Tech Stock Dip: 3 Companies Falling Due To Tariffs – Buy Or Sell?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tech Stock Dip: 3 Companies Falling Due to Tariffs – Buy or Sell?

The tech sector is feeling the heat from escalating trade tensions, with several prominent companies experiencing significant stock dips due to newly implemented tariffs. This turbulent market presents both a challenge and an opportunity for investors. But which path is the right one? Should you buy the dip or cut your losses and sell? Let's analyze three key players heavily impacted and explore the potential implications.

The Tariff Tsunami Hits Tech:

The recent imposition of tariffs on imported goods has sent shockwaves through the global economy, and the technology sector is no exception. Companies reliant on global supply chains and international sales are particularly vulnerable. Increased costs associated with tariffs directly impact profitability, potentially leading to decreased earnings and lower stock prices. This isn't just a short-term blip; the long-term effects could significantly reshape the tech landscape.

3 Tech Companies Feeling the Pinch:

Several tech giants are grappling with the fallout from these tariffs. Let's examine three specific cases:

1. [Company A]: Navigating Supply Chain Disruptions:

[Company A], a major player in [Industry – e.g., semiconductor manufacturing], has seen its stock price decline by [Percentage]% in the past [Timeframe – e.g., month] due to increased costs associated with imported components. The company's reliance on [Specific country] for [Specific component] has left it particularly exposed to the new tariffs. While [Company A] has announced plans to [Mitigation strategy – e.g., diversify its supply chain], investors remain cautious about the short-term impact on profitability.

- Key Considerations: The success of [Company A]'s mitigation strategy will be crucial in determining future stock performance. Investors should monitor news regarding supply chain diversification and potential cost-cutting measures.

2. [Company B]: Impact on Consumer Demand:

[Company B], a leading producer of [Product Category – e.g., consumer electronics], is facing a double whammy: increased production costs due to tariffs and potential declines in consumer demand as prices rise. The impact on [Company B]'s stock price has been notable, with a [Percentage]% drop in recent weeks. Analysts are divided on the long-term outlook, with some predicting a rebound once the tariff situation stabilizes, while others express concern about sustained damage to consumer confidence.

- Key Considerations: Closely monitor consumer spending trends and [Company B]'s strategies for maintaining market share in the face of rising prices.

3. [Company C]: Global Market Vulnerability:

[Company C], a significant player in [Industry – e.g., cloud computing], boasts a large international customer base. However, the tariffs have increased operational costs, particularly in regions where [Company C] relies heavily on imported infrastructure. The resulting impact on profit margins is a major concern for investors, leading to a [Percentage]% dip in stock value.

- Key Considerations: Analyze [Company C]'s geographic diversification and its ability to offset tariff impacts through price adjustments or operational efficiencies.

Buy or Sell? A Cautious Approach:

The decision to buy or sell tech stocks impacted by tariffs requires careful consideration. There's no one-size-fits-all answer. Investors should:

- Conduct thorough due diligence: Research each company's financial position, mitigation strategies, and long-term growth prospects.

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across different sectors to minimize risk.

- Monitor market trends: Stay informed about ongoing trade negotiations and their potential impact on the tech sector.

- Consider your risk tolerance: Only invest what you can afford to lose.

The current market volatility presents both opportunities and risks. A well-informed and cautious approach is essential for navigating these turbulent waters. Remember to consult with a financial advisor before making any significant investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tech Stock Dip: 3 Companies Falling Due To Tariffs – Buy Or Sell?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

What To Stream On Max In April 2025 Complete New Movie List

Apr 07, 2025

What To Stream On Max In April 2025 Complete New Movie List

Apr 07, 2025 -

Monday Market Open Chinese Shares Experience Decline

Apr 07, 2025

Monday Market Open Chinese Shares Experience Decline

Apr 07, 2025 -

Complete Nyt Mini Crossword Answers For April 5th Saturday

Apr 07, 2025

Complete Nyt Mini Crossword Answers For April 5th Saturday

Apr 07, 2025 -

Should You Buy Amazon Stock After The Tariff Induced Drop

Apr 07, 2025

Should You Buy Amazon Stock After The Tariff Induced Drop

Apr 07, 2025 -

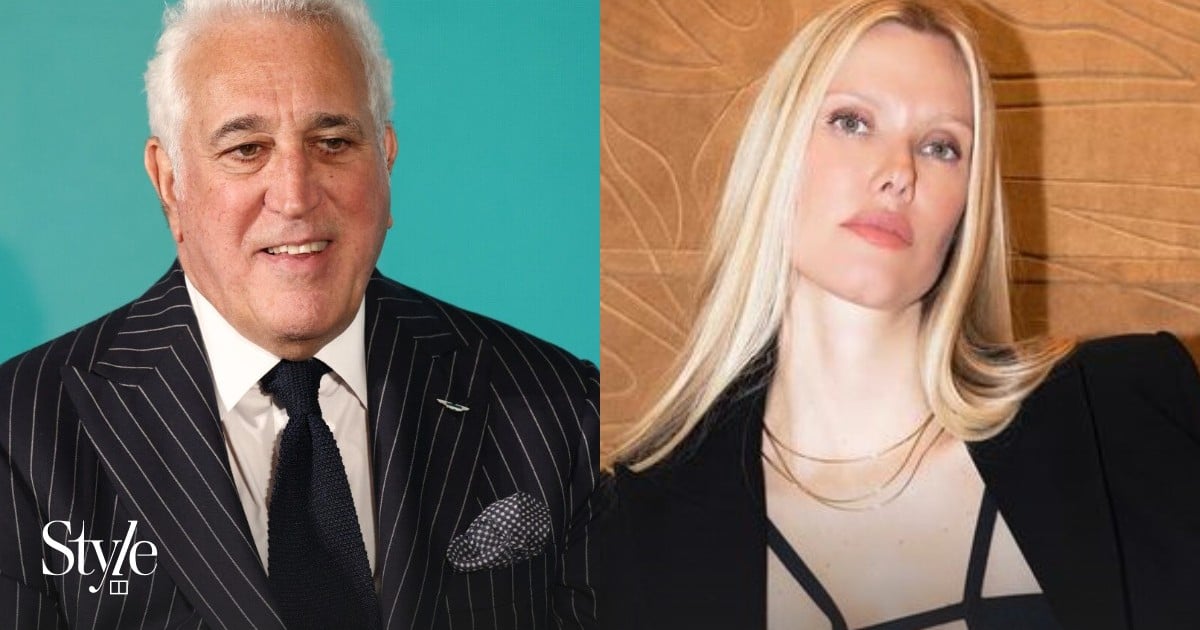

Raquel Stroll A Look Into The Life Of Aston Martins Lawrence Strolls Wife

Apr 07, 2025

Raquel Stroll A Look Into The Life Of Aston Martins Lawrence Strolls Wife

Apr 07, 2025