Super Micro Computer Stock: Evaluating The Major Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Super Micro Computer Stock: Evaluating the Major Risks

Super Micro Computer (SMCI) has enjoyed significant growth, becoming a leading provider of data center, cloud computing, and edge computing solutions. However, investing in any stock involves risk, and SMCI is no exception. This article delves into the major risks investors should carefully consider before adding Super Micro Computer stock to their portfolio.

H2: Competition in a Highly Competitive Market

The server and data center market is fiercely competitive. Super Micro Computer faces stiff competition from industry giants like Dell Technologies, Hewlett Packard Enterprise (HPE), and Lenovo. These larger companies often possess greater resources, brand recognition, and economies of scale, potentially impacting SMCI's market share and profitability. The ongoing consolidation within the industry further intensifies the competitive pressure. Investors need to carefully monitor SMCI's ability to innovate and maintain its competitive edge in this rapidly evolving landscape.

H2: Supply Chain Disruptions and Geopolitical Risks

Like many technology companies, Super Micro Computer relies on a global supply chain. This exposes the company to various risks, including:

- Component shortages: The ongoing global chip shortage and other component supply constraints can significantly impact production, leading to delays in fulfilling orders and potentially hurting revenue.

- Trade wars and tariffs: Geopolitical instability and trade disputes can disrupt supply chains, increase costs, and negatively affect profitability. SMCI's significant international operations make it particularly vulnerable to these risks.

- Transportation challenges: Global logistics disruptions, including port congestion and rising shipping costs, can add to the company's operational expenses.

H3: Mitigating Supply Chain Risks:

SMCI has been actively working on mitigating supply chain risks by diversifying its sourcing and strengthening relationships with key suppliers. However, the effectiveness of these strategies remains to be seen, and investors should remain vigilant about potential supply chain disruptions.

H2: Dependence on Specific Customers and Industries

Super Micro Computer's revenue is concentrated among a relatively small number of key customers. The loss of a major customer or a downturn in a specific industry (e.g., cloud computing) could have a disproportionately negative impact on SMCI's financial performance. Investors should analyze the company's customer concentration and its exposure to various market segments.

H2: Economic Downturn Risk

As a technology company heavily reliant on capital expenditure by businesses, Super Micro Computer is vulnerable to economic downturns. During periods of economic uncertainty, businesses may reduce their IT spending, negatively impacting SMCI's demand and revenue. Understanding the cyclical nature of the technology sector is crucial for evaluating the long-term investment potential of SMCI stock.

H2: Valuation and Growth Expectations

SMCI's current valuation should be carefully assessed against its future growth prospects. Investors need to consider whether the current stock price accurately reflects the company's risk profile and its potential for future earnings growth. Overly optimistic growth expectations could lead to disappointment and price corrections.

H2: Conclusion: A Cautious Approach

Super Micro Computer presents an interesting investment opportunity for those with an appetite for technology stocks. However, the risks outlined above necessitate a cautious approach. Thorough due diligence, including a careful analysis of the company's financial statements, competitive landscape, and overall macroeconomic environment, is crucial before investing in SMCI. Remember, past performance is not indicative of future results, and investing in the stock market always involves risk. Consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Super Micro Computer Stock: Evaluating The Major Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

First Look Gacs Cybertruck Esque Concept Electric Vehicle

May 14, 2025

First Look Gacs Cybertruck Esque Concept Electric Vehicle

May 14, 2025 -

400 Million Luxury Jet For Trump Examining The Legal And Ethical Implications

May 14, 2025

400 Million Luxury Jet For Trump Examining The Legal And Ethical Implications

May 14, 2025 -

Russias False Euphoria A Critical Assessment Of The Current Situation

May 14, 2025

Russias False Euphoria A Critical Assessment Of The Current Situation

May 14, 2025 -

Previsions Astrologiques Du 13 Mai Difficultes Pour 4 Signes Du Zodiaque

May 14, 2025

Previsions Astrologiques Du 13 Mai Difficultes Pour 4 Signes Du Zodiaque

May 14, 2025 -

Receba Dividendos Agora Melhores Acoes Para Investir Em 2024

May 14, 2025

Receba Dividendos Agora Melhores Acoes Para Investir Em 2024

May 14, 2025

Latest Posts

-

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025 -

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025 -

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025 -

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025 -

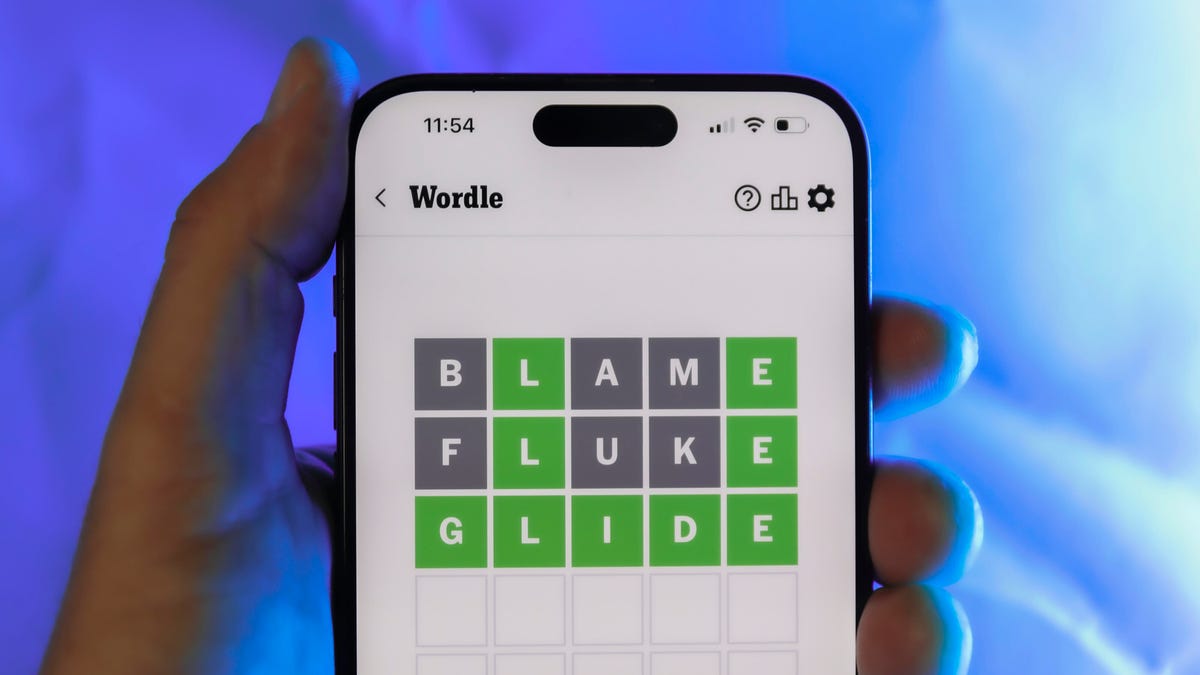

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025