Super Micro Computer (SMCI): Analyzing The Significant Stock Increase On Tuesday

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer (SMCI) Soars: Unpacking Tuesday's Significant Stock Increase

Super Micro Computer (SMCI) experienced a remarkable surge in its stock price on Tuesday, leaving investors and analysts scrambling to understand the driving forces behind this significant jump. The unexpected increase sparked considerable interest, prompting questions about the company's future prospects and the potential catalysts for such dramatic market movement. This article delves into the key factors that likely contributed to SMCI's impressive performance, offering insights for investors considering adding this technology stock to their portfolios.

Tuesday's Surge: A Closer Look at the Numbers

SMCI's stock price saw a substantial increase of [Insert Percentage]% on Tuesday, closing at [Insert Closing Price]. This represents a significant gain compared to its recent trading performance and the broader market trends. The sheer magnitude of the increase caught many off guard, highlighting the volatility and potential for rapid shifts within the technology sector.

Potential Catalysts Behind the Stock Increase:

Several factors could have contributed to this unexpected surge in SMCI's stock price. While no single definitive cause has been officially confirmed, several key areas warrant consideration:

-

Strong Q[Quarter] Earnings Expectations: Market speculation often precedes official earnings reports. Positive whispers about Super Micro's upcoming financial results could have fueled anticipation and driven preemptive buying. Strong sales growth in key segments like cloud computing and AI infrastructure would be particularly bullish.

-

Increased Demand for Data Center Infrastructure: The global demand for data center infrastructure is experiencing exponential growth, driven by the increasing adoption of cloud computing, big data analytics, and artificial intelligence. Super Micro, a major player in this space, is well-positioned to benefit from this expanding market. This underlying market strength likely contributes to investor confidence.

-

Positive Analyst Ratings and Upgrades: A recent positive shift in analyst sentiment, with upgrades or positive commentary from influential financial institutions, could have significantly influenced SMCI's stock price. Favorable ratings can trigger a domino effect, leading to increased investor interest and buying pressure.

-

Competitive Landscape: Positive news regarding competitive pressures, successful product launches, or the acquisition of smaller competitors could also contribute to the stock price increase. Success in securing major contracts with large technology companies would be equally significant.

-

Industry-Wide Trends: Positive momentum within the broader technology sector can lift even individual stocks, particularly those considered growth stocks. An overall positive market sentiment often leads to increased investor risk appetite, boosting the performance of technology companies.

Analyzing the Long-Term Outlook for SMCI:

While Tuesday's surge is exciting, investors need to look beyond short-term fluctuations to assess the long-term potential of Super Micro Computer. A thorough analysis should include:

- Financial Performance: Examining historical revenue growth, profitability, and debt levels is crucial for determining SMCI's financial health and sustainability.

- Competitive Advantages: Identifying SMCI's unique selling propositions, technological innovation, and market share compared to competitors is essential.

- Management Team: Assessing the experience, expertise, and track record of SMCI's leadership team provides valuable insights into the company's strategic direction.

- Future Growth Opportunities: Exploring emerging markets and technologies, as well as SMCI's potential for expansion into new sectors, is critical for long-term investment decisions.

Conclusion:

The significant stock increase in Super Micro Computer (SMCI) on Tuesday presents a compelling case study in market volatility and investor sentiment. While pinpointing a single definitive cause remains challenging, the interplay of positive market trends, industry-specific growth drivers, and potential positive earnings expectations likely contributed to this surge. Investors should conduct thorough due diligence, considering the factors outlined above, before making any investment decisions based on this recent price movement. The future success of SMCI depends on its continued innovation, market adaptability, and execution of its strategic vision.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer (SMCI): Analyzing The Significant Stock Increase On Tuesday. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eurovision Semi Final 1 Results Who Made The Grand Final

