TD Bank To Invest $1 Billion In Compliance Overhaul

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank to Invest $1 Billion in Major Compliance Overhaul

Toronto, ON – TD Bank Group announced a significant commitment today, pledging $1 billion over the next three years to overhaul its compliance infrastructure and enhance its risk management capabilities. This substantial investment underscores the bank's dedication to strengthening its regulatory compliance and bolstering customer trust following recent scrutiny. The move signals a proactive approach to mitigating future risks and solidifying its position within the highly regulated financial services sector.

The initiative, dubbed "Project Integrity," will focus on several key areas:

H2: Key Areas of Focus for Project Integrity:

-

Enhanced Technology Infrastructure: A major portion of the investment will be directed towards upgrading TD Bank's technological infrastructure related to compliance. This includes implementing cutting-edge AI-powered systems for fraud detection, anti-money laundering (AML) compliance, and Know Your Customer (KYC) protocols. The bank aims to achieve real-time monitoring and analysis, allowing for quicker identification and response to potential compliance breaches.

-

Expanded Compliance Team: TD Bank plans to significantly expand its compliance team, recruiting experts in various regulatory fields including financial crime, data privacy, and cybersecurity. This expansion will involve hiring both domestically and internationally to strengthen expertise across diverse jurisdictions.

-

Improved Training and Education: A comprehensive training program will be developed and implemented across all levels of the organization. The goal is to foster a strong culture of compliance, ensuring all employees understand and adhere to relevant regulations and internal policies. This includes enhanced training modules on AML, KYC, sanctions compliance, and data protection.

-

Strengthened Oversight and Governance: The bank will also enhance its internal audit and oversight functions, implementing more rigorous monitoring and reporting mechanisms. This will include independent reviews of compliance processes and regular assessments of effectiveness.

H2: Addressing Past Concerns and Building Future Trust:

While TD Bank hasn't explicitly detailed specific past incidents motivating this investment, the move comes amidst increased regulatory scrutiny of the financial services industry globally. The $1 billion commitment demonstrates a proactive response to potential challenges and a clear intention to enhance its risk management framework. This proactive approach aims to preempt potential regulatory penalties and maintain public trust, vital for long-term success in a competitive market.

H2: Industry Implications and Long-Term Strategy:

This substantial investment by TD Bank sets a precedent for other financial institutions. It signals a shift towards more robust and technologically advanced compliance strategies within the sector. The adoption of AI and other advanced technologies in compliance management is likely to become increasingly prevalent as regulators demand more sophisticated risk mitigation techniques.

The success of "Project Integrity" will be crucial for TD Bank's future. The substantial investment highlights the bank's commitment to operating within the highest ethical and regulatory standards, ensuring long-term sustainability and maintaining customer confidence in a continuously evolving financial landscape. The long-term implications for the industry are significant, potentially influencing other major banks to implement similar large-scale compliance overhauls. The coming years will be critical in evaluating the effectiveness of this initiative and its impact on the broader financial sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on TD Bank To Invest $1 Billion In Compliance Overhaul. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

