Super Micro Computer (SMCI) Stock Market Surge: Reasons Behind The Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer (SMCI) Stock Market Surge: Reasons Behind the Rise

Super Micro Computer, Inc. (SMCI) has experienced a significant surge in its stock price recently, leaving investors buzzing and analysts scrambling to understand the driving forces behind this impressive climb. This article delves into the key factors contributing to SMCI's remarkable market performance, examining both short-term catalysts and long-term growth prospects.

The Recent Surge: A Closer Look

SMCI's stock has seen a substantial increase, outperforming many of its competitors in the server and data center technology sector. This upward trajectory isn't simply a matter of random market fluctuations; several fundamental factors are at play. Understanding these factors is crucial for investors considering adding SMCI to their portfolios or assessing their existing holdings.

Key Factors Fueling SMCI's Rise:

-

Strong Q4 Earnings Beat: Super Micro exceeded analysts' expectations in its most recent quarterly earnings report, showcasing robust revenue growth and impressive profitability. This positive financial performance served as a significant catalyst, boosting investor confidence and driving up the stock price. The report highlighted strong demand for their high-performance computing (HPC) solutions and artificial intelligence (AI) infrastructure products.

-

AI Boom and Server Demand: The burgeoning artificial intelligence sector is a major growth driver for SMCI. The company's advanced server technology is perfectly positioned to capitalize on the increasing demand for powerful computing resources needed to support AI development and deployment. This surge in demand for AI-optimized servers is a key factor behind SMCI's recent success.

-

Supply Chain Improvements: The global supply chain continues to be a challenge for many tech companies. However, Super Micro has demonstrated a greater ability to navigate these complexities, leading to improved production efficiency and timely delivery of its products. This improved supply chain resilience contributes to their ability to meet the growing market demands.

-

Strategic Partnerships and Innovation: SMCI is actively forging strategic partnerships and investing heavily in research and development. This commitment to innovation keeps the company at the forefront of server technology and ensures they continue to offer cutting-edge solutions to their customers. New product releases and collaborations with leading tech firms further bolster their market position.

H2: Long-Term Growth Potential:

Beyond the immediate market drivers, SMCI's long-term prospects look promising. The continued growth of cloud computing, the expanding AI market, and the increasing demand for high-performance computing solutions all point towards sustained demand for Super Micro's products. This positions SMCI for continued expansion and potential for further stock price appreciation.

H2: Risks and Considerations:

While the outlook for SMCI is generally positive, investors should also consider potential risks:

- Competition: The server market is highly competitive, with established players and emerging rivals constantly vying for market share.

- Economic Slowdown: A potential economic downturn could impact demand for server technology, affecting SMCI's sales and profitability.

- Supply Chain Disruptions: While SMCI has improved its supply chain resilience, unexpected disruptions remain a possibility.

H2: Conclusion:

The recent surge in Super Micro Computer's stock price is a result of a confluence of factors, including strong financial performance, the booming AI market, and effective supply chain management. While risks remain inherent in any investment, SMCI's strategic positioning, technological advancements, and positive growth trajectory suggest a promising outlook for the company and its shareholders. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions. The information provided here is for informational purposes only and should not be considered investment advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer (SMCI) Stock Market Surge: Reasons Behind The Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

