TD Bank's Cost-Cutting Measures: 2% Job Cuts And $3 Billion Portfolio Reduction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Cuts Costs: 2% Job Losses and $3 Billion Portfolio Shrinkage Signal Shifting Strategy

TD Bank Group, a major player in the North American financial landscape, has announced significant cost-cutting measures impacting both its workforce and investment portfolio. The bank revealed plans to reduce its workforce by approximately 2% and shed $3 billion in assets, signaling a strategic shift amidst a challenging economic climate. This move has sent ripples through the financial industry, sparking discussions about the future of banking and the potential impact on employees and customers.

Job Cuts and Restructuring:

The 2% workforce reduction translates to approximately 1,000 job losses across TD Bank's operations. While the exact breakdown of affected roles and locations remains undisclosed, the bank emphasized its commitment to supporting impacted employees through severance packages and outplacement services. This restructuring is framed as a necessary step to streamline operations and enhance efficiency, a common strategy among financial institutions navigating economic uncertainty and increased competition. The bank's statement highlighted a focus on "right-sizing" the workforce to better align with current market demands and long-term strategic objectives. This isn't the first instance of job cuts in the financial sector recently, underscoring the broader trend of cost-containment measures.

$3 Billion Portfolio Reduction: A Strategic Retreat?

Beyond the job cuts, TD Bank's decision to reduce its investment portfolio by $3 billion is equally significant. This reduction likely involves divesting from certain assets or scaling back on specific investment strategies. While the bank hasn't specified the exact nature of these reductions, analysts suggest it may reflect a more cautious approach to risk management in the current economic environment. This strategic retreat could involve exiting less profitable ventures or reallocating capital to more promising areas. The move reflects a broader trend amongst financial institutions reevaluating their risk profiles and optimizing their portfolios for enhanced stability.

Impact on Customers and the Broader Market:

The impact of these cost-cutting measures on TD Bank's customers remains to be seen. While the bank assures that its commitment to customer service remains paramount, the reduction in workforce could potentially lead to longer wait times or reduced service availability in certain areas. However, the bank maintains that the restructuring is designed to improve operational efficiency in the long run, ultimately benefiting customers through enhanced service offerings and improved financial stability.

The broader market is closely watching TD Bank's moves, as they represent a significant shift in strategy for a major financial institution. This could trigger similar cost-cutting measures from competitors, potentially leading to further job losses and a reshaping of the financial services landscape.

Looking Ahead:

TD Bank's cost-cutting strategy underscores the challenges faced by financial institutions navigating the current economic climate. The combination of workforce reductions and portfolio adjustments indicates a proactive approach to enhance profitability and long-term sustainability. The success of these measures will depend on their effective implementation and the bank's ability to maintain customer trust and satisfaction amidst significant organizational changes. The coming months will be crucial in assessing the long-term impact of these decisions on TD Bank and the broader financial sector. Analysts will be closely monitoring the bank's performance and the market’s reaction to gauge the effectiveness of this strategic realignment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on TD Bank's Cost-Cutting Measures: 2% Job Cuts And $3 Billion Portfolio Reduction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

