Super Micro Computer (SMCI) Stock: Deconstructing Tuesday's Unexpected Gains

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer (SMCI) Stock: Deconstructing Tuesday's Unexpected Gains

Super Micro Computer (SMCI) stock experienced a surprising surge on Tuesday, leaving many investors scrambling to understand the reasons behind this unexpected jump. While the tech sector grappled with broader market anxieties, SMCI bucked the trend, showcasing resilience and sparking considerable interest. This article delves into the potential catalysts behind this impressive performance and explores what this might mean for future SMCI stock predictions.

Unpacking the Tuesday Rally: Potential Factors

Several factors could have contributed to SMCI's impressive gains on Tuesday. While no single, definitive explanation has emerged, a confluence of events likely fueled investor confidence:

-

Strong Q4 Earnings Beat Expectations: Although the official Q4 earnings report hadn't been released at the time of the stock surge, whispers of a strong performance exceeding analyst estimates may have circulated amongst institutional investors. Positive pre-release sentiment can significantly impact stock prices.

-

Increased Demand for AI Hardware: Super Micro Computer is a major player in the high-performance computing (HPC) market, a sector experiencing explosive growth fueled by the artificial intelligence (AI) boom. Increased demand for their servers and data center solutions could be driving investor optimism. The company's focus on AI-optimized hardware positions it strategically for continued growth in this booming sector.

-

Positive Analyst Ratings and Upgrades: Prior to Tuesday's jump, SMCI might have received positive ratings or upgrades from influential financial analysts. These recommendations can significantly influence investor sentiment and trigger buying activity. Checking for any analyst reports released around that time is crucial for a complete picture.

-

Short Squeeze Potential: While not confirmed, a short squeeze couldn't be entirely ruled out. If a significant portion of SMCI stock was shorted, a sudden surge in buying pressure could force short sellers to cover their positions, further driving up the price.

-

General Market Sentiment: It's important to acknowledge the broader market context. While the overall tech sector might have faced headwinds, a positive shift in overall market sentiment could have positively impacted SMCI, regardless of company-specific news.

SMCI Stock: Long-Term Outlook and Investment Considerations

While Tuesday's gains were impressive, it's crucial to avoid impulsive investment decisions based solely on short-term fluctuations. Investors should conduct thorough due diligence before investing in SMCI or any other stock.

Key Considerations for Investors:

-

Fundamental Analysis: Analyze SMCI's financial statements, including revenue growth, profitability, and debt levels, to assess the company's long-term viability and growth potential.

-

Competitive Landscape: Research SMCI's competitors and their market share to understand the company's position within the industry.

-

Future Growth Prospects: Evaluate the potential for continued growth in the HPC and AI markets, which are crucial for SMCI's future success.

-

Risk Assessment: Consider the inherent risks associated with investing in the technology sector, including market volatility and competition.

Conclusion: Cautious Optimism for SMCI

Super Micro Computer's unexpected stock surge on Tuesday warrants attention. While the precise reasons remain partly speculative, the potential for strong Q4 earnings, coupled with the burgeoning AI market and possibly other contributing factors, presents a compelling case for cautious optimism. However, investors should always prioritize thorough research and a long-term investment strategy, avoiding impulsive decisions driven solely by short-term market movements. Monitoring upcoming earnings reports and analyst commentary will be vital for understanding the sustainability of these gains. Remember, this analysis is for informational purposes only and is not financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer (SMCI) Stock: Deconstructing Tuesday's Unexpected Gains. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

