TD Bank's Massive Compliance Spending: $1 Billion In Two Years

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank's Massive Compliance Spending: A $1 Billion Investment in Regulatory Adherence

TD Bank Group, a prominent North American financial institution, has revealed a staggering investment in compliance: a monumental $1 billion over the past two years. This substantial expenditure underscores the increasing complexities and costs associated with navigating the ever-evolving regulatory landscape within the financial services sector. The news has sent ripples through the industry, prompting discussions about the future of compliance spending and its potential impact on profitability.

Why the Billion-Dollar Investment?

The hefty sum isn't simply a result of increased regulatory scrutiny; it reflects a multifaceted approach to compliance management. TD Bank's investment encompasses several key areas:

-

Enhanced Technology Infrastructure: Investing in cutting-edge technology is crucial for effective compliance. This includes upgrading systems for anti-money laundering (AML), know your customer (KYC), and sanctions screening. The bank likely implemented advanced data analytics and AI-powered tools to enhance the efficiency and accuracy of its compliance efforts.

-

Expanded Compliance Teams: To manage the increased complexity and volume of regulatory requirements, TD Bank has undoubtedly expanded its compliance teams. This includes hiring specialized professionals in areas like AML, financial crime, and data privacy, leading to higher personnel costs.

-

Strengthened Internal Controls: Robust internal controls are vital for preventing and detecting regulatory violations. TD Bank's investment likely included strengthening its internal audit functions, implementing more rigorous risk assessment procedures, and enhancing employee training programs.

-

Responding to Regulatory Changes: The financial services industry is subject to constant changes in regulations. From evolving KYC rules to stricter sanctions enforcement, TD Bank's investment reflects its commitment to adapting to and complying with these changes proactively.

Impact on the Banking Industry and Investors

This substantial investment highlights a broader trend within the banking industry. Increased regulatory pressure and the escalating costs of compliance are forcing financial institutions to prioritize these expenditures. While this may impact short-term profitability, it's seen as a necessary investment to maintain operational integrity and avoid potentially far more costly penalties for non-compliance.

For investors, TD Bank's transparency regarding its compliance spending can be viewed positively. It signals a commitment to responsible governance and risk management, which can build investor confidence and trust. However, the significant expense should also be considered when analyzing the bank's financial performance.

Looking Ahead: The Future of Compliance in Banking

TD Bank's $1 billion investment serves as a stark reminder of the evolving landscape of regulatory compliance in the financial industry. The rising costs necessitate ongoing innovation in compliance technologies and methodologies. We can expect to see further investment in areas like artificial intelligence, machine learning, and automation to streamline compliance processes and mitigate risks. The focus will remain on proactively adapting to new regulations and strengthening internal controls to build a robust and resilient compliance framework. This ensures not only regulatory adherence but also protects the bank's reputation and maintains the trust of its customers and stakeholders. The coming years will undoubtedly witness continued evolution in how financial institutions manage compliance, and TD Bank's significant investment represents a key step in shaping this future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on TD Bank's Massive Compliance Spending: $1 Billion In Two Years. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kraken Global Trading Of Apple Tesla And Nvidia Fractional Ownership Tokens Begins

May 23, 2025

Kraken Global Trading Of Apple Tesla And Nvidia Fractional Ownership Tokens Begins