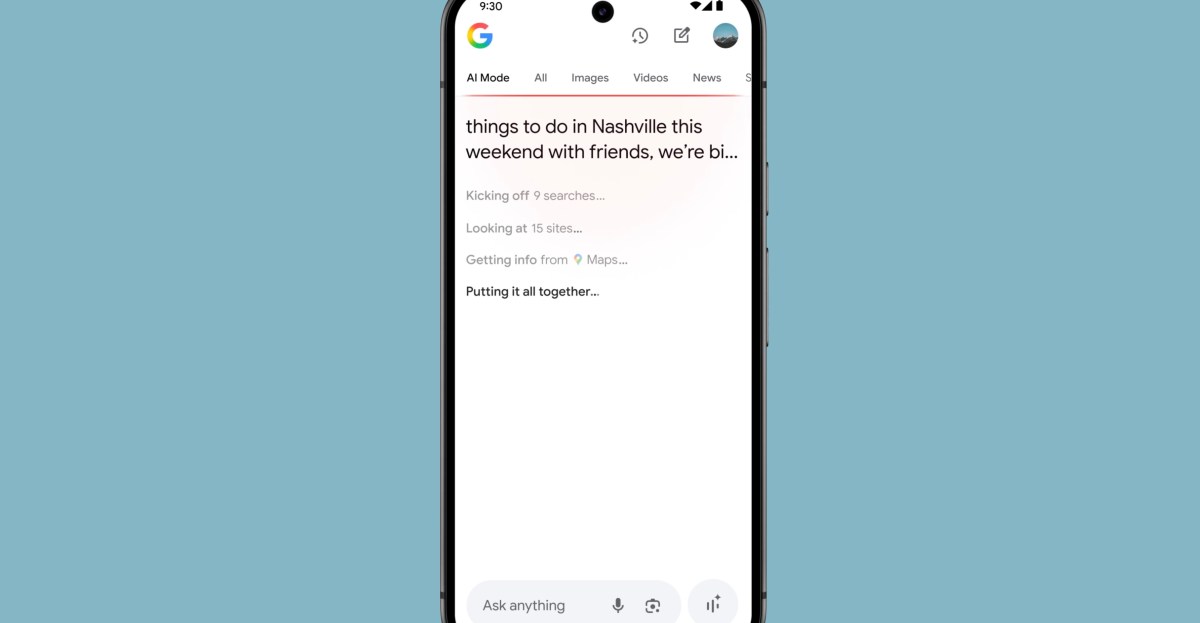

Ai Mode In Google Search Benefits Challenges And Future Outlook

May 23, 2025

Ai Mode In Google Search Benefits Challenges And Future Outlook

May 23, 2025 -

Knicks Vs Pacers Indianas Stunning Comeback Wins Game 1 In Overtime

May 23, 2025

Knicks Vs Pacers Indianas Stunning Comeback Wins Game 1 In Overtime

May 23, 2025 -

Ocean Gate Titan Sub Ceos Wifes Smile Hid A Harrowing Truth

May 23, 2025

Ocean Gate Titan Sub Ceos Wifes Smile Hid A Harrowing Truth

May 23, 2025 -

Buffett Sells Apple Shares The Oracles Investment Strategy Shift

May 23, 2025

Buffett Sells Apple Shares The Oracles Investment Strategy Shift

May 23, 2025 -

Follow The Action Timberwolves Vs Thunder Live Score May 21 2025

May 23, 2025

Follow The Action Timberwolves Vs Thunder Live Score May 21 2025

May 23, 2025

Latest Posts

-

Game Of Thrones Kingsroad Review A Progress Report

May 23, 2025

Game Of Thrones Kingsroad Review A Progress Report

May 23, 2025 -

Dados Da China E O Cenario Brasileiro Copom Ipca E Setor Industrial

May 23, 2025

Dados Da China E O Cenario Brasileiro Copom Ipca E Setor Industrial

May 23, 2025 -

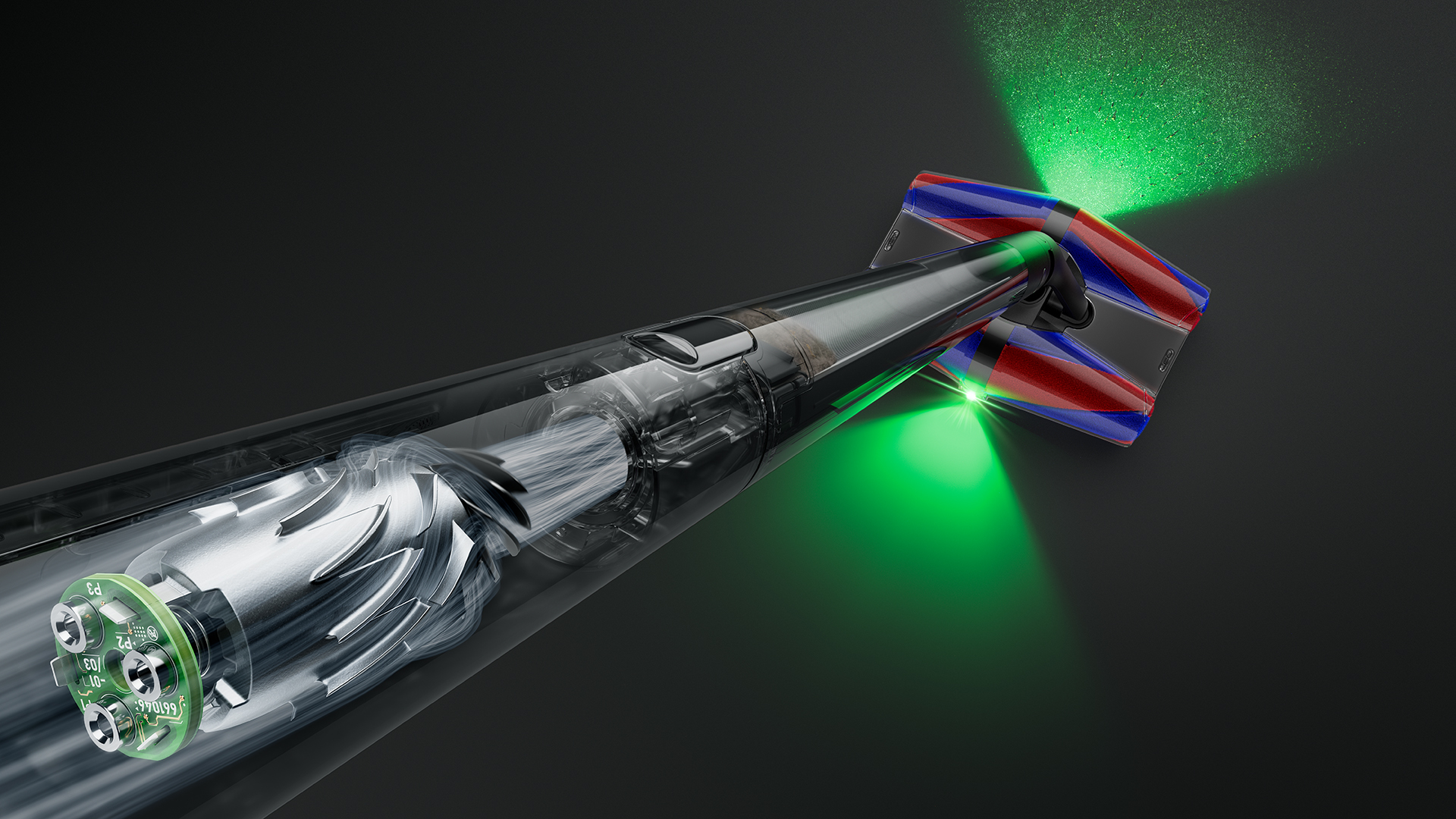

New Dyson Vacuum Ultra Slim Design For Superior Cleaning

May 23, 2025

New Dyson Vacuum Ultra Slim Design For Superior Cleaning

May 23, 2025 -

Is Micro Strategy Mstr Stock A Better Investment Than Bitcoin Btc A February 2025 Perspective

May 23, 2025

Is Micro Strategy Mstr Stock A Better Investment Than Bitcoin Btc A February 2025 Perspective

May 23, 2025 -

Australian Communications Regulator Targets Starlink Amidst Complaints

May 23, 2025

Australian Communications Regulator Targets Starlink Amidst Complaints

May 23, 2025