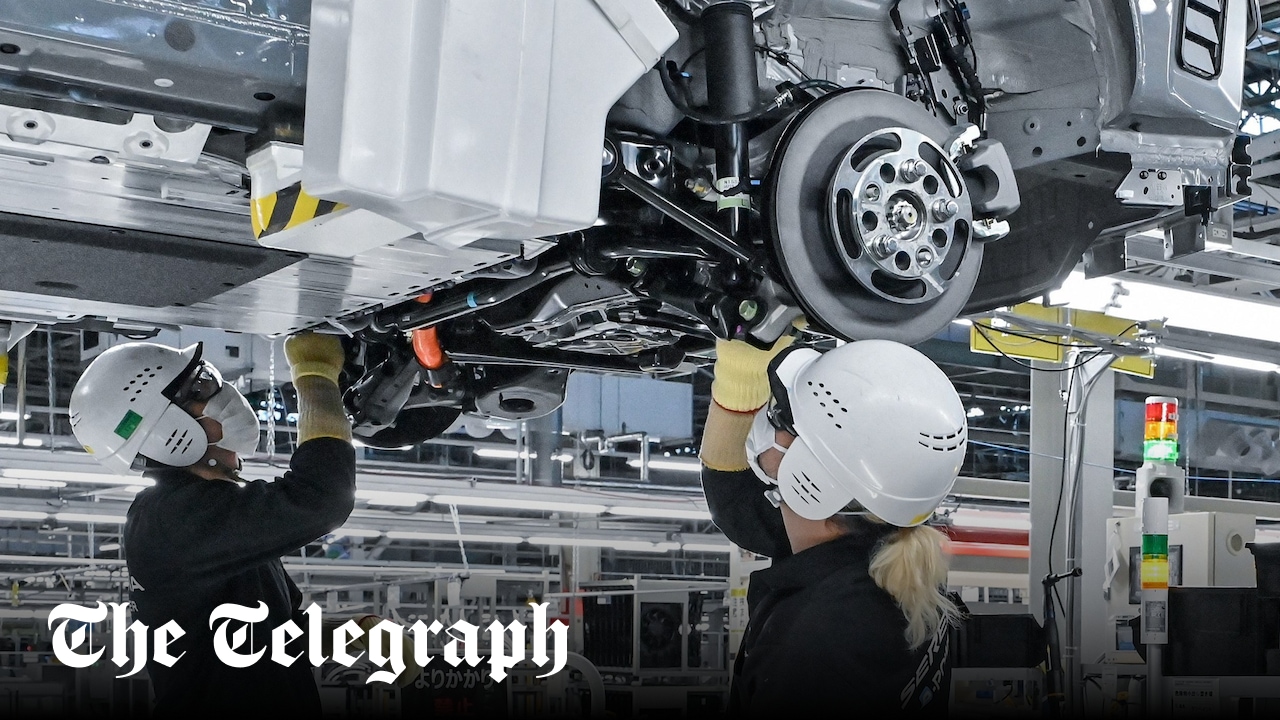

Nissans Cost Cutting Measures 20 000 Job Losses Shake The Auto Industry

May 14, 2025

Nissans Cost Cutting Measures 20 000 Job Losses Shake The Auto Industry

May 14, 2025 -

F1 Singapore Grand Prix 2025 Cl Babymetal Join Stellar Music Lineup

May 14, 2025

F1 Singapore Grand Prix 2025 Cl Babymetal Join Stellar Music Lineup

May 14, 2025 -

Live Tennis Updates Gauff Andreeva Alcaraz And Draper Matches In Rome

May 14, 2025

Live Tennis Updates Gauff Andreeva Alcaraz And Draper Matches In Rome

May 14, 2025 -

Meet The Chinese Cybertruck Design Specs And Production Launch

May 14, 2025

Meet The Chinese Cybertruck Design Specs And Production Launch

May 14, 2025 -

Gauff Sabalenka Zheng Andreeva Who Reaches The Rome Semifinals

May 14, 2025

Gauff Sabalenka Zheng Andreeva Who Reaches The Rome Semifinals

May 14, 2025

Latest Posts

-

The Handmaids Tale Season 6 Aunt Lydias Spiritual Transformation

May 14, 2025

The Handmaids Tale Season 6 Aunt Lydias Spiritual Transformation

May 14, 2025 -

Update Karen Read Trial Proceedings Suspended Due To Unforeseen Events

May 14, 2025

Update Karen Read Trial Proceedings Suspended Due To Unforeseen Events

May 14, 2025 -

Wednesday May 14 Nyt Mini Crossword Complete Puzzle Solutions

May 14, 2025

Wednesday May 14 Nyt Mini Crossword Complete Puzzle Solutions

May 14, 2025 -

Bruins Address Critical Need 2025 Nhl Mock Draft Analysis

May 14, 2025

Bruins Address Critical Need 2025 Nhl Mock Draft Analysis

May 14, 2025 -

Nba Playoffs Thunders Comeback Victory Over Nuggets Take 3 2 Series Lead

May 14, 2025

Nba Playoffs Thunders Comeback Victory Over Nuggets Take 3 2 Series Lead

May 14, 2025