2025

Trauma And Transformation Understanding Doom Patrols Complex Characters

May 14, 2025