TD Bank's Cost-Cutting Measures: 2% Workforce Reduction And $3 Billion Portfolio Sale

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Announces Cost-Cutting Measures: 2% Workforce Reduction and $3 Billion Portfolio Sale

TD Bank Group is undertaking significant cost-cutting measures in response to challenging economic conditions, announcing a 2% reduction in its workforce and the sale of a $3 billion loan portfolio. This strategic move aims to bolster profitability and enhance shareholder value amidst increasing economic uncertainty. The news sent ripples through the financial sector, prompting analysis of the broader implications for the banking industry.

The Canadian banking giant, known for its extensive branch network and customer base across North America, cited a need for increased efficiency and a sharper focus on core business operations as the primary drivers behind the restructuring. This decision, while undeniably impacting employees, is viewed by some analysts as a necessary step to navigate the current economic climate.

Workforce Reduction: A Difficult but Necessary Decision

The 2% workforce reduction translates to approximately 1,000 jobs across TD Bank's various operations. While the exact breakdown of job losses across different departments and geographical locations remains unclear, the bank has pledged to support affected employees through severance packages and outplacement services. This commitment to employee well-being is crucial in mitigating the negative impact of such a large-scale restructuring. The bank emphasized that these reductions are aimed at streamlining operations and improving overall efficiency, not a reflection of employee performance.

- Impact on Employees: The announcement has understandably caused concern among TD Bank employees, highlighting the human cost of corporate restructuring.

- Severance Packages and Support: TD Bank's commitment to supporting affected employees through comprehensive severance and outplacement services is a positive aspect of this difficult decision.

- Long-Term Strategy: The bank maintains this is a strategic move to ensure long-term sustainability and growth.

$3 Billion Loan Portfolio Sale: A Strategic Asset Restructuring

In addition to the workforce reduction, TD Bank announced the sale of a $3 billion loan portfolio. This strategic move allows the bank to further streamline its operations, focusing resources on higher-growth areas and reducing risk exposure. While the buyer of the portfolio remains undisclosed, the sale is expected to close in the coming months.

- Strategic Diversification: The sale indicates a shift in TD Bank's asset allocation strategy, potentially signaling a focus on core business segments.

- Improved Capital Ratios: The sale is likely to improve TD Bank's capital ratios, strengthening its financial position.

- Market Response: Market analysts are closely watching the impact of this portfolio sale on TD Bank's overall financial performance.

Implications for the Broader Banking Sector

TD Bank's cost-cutting measures reflect a broader trend within the banking sector as institutions adapt to evolving economic conditions. Increased regulatory scrutiny, rising interest rates, and potential economic slowdown are pushing banks to reassess their operational efficiency and strategic priorities. This move by TD Bank could signal further restructuring and consolidation within the industry in the coming months.

Looking Ahead: Navigating Uncertainty

TD Bank's actions underscore the challenges facing the banking industry in navigating the current economic landscape. While the cost-cutting measures are undoubtedly difficult, they represent a proactive approach to maintaining profitability and ensuring long-term sustainability. The coming months will be crucial in assessing the effectiveness of these strategic decisions and their impact on the bank's overall performance and the broader financial market. Further announcements and updates from TD Bank are anticipated.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on TD Bank's Cost-Cutting Measures: 2% Workforce Reduction And $3 Billion Portfolio Sale. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Misinformation Scandal Chicago Sun Times Publishes Fictitious Ai Content