May 23, 2025 -

Edmonton Oilers Vs Dallas Stars Score Stats And Play By Play

May 23, 2025

Edmonton Oilers Vs Dallas Stars Score Stats And Play By Play

May 23, 2025 -

Sydney Sweeney On Euphoria Season 3 More Unhinged Cassie And A Shocking Update

May 23, 2025

Sydney Sweeney On Euphoria Season 3 More Unhinged Cassie And A Shocking Update

May 23, 2025 -

Knicks Vs Pacers Jon Hamms Presence Fuels Haliburtons Intense Game 1 Performance

May 23, 2025

Knicks Vs Pacers Jon Hamms Presence Fuels Haliburtons Intense Game 1 Performance

May 23, 2025 -

1 500 Pharmacies Or Fewer Using Nhs App For Prescription Tracking A Report

May 23, 2025

1 500 Pharmacies Or Fewer Using Nhs App For Prescription Tracking A Report

May 23, 2025

Latest Posts

-

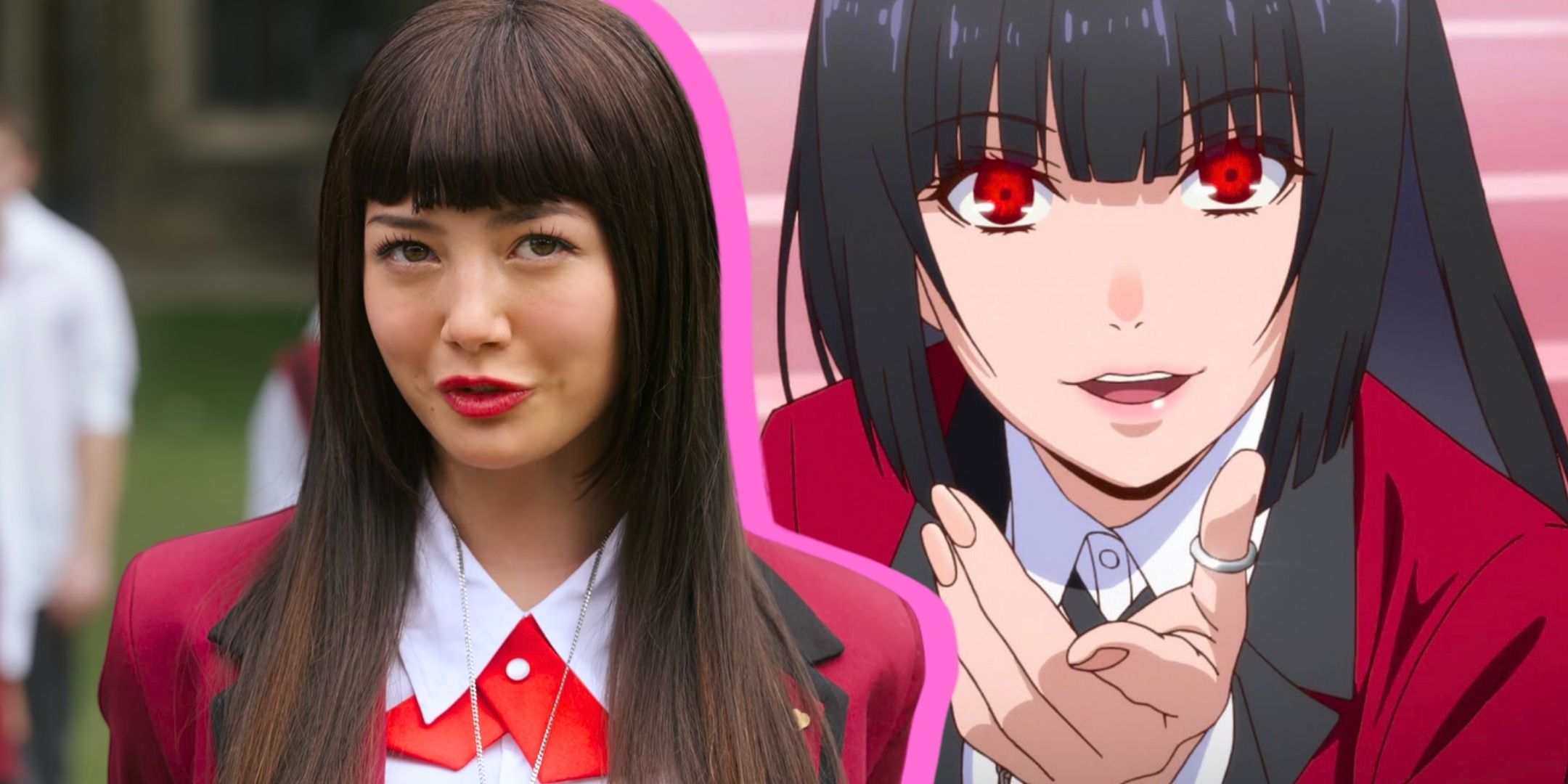

Divisive Rotten Tomatoes Score Doesnt Stop Netflixs New Anime Series

May 23, 2025

Divisive Rotten Tomatoes Score Doesnt Stop Netflixs New Anime Series

May 23, 2025 -

Hay Festival 2025 Preview Key Highlights And Dates

May 23, 2025

Hay Festival 2025 Preview Key Highlights And Dates

May 23, 2025 -

Shai Gilgeous Alexander Mvp Award Caps Thunders Dominance

May 23, 2025

Shai Gilgeous Alexander Mvp Award Caps Thunders Dominance

May 23, 2025 -

Hands On With The Fujifilm X Half Tiny Camera Big On Creative Control

May 23, 2025

Hands On With The Fujifilm X Half Tiny Camera Big On Creative Control

May 23, 2025 -

Open Ai Welcomes Jony Ive Implications For The Future Of Ai

May 23, 2025

Open Ai Welcomes Jony Ive Implications For The Future Of Ai

May 23, 2025