TD Bank's Cost-Cutting Measures: 2% Job Cuts And $3 Billion Portfolio Wind-Down

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Announces 2% Job Cuts and $3 Billion Portfolio Wind-Down in Cost-Cutting Drive

TD Bank Group, a major player in the North American financial landscape, has announced significant cost-cutting measures aimed at streamlining operations and boosting profitability. The move, which sent ripples through the financial industry, involves a 2% reduction in its workforce and the winding down of a $3 billion portfolio. This strategic shift signals a broader trend among financial institutions navigating a challenging economic climate.

The announcement, made [Insert Date of Announcement], detailed a multifaceted approach to enhancing efficiency and shareholder value. While the specific details regarding the impacted employees and the exact nature of the portfolio being wound down remain unclear, the magnitude of the changes has raised questions about the future direction of TD Bank.

2% Workforce Reduction: A Necessary Evil?

The planned job cuts, affecting approximately [Insert approximate number] employees across TD Bank's extensive network, have been framed as a necessary step to optimize the company's structure and enhance operational effectiveness. TD Bank has emphasized its commitment to supporting affected employees through severance packages and outplacement services. However, the news has understandably sparked concerns about job security within the financial sector and the broader implications for the economy.

This isn't an isolated incident. Many financial institutions are facing increased pressure to reduce costs in the face of rising interest rates, inflation, and shifting market dynamics. The competitive landscape is forcing banks to re-evaluate their operational models and streamline processes to maintain profitability.

$3 Billion Portfolio Wind-Down: A Strategic Realignment?

The decision to wind down a $3 billion portfolio signals a more strategic realignment within TD Bank's investment strategy. While the specifics haven't been fully disclosed, this move likely reflects a shift in priorities towards more profitable ventures and a reduction in exposure to potentially less lucrative assets. This proactive approach is typical of businesses seeking to navigate economic uncertainty and optimize their return on investment.

Impact on Shareholders and Customers

TD Bank maintains that these cost-cutting measures are designed to enhance long-term shareholder value and improve the overall financial health of the institution. While this may translate into increased profitability in the long run, the immediate impact on shareholders remains to be seen. The bank has assured customers that the changes will not affect the quality of their services.

However, the potential for disruption in service during the transition period remains a concern. Customers are advised to stay informed through official TD Bank channels for updates and any potential changes to their banking experience.

Looking Ahead: Navigating Uncertain Times

TD Bank's cost-cutting measures reflect the broader challenges faced by the financial services industry in the current economic environment. The combination of workforce reductions and portfolio wind-downs highlights a proactive approach to adapting to market pressures and enhancing operational efficiency. The long-term success of this strategy will depend on various factors, including the execution of the plan, market conditions, and the overall response from employees and customers. Analysts will be closely watching TD Bank's performance in the coming quarters to assess the effectiveness of these significant changes.

Keywords: TD Bank, cost-cutting, job cuts, portfolio wind-down, financial industry, economic climate, workforce reduction, shareholder value, strategic realignment, market pressures, profitability, banking, investment strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on TD Bank's Cost-Cutting Measures: 2% Job Cuts And $3 Billion Portfolio Wind-Down. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Netflixs Manga Adaptation Bet Worth Watching A Honest Tv Review

