TD's $1 Billion Compliance Overhaul: A Two-Year Plan

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank's $1 Billion Compliance Overhaul: A Two-Year Plan to Strengthen Regulatory Adherence

Toronto, ON – TD Bank Group (TD) has announced a significant investment of $1 billion over the next two years to overhaul its compliance program. This ambitious undertaking aims to bolster the bank's regulatory adherence, enhance its risk management capabilities, and strengthen its overall control environment. The move comes amidst increasing regulatory scrutiny and a growing emphasis on robust compliance practices within the financial sector.

This isn't simply a reactive measure; it's a proactive strategic investment designed to position TD for sustained growth in a complex and evolving regulatory landscape. The bank acknowledges the need for continuous improvement and states that this investment underscores its commitment to maintaining the highest ethical and regulatory standards.

What the $1 Billion Investment Encompasses:

The $1 billion commitment will be channeled into several key areas:

-

Enhanced Technology Infrastructure: A major portion of the investment will focus on upgrading and modernizing TD's technology infrastructure to support more robust compliance monitoring and reporting. This includes advanced data analytics tools, improved systems for detecting and preventing financial crime, and strengthened cybersecurity measures.

-

Expanded Compliance Team: TD plans to significantly expand its compliance team, recruiting and training highly skilled professionals specializing in areas such as anti-money laundering (AML), know your customer (KYC), sanctions compliance, and regulatory reporting. This expansion will ensure sufficient resources are dedicated to managing the increasing complexity of regulatory requirements.

-

Improved Training and Education: A substantial investment will go towards enhanced training programs for employees at all levels of the organization. This will focus on improving awareness of compliance regulations, strengthening ethical conduct, and fostering a culture of compliance within the bank.

-

Strengthened Internal Controls: TD will implement robust internal control frameworks to ensure effective oversight and accountability across all business units. This includes strengthening processes for identifying, assessing, and mitigating compliance risks.

Addressing Growing Regulatory Scrutiny:

The financial industry faces unprecedented regulatory scrutiny, with regulators worldwide increasingly focused on preventing financial crime and ensuring the integrity of the financial system. This substantial investment by TD signals a proactive response to these pressures and a commitment to staying ahead of evolving regulatory expectations. The bank aims to demonstrate its dedication to maintaining a strong control environment and mitigating potential risks.

Long-Term Benefits and Strategic Implications:

This two-year compliance overhaul is not just about meeting regulatory requirements; it's a strategic investment with long-term benefits. By enhancing its compliance program, TD aims to:

-

Reduce Regulatory Risk: A robust compliance program minimizes the risk of penalties, fines, and reputational damage associated with regulatory breaches.

-

Improve Operational Efficiency: Streamlined processes and improved technology can lead to increased efficiency and reduced operational costs in the long run.

-

Enhance Customer Trust: Demonstrating a strong commitment to compliance fosters trust and confidence among customers and stakeholders.

-

Support Sustainable Growth: A strong compliance framework provides a foundation for responsible and sustainable growth in the years to come.

Conclusion:

TD's $1 billion investment in compliance represents a significant commitment to maintaining the highest standards of ethical conduct and regulatory adherence. This comprehensive two-year plan signals a proactive approach to managing risk in an increasingly complex regulatory environment. The long-term benefits of this investment will be crucial for the bank's continued success and solidify its position as a leader in the financial industry. The initiative should serve as a model for other financial institutions facing similar challenges in navigating the ever-evolving regulatory landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on TD's $1 Billion Compliance Overhaul: A Two-Year Plan. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Laos Economic Crisis Debt Relief Needed To Avoid Lost Decade