May 23, 2025

Misinformation Scandal Chicago Sun Times Publishes Fictitious Ai Content

May 23, 2025 -

Second Gta 6 Trailer Hidden Clue Prompts Pre Order Cancellations

May 23, 2025

Second Gta 6 Trailer Hidden Clue Prompts Pre Order Cancellations

May 23, 2025 -

Shai Gilgeous Alexanders Masterclass Analyzing The Thunders Game 1 Win

May 23, 2025

Shai Gilgeous Alexanders Masterclass Analyzing The Thunders Game 1 Win

May 23, 2025 -

Chilling Revelation Ocean Gate Ceos Wifes Words Following Titan Disaster

May 23, 2025

Chilling Revelation Ocean Gate Ceos Wifes Words Following Titan Disaster

May 23, 2025 -

Wwe 2 K25 Haliburtons Inclusion As Playable Character Announced

May 23, 2025

Wwe 2 K25 Haliburtons Inclusion As Playable Character Announced

May 23, 2025

Latest Posts

-

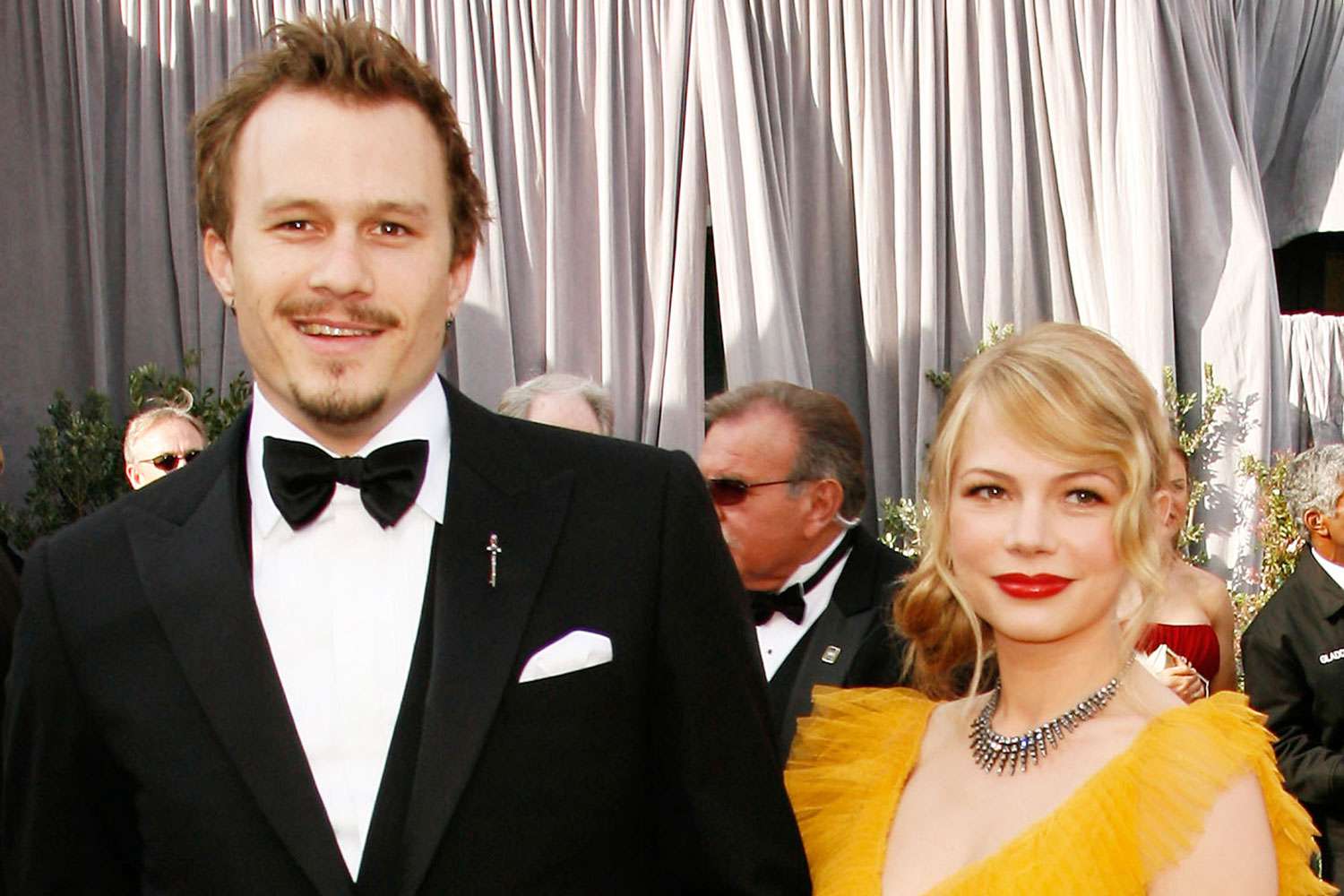

Heath Ledgers Daughter Matilda Michelle Williams Shares Poignant Reflections On Family

May 23, 2025

Heath Ledgers Daughter Matilda Michelle Williams Shares Poignant Reflections On Family

May 23, 2025 -

Woodlands And Tuas Checkpoints Ica Advises Travelers To Prepare For Heavy Traffic This June

May 23, 2025

Woodlands And Tuas Checkpoints Ica Advises Travelers To Prepare For Heavy Traffic This June

May 23, 2025 -

Nhl Forward Tom Eisenhuth Retires Due To Persistent Injuries

May 23, 2025

Nhl Forward Tom Eisenhuth Retires Due To Persistent Injuries

May 23, 2025 -

Hulus Upcoming Zombie Film 18 Year Olds Fight The Undead

May 23, 2025

Hulus Upcoming Zombie Film 18 Year Olds Fight The Undead

May 23, 2025 -

First Successful Flight Test Venus Aerospaces Revolutionary Rde Engine

May 23, 2025

First Successful Flight Test Venus Aerospaces Revolutionary Rde Engine

May 23, 2025