Tariff Impact: Evaluating 3 Tech Stocks Facing Price Drops

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tariff Impact: Evaluating 3 Tech Stocks Facing Price Drops

The escalating trade war and the imposition of new tariffs are sending ripples through the global economy, and the tech sector is feeling the pinch. Several tech giants are facing significant price drops as a result of increased import costs and disrupted supply chains. This article delves into the impact of tariffs on three prominent tech stocks, examining their current vulnerabilities and potential future trajectories.

The Tariff Tightrope: Navigating Uncertain Waters

Tariffs, essentially taxes on imported goods, directly impact the cost of production for many tech companies. This is particularly true for companies heavily reliant on manufacturing components sourced from countries subject to these tariffs, like China. Increased input costs translate to higher prices for consumers, potentially dampening demand and squeezing profit margins. Simultaneously, the uncertainty surrounding future tariff policies creates volatility in the market, leading to stock price fluctuations.

Stock Spotlight: 3 Tech Companies Feeling the Heat

We'll be analyzing three tech stocks significantly impacted by the current tariff environment:

1. [Company A]: The Semiconductor Squeeze

[Company A], a major player in the semiconductor industry, is experiencing significant pressure due to tariffs on imported components. Their reliance on global supply chains, particularly those based in Asia, makes them particularly vulnerable. The increased costs of raw materials and manufacturing are directly impacting their profit margins, leading to a recent decline in their stock price.

- Challenges: Rising production costs, potential loss of market share due to higher prices, supply chain disruptions.

- Opportunities: Potential for increased domestic manufacturing, exploration of alternative supply chains, government support for domestic semiconductor production.

2. [Company B]: The Consumer Electronics Conundrum

[Company B], a leading manufacturer of consumer electronics, is facing a double whammy. Not only are the costs of imported components rising, but tariffs also impact the price of their finished products, potentially decreasing consumer demand. This combination has led to a significant drop in their stock price.

- Challenges: Reduced consumer demand, pressure to absorb increased costs without passing them on to consumers, increased competition from companies with lower manufacturing costs.

- Opportunities: Investment in automation and domestic manufacturing, focus on higher-margin products, development of more cost-effective manufacturing processes.

3. [Company C]: The Cloud Computing Crunch

While seemingly less directly impacted than hardware manufacturers, [Company C], a major cloud computing provider, is also feeling the ripple effects. Their data centers rely on imported components, and increased costs for servers and other infrastructure are impacting their operational expenses.

- Challenges: Rising operational costs, pressure to maintain competitive pricing, uncertainty surrounding future infrastructure investments.

- Opportunities: Optimization of data center operations, exploration of alternative energy sources, innovation in cloud-based services to offset increased costs.

Looking Ahead: Navigating the Tariff Landscape

The impact of tariffs on these tech stocks remains a dynamic situation. The future trajectory of these companies will depend on their ability to adapt to the changing landscape, including diversification of supply chains, investment in domestic manufacturing, and innovation to offset increased costs. Investors need to carefully consider these factors before making any investment decisions. Continuous monitoring of the trade situation and the performance of these companies is crucial. Further research into individual company financial reports and strategies is strongly recommended before making any investment choices. This analysis provides a starting point for a deeper dive into the complex impact of tariffs on the tech sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tariff Impact: Evaluating 3 Tech Stocks Facing Price Drops. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Buffett Aponta Greg Abel Para Liderar Investimentos Da Berkshire Fim De Uma Era

Apr 08, 2025

Buffett Aponta Greg Abel Para Liderar Investimentos Da Berkshire Fim De Uma Era

Apr 08, 2025 -

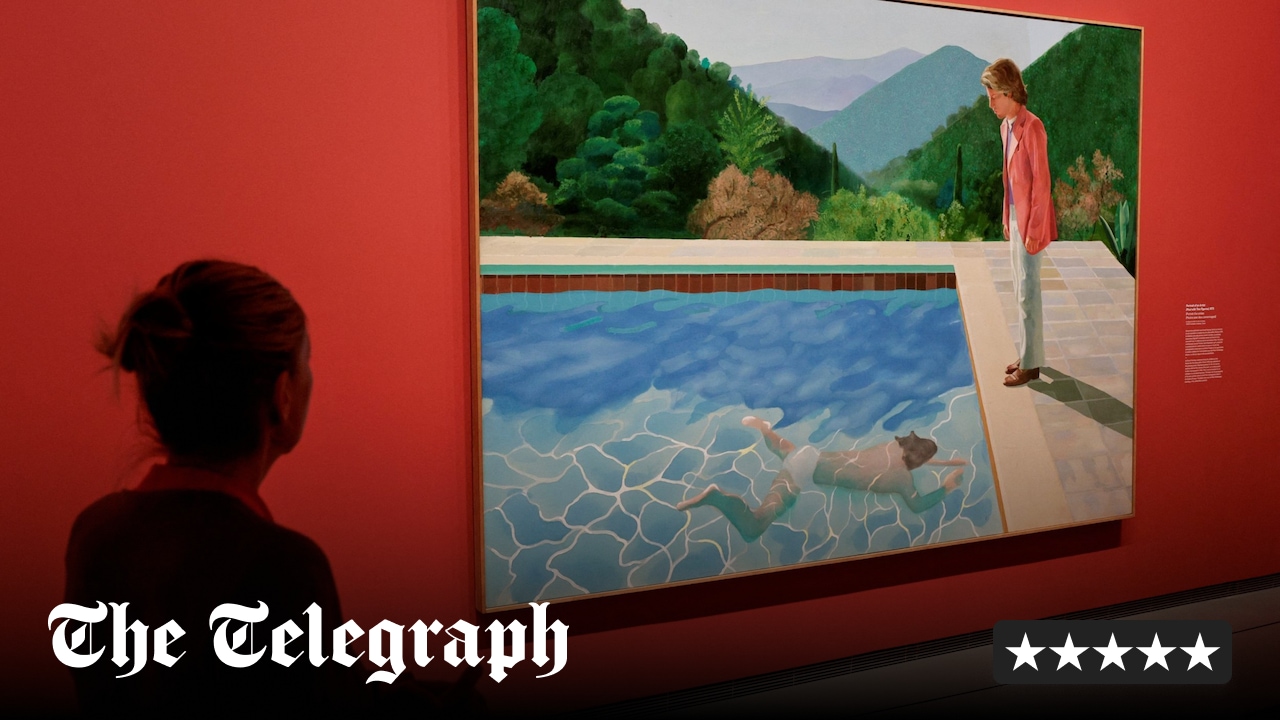

Fondation Louis Vuitton A New Perspective On David Hockneys Work

Apr 08, 2025

Fondation Louis Vuitton A New Perspective On David Hockneys Work

Apr 08, 2025 -

Death Of A Unicorn Film Review Ortega Leads A Clever Cynical Comedy

Apr 08, 2025

Death Of A Unicorn Film Review Ortega Leads A Clever Cynical Comedy

Apr 08, 2025 -

Masters Tournament Power Rankings Predicting The 2024 Champion

Apr 08, 2025

Masters Tournament Power Rankings Predicting The 2024 Champion

Apr 08, 2025 -

Breakup Leads To Stabbing Woman Charged With Assaulting Former Boyfriend And Landlord

Apr 08, 2025

Breakup Leads To Stabbing Woman Charged With Assaulting Former Boyfriend And Landlord

Apr 08, 2025