May 23, 2025

Is Netflixs Manga Adaptation Bet Worth Watching A Honest Tv Review

May 23, 2025 -

Extremely Excruciating Miley Cyrus On Her Nye Ovarian Cyst Rupture

May 23, 2025

Extremely Excruciating Miley Cyrus On Her Nye Ovarian Cyst Rupture

May 23, 2025 -

Serie A Beckons Ange Postecoglous Next Move Revealed

May 23, 2025

Serie A Beckons Ange Postecoglous Next Move Revealed

May 23, 2025 -

Hayley Atwell On The Unexpected Guests That Stopped Mission Impossible Filming

May 23, 2025

Hayley Atwell On The Unexpected Guests That Stopped Mission Impossible Filming

May 23, 2025 -

Octopus Energy Targets China Ceos Focus On Strategic Alliances

May 23, 2025

Octopus Energy Targets China Ceos Focus On Strategic Alliances

May 23, 2025

Latest Posts

-

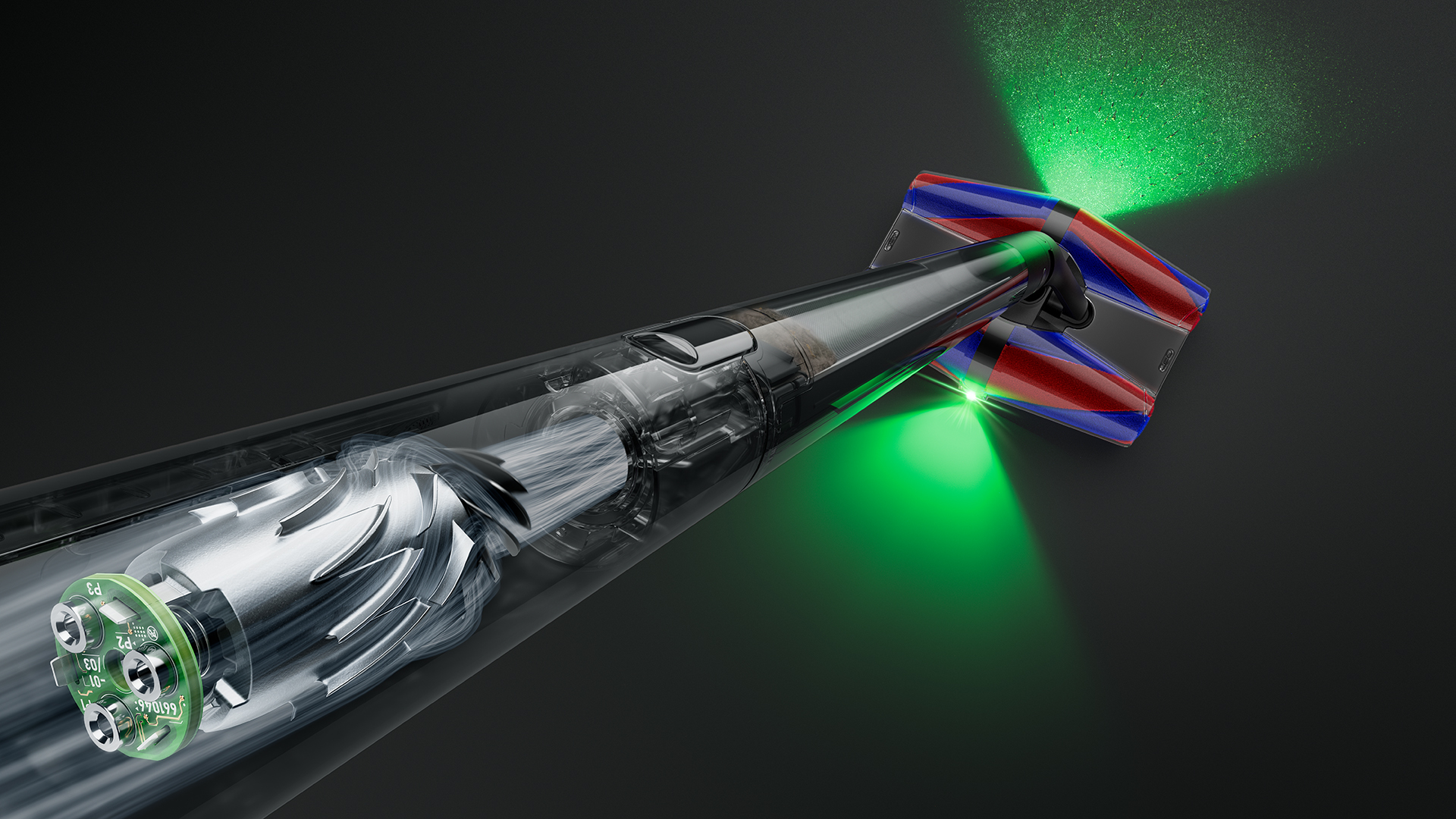

Lightweight And Powerful Dysons Latest Vacuum Redefines Cleaning

May 23, 2025

Lightweight And Powerful Dysons Latest Vacuum Redefines Cleaning

May 23, 2025 -

Understanding The Mission Impossible Timeline From Dead Reckoning To The Beginning

May 23, 2025

Understanding The Mission Impossible Timeline From Dead Reckoning To The Beginning

May 23, 2025 -

Que Peliculas Ver Aventura Y Ciencia Ficcion Con Localizaciones En Bangkok Y Egipto

May 23, 2025

Que Peliculas Ver Aventura Y Ciencia Ficcion Con Localizaciones En Bangkok Y Egipto

May 23, 2025 -

Channel Sevens Sunrise Welcomes Newest Member A Healthy Baby Girl

May 23, 2025

Channel Sevens Sunrise Welcomes Newest Member A Healthy Baby Girl

May 23, 2025 -

Concerns Rise As Martin Place Homeless Kitchen Closes For Vivid

May 23, 2025

Concerns Rise As Martin Place Homeless Kitchen Closes For Vivid

May 23, 2025