Survey Reveals: Reeves' £25bn Tax Grab Deemed "Toxic" By UK Firms

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Survey Reveals Reeves' £25bn Tax Grab Deemed "Toxic" by UK Firms

Businesses express deep concern over Chancellor's plans, warning of investment slowdown and job losses.

The UK business community has delivered a scathing verdict on Chancellor Jeremy Hunt's planned £25 billion tax grab, with a new survey revealing widespread alarm and accusations that the measures are "toxic" for the economy. The findings, released this morning by the Confederation of British Industry (CBI), paint a bleak picture, suggesting the Chancellor's fiscal strategy could severely hamper economic growth and threaten thousands of jobs.

The survey, which polled over 500 businesses across various sectors, found an overwhelming majority expressing negative sentiment towards the planned tax increases. Many cited concerns about the impact on investment, with a significant proportion indicating they would likely postpone or cancel expansion plans in light of the increased tax burden. This comes at a time when the UK is already grappling with stubbornly high inflation and sluggish economic growth.

H2: Key Findings Highlight Deep-Seated Anxiety

The CBI report highlights several key concerns voiced by businesses:

- Investment Chill: Over 70% of respondents stated the tax increases would negatively impact their investment decisions, leading to a potential slowdown in much-needed capital expenditure across the UK economy. This could stifle innovation and long-term economic prosperity.

- Job Security Fears: A significant number of businesses indicated that the increased tax burden could force them to reconsider staffing levels, raising concerns about potential job losses across various sectors. This adds further pressure to an already tight labour market.

- International Competitiveness: Respondents expressed worries that the higher tax regime would make the UK less competitive compared to other international markets, potentially discouraging foreign investment and hindering economic growth.

- Lack of Clarity: Many businesses also criticized the lack of clarity surrounding the implementation of the tax measures, expressing frustration over the uncertainty surrounding the future fiscal landscape.

H2: "Toxic" Tax Measures Spark Calls for Government Rethink

The CBI Director-General, [Insert Name and Title], described the findings as "deeply concerning," stating that the Chancellor's tax plans risk creating a "toxic environment" for businesses. He urged the government to reconsider its approach, suggesting a more balanced strategy that supports economic growth while addressing fiscal challenges. The report echoes concerns raised by numerous business organizations in recent weeks, highlighting a growing sense of unease among business leaders.

H2: Government Responds, But Concerns Remain

The Treasury responded to the report by emphasizing the government's commitment to fiscal responsibility and its aim to reduce the national debt. However, the response did little to alleviate concerns among businesses, with many arguing that the current strategy prioritizes short-term fiscal consolidation over long-term economic growth. The debate over the £25 billion tax grab is expected to continue, with businesses pressing for a more business-friendly approach to avoid a damaging economic slowdown.

H2: What Happens Next? The Road Ahead for UK Businesses

The coming months will be crucial in determining the impact of the Chancellor's tax plans. The CBI is calling for urgent dialogue with the government to address the concerns raised in the report. The success of the UK economy will heavily depend on the government's ability to navigate this challenging period and create a more supportive environment for businesses to thrive. The continued monitoring of economic indicators will be vital in assessing the actual impact of these controversial tax measures. The future looks uncertain, but one thing is clear: the business community is watching closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Survey Reveals: Reeves' £25bn Tax Grab Deemed "Toxic" By UK Firms. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

When You Cant Win Take A Point Diaby Reflects On Intense Al Ittihad Sea Derby

Apr 07, 2025

When You Cant Win Take A Point Diaby Reflects On Intense Al Ittihad Sea Derby

Apr 07, 2025 -

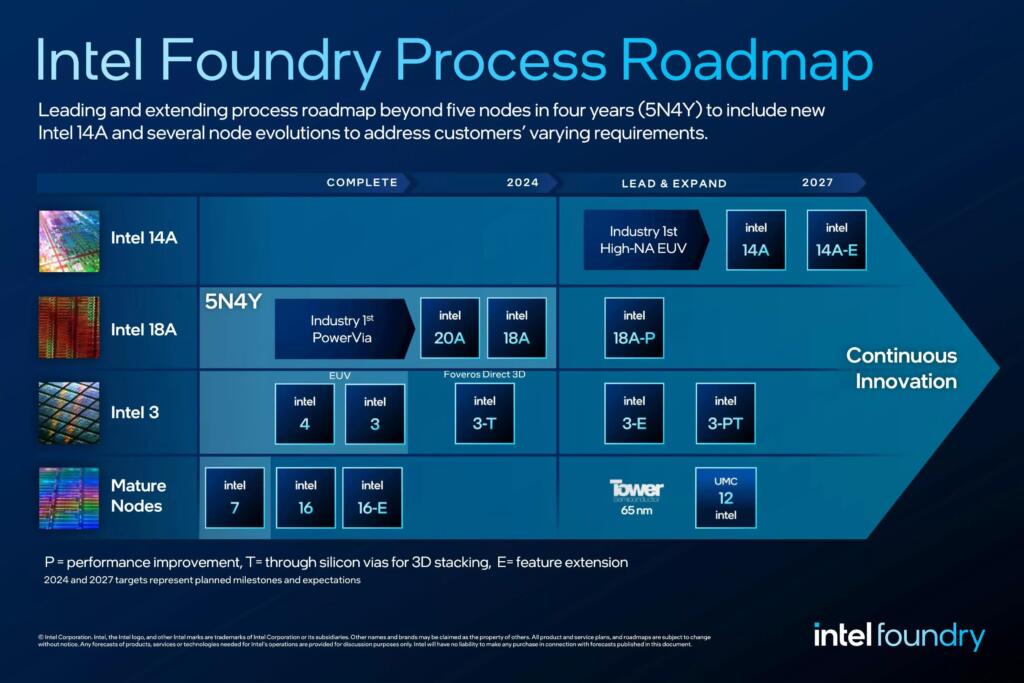

2025 Intel Targets Mass Production Of Its Revolutionary 18 Angstrom Chips

Apr 07, 2025

2025 Intel Targets Mass Production Of Its Revolutionary 18 Angstrom Chips

Apr 07, 2025 -

Secure Ideas Achieves Key Security Milestones Crest And Cmmc Level 1 Compliance

Apr 07, 2025

Secure Ideas Achieves Key Security Milestones Crest And Cmmc Level 1 Compliance

Apr 07, 2025 -

Chuvas Devastadoras Gerdau Interrompe Producao Em Suas Origens No Rio Grande Do Sul

Apr 07, 2025

Chuvas Devastadoras Gerdau Interrompe Producao Em Suas Origens No Rio Grande Do Sul

Apr 07, 2025 -

Is A New Cinema Trend Ruining The Minecraft Movie Experience

Apr 07, 2025

Is A New Cinema Trend Ruining The Minecraft Movie Experience

Apr 07, 2025