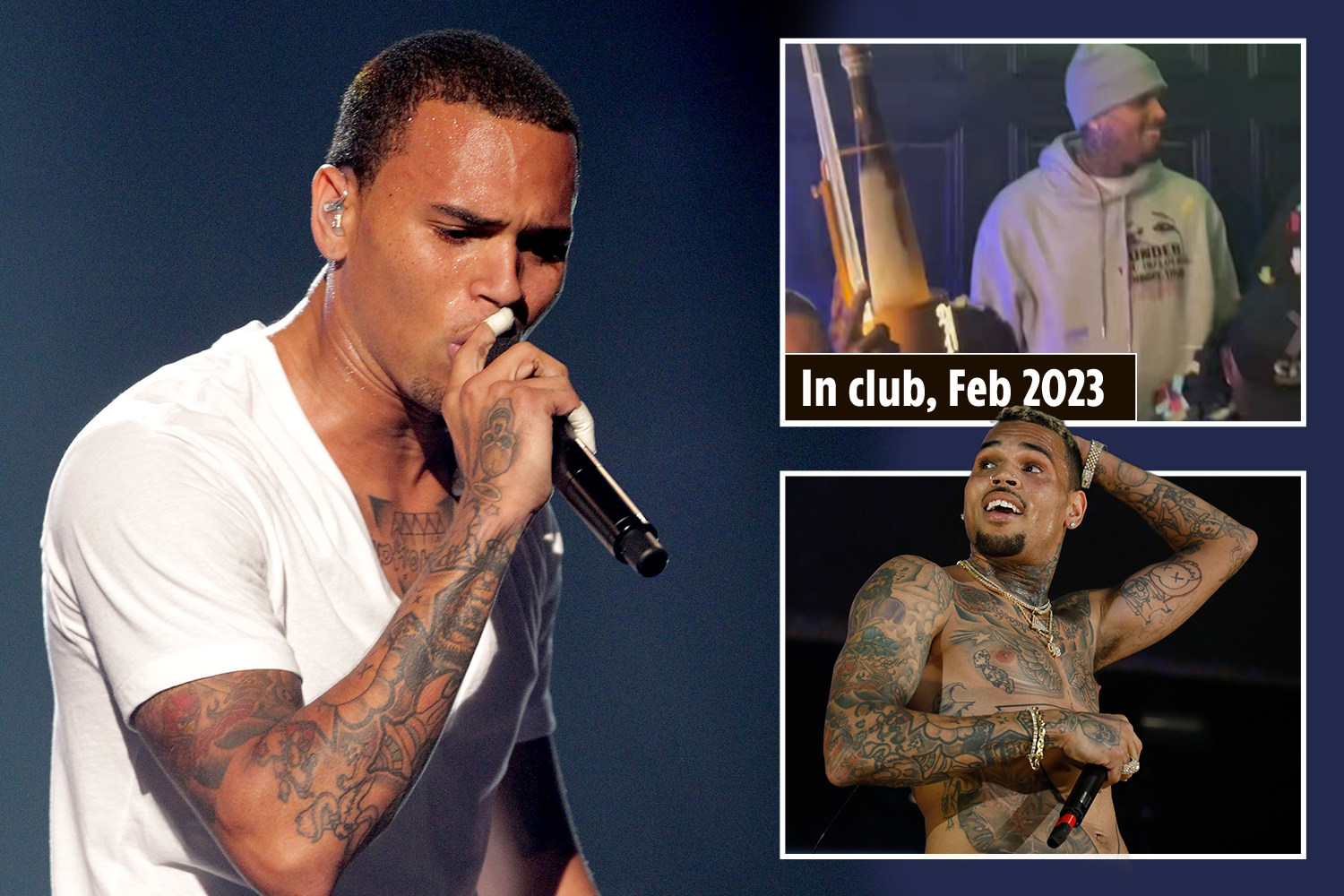

Police Arrest Chris Brown At 5 Star Uk Hotel Allegations Of Nightclub Assault

May 15, 2025

Police Arrest Chris Brown At 5 Star Uk Hotel Allegations Of Nightclub Assault

May 15, 2025 -

Asesinato Valeria Marquez Mensajes Entregas Y Sospechas Previas

May 15, 2025

Asesinato Valeria Marquez Mensajes Entregas Y Sospechas Previas

May 15, 2025 -

Nyt Mini Crossword Answers May 13 2025 Complete Solutions

May 15, 2025

Nyt Mini Crossword Answers May 13 2025 Complete Solutions

May 15, 2025 -

Bill Belichicks Relationship With Jordon Hudson Separating Romance From College Football

May 15, 2025

Bill Belichicks Relationship With Jordon Hudson Separating Romance From College Football

May 15, 2025 -

Warren Buffett Y Apple La Historia Detras De La Disminucion Del 13 En Su Participacion

May 15, 2025

Warren Buffett Y Apple La Historia Detras De La Disminucion Del 13 En Su Participacion

May 15, 2025

Latest Posts

-

Ford Defends Ontario Budget Infrastructure Focus To Offset Us Tariff Impact

May 15, 2025

Ford Defends Ontario Budget Infrastructure Focus To Offset Us Tariff Impact

May 15, 2025 -

Jasmine Paolinis Powerful Quote On Francesca Schiavones Tennis Career

May 15, 2025

Jasmine Paolinis Powerful Quote On Francesca Schiavones Tennis Career

May 15, 2025 -

1 000 New Bto Flats Keppel Club Site Launch In October

May 15, 2025

1 000 New Bto Flats Keppel Club Site Launch In October

May 15, 2025 -

Sia Announces 2 8 Billion Profit Significant Bonuses For Employees

May 15, 2025

Sia Announces 2 8 Billion Profit Significant Bonuses For Employees

May 15, 2025 -

You Tube Tv Needs C Span Why Viewers Demand Its Return

May 15, 2025

You Tube Tv Needs C Span Why Viewers Demand Its Return

May 15, 2025