May 23, 2025

Laos Economic Crisis Debt Relief Needed To Avoid Lost Decade

May 23, 2025 -

Bitcoin Btc Surges To New Peak Analyzing The Rally And Future Trends

May 23, 2025

Bitcoin Btc Surges To New Peak Analyzing The Rally And Future Trends

May 23, 2025 -

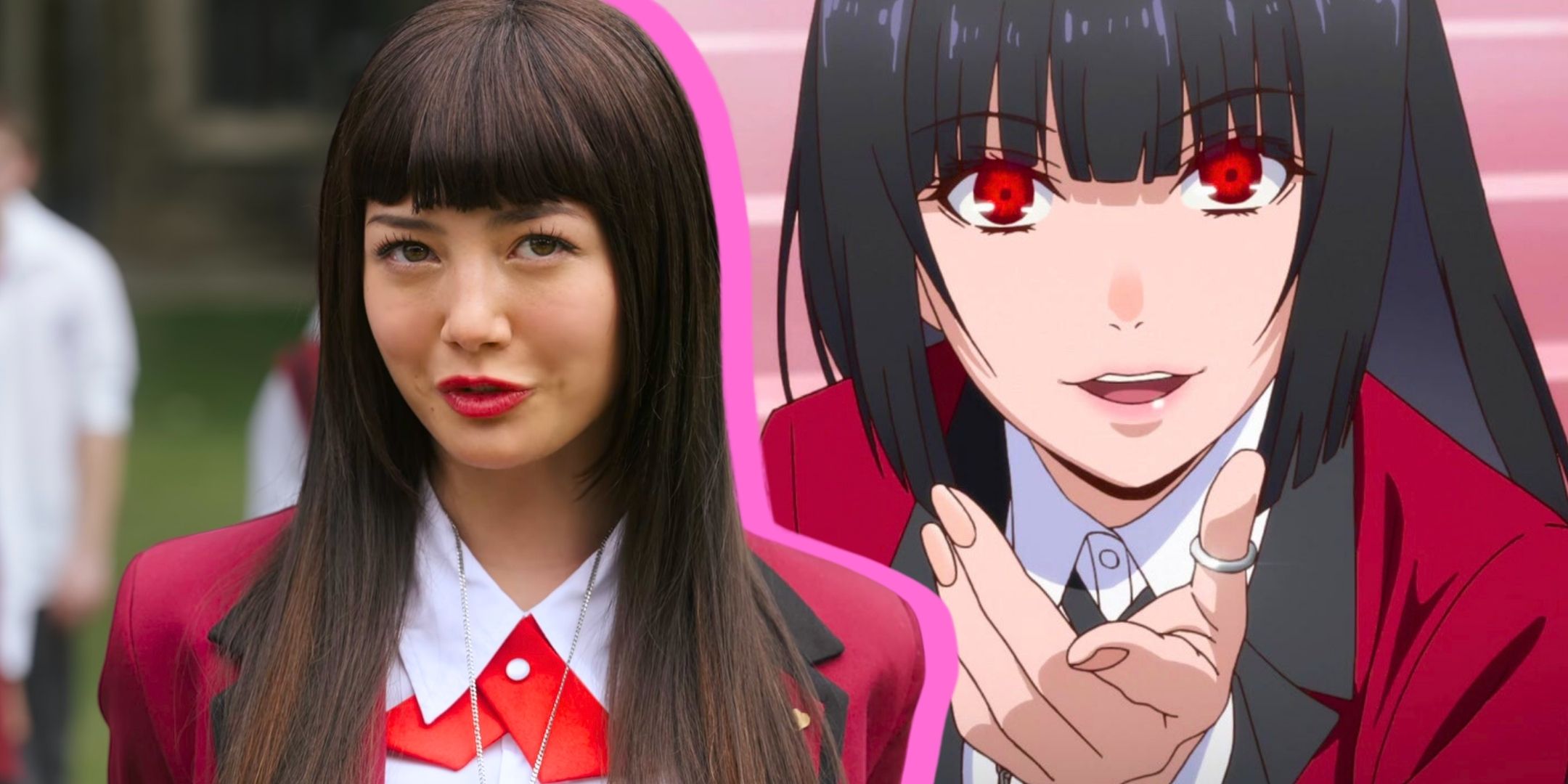

Netflix Animes Live Action Remake A Streaming Hit Against The Odds

May 23, 2025

Netflix Animes Live Action Remake A Streaming Hit Against The Odds

May 23, 2025 -

Live Stream Tottenham Vs Manchester United Europa League Final 2025 Match Build Up

May 23, 2025

Live Stream Tottenham Vs Manchester United Europa League Final 2025 Match Build Up

May 23, 2025 -

Gillian Andersons Dual Citizenship Uk Vs Usa

May 23, 2025

Gillian Andersons Dual Citizenship Uk Vs Usa

May 23, 2025

Latest Posts

-

Gilgeous Alexander Nba Mvp Award Winner

May 23, 2025

Gilgeous Alexander Nba Mvp Award Winner

May 23, 2025 -

New Years Eve Health Scare Miley Cyrus Reveals Ovarian Cyst Rupture

May 23, 2025

New Years Eve Health Scare Miley Cyrus Reveals Ovarian Cyst Rupture

May 23, 2025 -

Silverstone Moto Gp 2024 What You May Have Missed From The Uk Race

May 23, 2025

Silverstone Moto Gp 2024 What You May Have Missed From The Uk Race

May 23, 2025 -

The Future Of Cleaning Dysons Shrinking Vacuum Technology

May 23, 2025

The Future Of Cleaning Dysons Shrinking Vacuum Technology

May 23, 2025 -

Game Of Thrones Kingsroad Challenge Tips And Tricks For Completion

May 23, 2025

Game Of Thrones Kingsroad Challenge Tips And Tricks For Completion

May 23, 2025