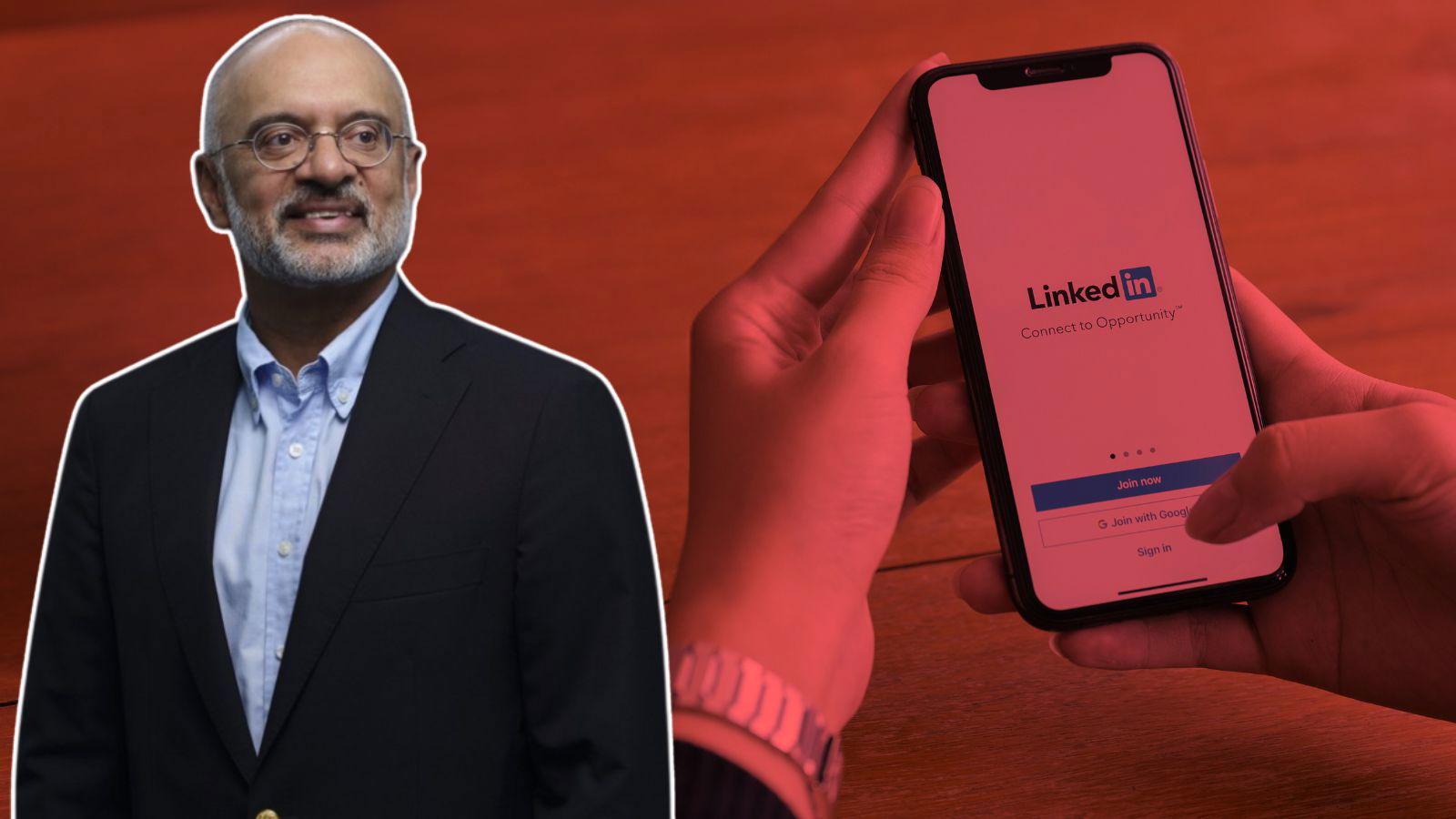

Identity Crisis On Linked In Piyush Guptas Unexpected Online Fame

May 23, 2025

Identity Crisis On Linked In Piyush Guptas Unexpected Online Fame

May 23, 2025 -

House Committee Approves Sweeping Trump Policy Bill Following 22 Hour Debate

May 23, 2025

House Committee Approves Sweeping Trump Policy Bill Following 22 Hour Debate

May 23, 2025 -

Jokic Vs Sga Gilgeous Alexanders Mvp Victory Over The Two Time Champion

May 23, 2025

Jokic Vs Sga Gilgeous Alexanders Mvp Victory Over The Two Time Champion

May 23, 2025 -

Gillian Anderson A Transatlantic Life Britain Or America

May 23, 2025

Gillian Anderson A Transatlantic Life Britain Or America

May 23, 2025 -

El Rodaje De Fountain Of Youth Experiencia De Eiza Gonzalez Junto A Guy Ritchie

May 23, 2025

El Rodaje De Fountain Of Youth Experiencia De Eiza Gonzalez Junto A Guy Ritchie

May 23, 2025

Latest Posts

-

45 Million Real Estate Portfolio Inside Amy Schumers Investments

May 24, 2025

45 Million Real Estate Portfolio Inside Amy Schumers Investments

May 24, 2025 -

Tom Cruises Popcorn Eating Habit Sparks Online Ridicule

May 24, 2025

Tom Cruises Popcorn Eating Habit Sparks Online Ridicule

May 24, 2025 -

Mission Impossible Production Halted Hayley Atwell Reveals Surprising Wildlife Encounters

May 24, 2025

Mission Impossible Production Halted Hayley Atwell Reveals Surprising Wildlife Encounters

May 24, 2025 -

Tik Toks Obsession The Underrated Dating Show Rivaling Love Island

May 24, 2025

Tik Toks Obsession The Underrated Dating Show Rivaling Love Island

May 24, 2025 -

Vivid Sydney 2025 A Curated List Of Unmissable Highlights

May 24, 2025

Vivid Sydney 2025 A Curated List Of Unmissable Highlights

May 24, 2025