TD To Eliminate 2% Of Its Workforce; $3 Billion Portfolio To Be Wound Down

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Cuts 2% of Workforce, Winds Down $3 Billion Portfolio in Restructuring Move

Toronto, ON – October 26, 2023 – TD Bank Group (TD) announced today a restructuring plan that will impact approximately 2% of its workforce and lead to the wind-down of a $3 billion portfolio. The move, described by the bank as necessary to streamline operations and improve efficiency, has sent ripples through the financial sector and sparked discussions about the future of banking in a rapidly evolving landscape.

The announcement follows a period of economic uncertainty and increased regulatory scrutiny within the financial industry. TD, like many other large financial institutions, is facing pressure to adapt to changing customer behaviors, technological advancements, and evolving market conditions. This restructuring is a significant step in the bank’s strategy to navigate these challenges and maintain its competitive edge.

Job Cuts and Employee Support

The planned reduction of approximately 2% of TD's workforce translates to hundreds of job losses across various departments and locations. While the exact number of impacted employees remains undisclosed, TD has emphasized its commitment to supporting affected individuals through comprehensive severance packages and career transition services. The bank stated it is prioritizing open communication and providing resources to help employees navigate this difficult period. This commitment to employee support is crucial in mitigating the negative impact of job losses and maintaining a positive employer brand image.

$3 Billion Portfolio Wind-Down

Simultaneously, TD announced the planned wind-down of a $3 billion portfolio. While specifics regarding the composition of this portfolio remain limited, the bank indicated that this strategic decision is aligned with its broader objective to optimize its asset allocation and focus on its core business areas. This move highlights the bank's proactive approach to managing risk and adapting to changing market dynamics. Analysts are already speculating about the potential impact on investors and the overall financial health of the bank.

Impact on the Broader Financial Sector

This restructuring by TD Bank serves as a strong indicator of the ongoing transformation within the financial services industry. Other major banks are likely to face similar pressures to streamline operations and adapt to the changing economic climate. Experts predict that further consolidation and restructuring within the sector could be on the horizon. The move by TD will undoubtedly be closely scrutinized by competitors, investors, and regulators alike.

Looking Ahead

TD’s restructuring plan is a bold move designed to position the bank for long-term success. While the short-term impact on employees is undeniable, the bank's focus on efficient operations and strategic asset allocation suggests a proactive approach to navigating future challenges. The success of this restructuring will depend on the effectiveness of the implementation process and the bank's ability to maintain its customer base and investor confidence during this period of transition. Further announcements and details are expected in the coming weeks and months as the restructuring unfolds. The ongoing impact on the Canadian economy and the broader financial landscape warrants further observation and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on TD To Eliminate 2% Of Its Workforce; $3 Billion Portfolio To Be Wound Down. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brockwell Park A Guide To Events And Entertainment

May 24, 2025

Brockwell Park A Guide To Events And Entertainment

May 24, 2025 -

Free Rpg Sparks Controversy Removed From Steam Download Here

May 24, 2025

Free Rpg Sparks Controversy Removed From Steam Download Here

May 24, 2025 -

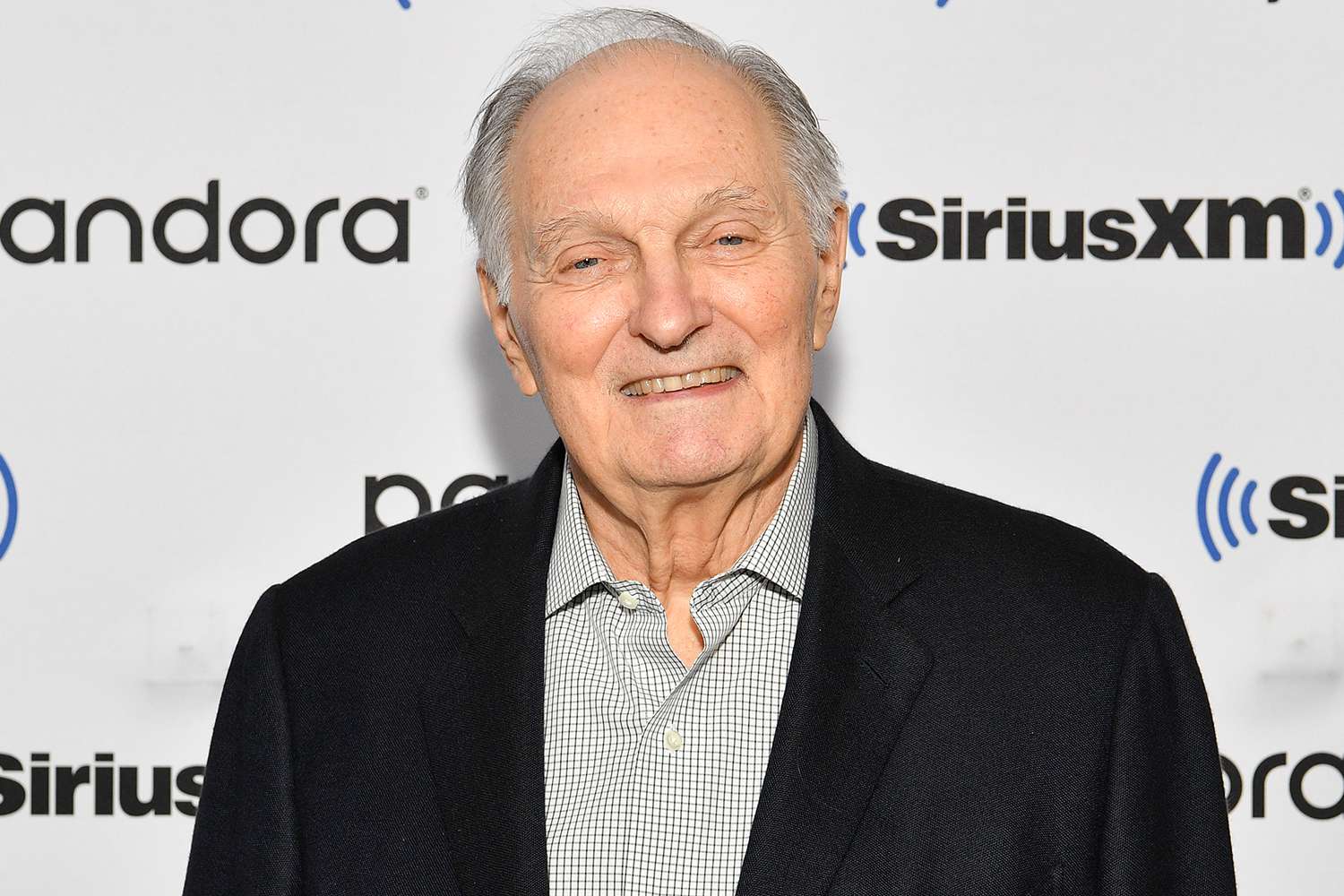

Keeps Me Looking For The Funny Alan Aldas Parkinsons Journey And Perspective

May 24, 2025

Keeps Me Looking For The Funny Alan Aldas Parkinsons Journey And Perspective

May 24, 2025 -

Nyt Wordle Today Solution And Hints For May 23rd Game 1434

May 24, 2025

Nyt Wordle Today Solution And Hints For May 23rd Game 1434

May 24, 2025 -

Retour Sur Scene De P A Declaration Importante Et Details De La Tournee

May 24, 2025

Retour Sur Scene De P A Declaration Importante Et Details De La Tournee

May 24, 2025