May 15, 2025

Eurovision Semi Final 1 Results Who Made The Grand Final

May 15, 2025 -

Pagamento De Dividendos Veja Quais Acoes Estao Distribuindo Lucros Esta Semana

May 15, 2025

Pagamento De Dividendos Veja Quais Acoes Estao Distribuindo Lucros Esta Semana

May 15, 2025 -

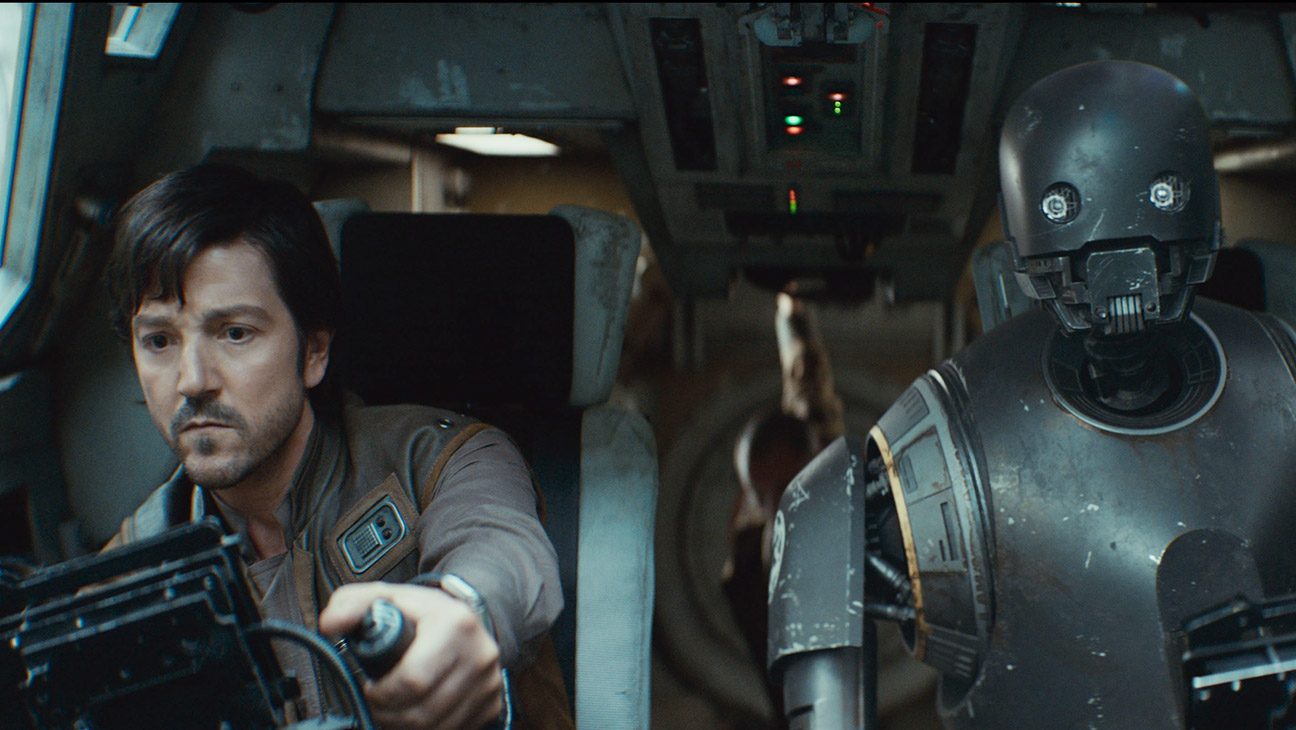

Tony Gilroy Reveals Andor Finales Biggest Moments And Rogue One Links

May 15, 2025

Tony Gilroy Reveals Andor Finales Biggest Moments And Rogue One Links

May 15, 2025 -

Chegg Layoffs 22 Workforce Reduction Amidst Ai Rise

May 15, 2025

Chegg Layoffs 22 Workforce Reduction Amidst Ai Rise

May 15, 2025 -

Exploring The Family Life Of Lauren Sanchez Her Children And Their Background

May 15, 2025

Exploring The Family Life Of Lauren Sanchez Her Children And Their Background

May 15, 2025

Latest Posts

-

Understanding Eurovision 2025 Dates Irelands Entry And How Voting Works

May 15, 2025

Understanding Eurovision 2025 Dates Irelands Entry And How Voting Works

May 15, 2025 -

Ford Issues Nationwide Recall Details On Affected Vehicles And Kentucky Production

May 15, 2025

Ford Issues Nationwide Recall Details On Affected Vehicles And Kentucky Production

May 15, 2025 -

Nuggets Vs Thunder Okcs Playoff Resilience Shines In Game 5 Victory

May 15, 2025

Nuggets Vs Thunder Okcs Playoff Resilience Shines In Game 5 Victory

May 15, 2025 -

Solanas Meta Blockchain Vision A Single Network For Competing Chains

May 15, 2025

Solanas Meta Blockchain Vision A Single Network For Competing Chains

May 15, 2025 -

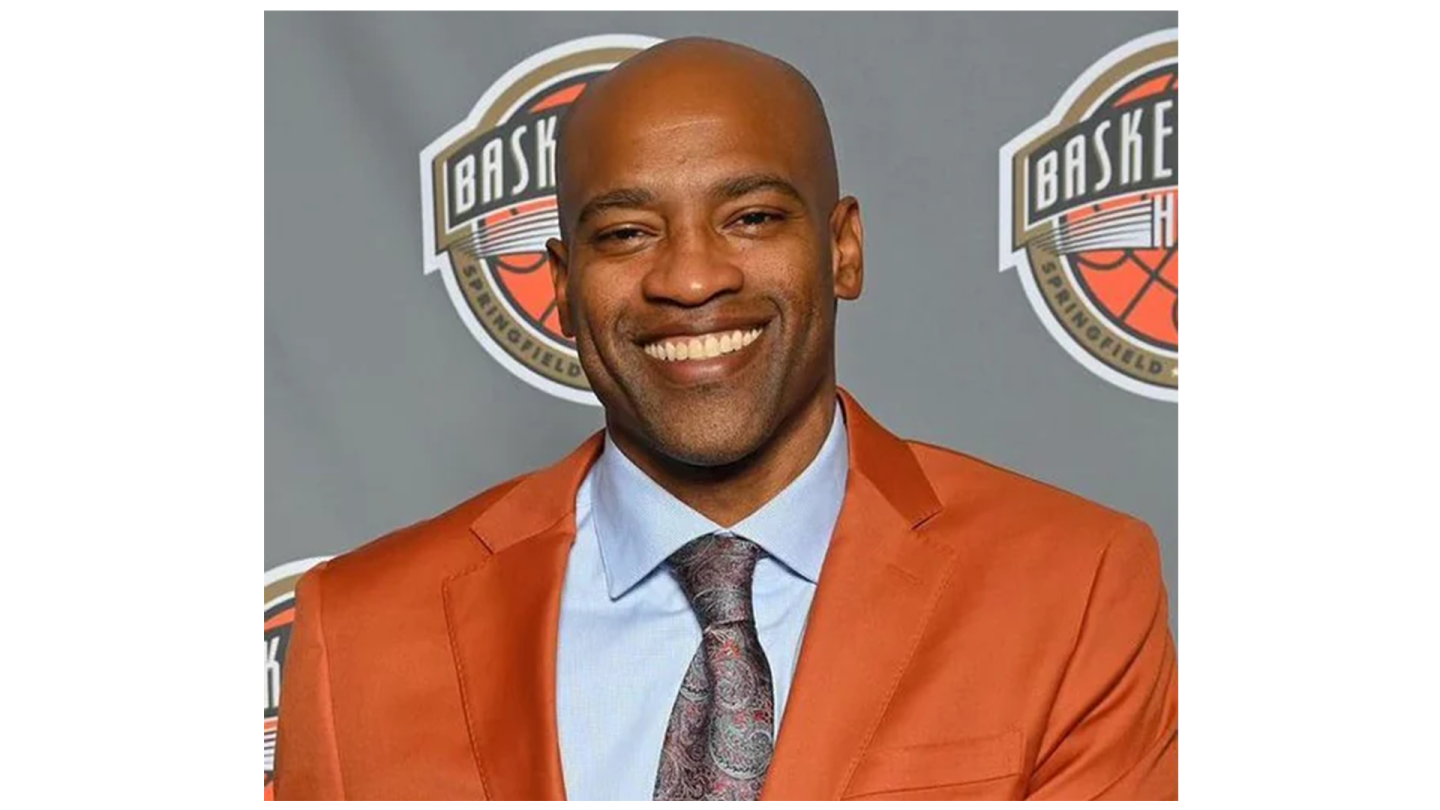

Nba Legend Vince Carters New Role Nbc Sports Studio Analyst

May 15, 2025

Nba Legend Vince Carters New Role Nbc Sports Studio Analyst

May 15, 2025