Tesla Price Action Analysis: Following The Recent Rally

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tesla Price Action Analysis: Following the Recent Rally

Tesla's stock price has experienced a significant rally recently, leaving investors wondering what's next. This analysis delves into the recent price action, examining potential catalysts and offering insights for navigating the volatile Tesla market. Understanding this price movement is crucial for both seasoned investors and those considering entering the electric vehicle (EV) giant's market.

The Recent Rally: A Closer Look

Tesla's stock price surge wasn't a spontaneous event. Several factors contributed to this upward trend. These include:

- Strong Q2 Earnings: Tesla exceeded expectations with its second-quarter earnings report, showcasing robust sales figures and positive profit margins, despite global economic headwinds. This boosted investor confidence significantly.

- Increased Production and Deliveries: The company's ramped-up production capacity and increased vehicle deliveries worldwide further solidified its position as a market leader in the EV sector. This demonstrates strong execution against their strategic growth plan.

- Cybertruck Hype: While still awaiting official release, the anticipation surrounding the Cybertruck continues to fuel speculation and positive sentiment surrounding the brand and its future potential. This represents a significant opportunity for market expansion.

- Further Expansion into Energy: Tesla's ongoing growth in its energy business, encompassing solar panels and energy storage solutions, diversifies its revenue streams and offers a hedge against potential fluctuations in the automotive market. This reduces overall risk for investors.

- Positive Analyst Sentiment: A shift towards more positive analyst ratings and price targets contributed to the increased buying pressure, fueling the rally. This reflects a growing belief in Tesla's long-term prospects.

Technical Analysis: Chart Patterns and Indicators

Analyzing Tesla's price action through a technical lens reveals several key insights. The recent rally shows signs of a potential breakout pattern, but caution is warranted. Investors should monitor key support and resistance levels. Key indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) should be carefully observed to gauge momentum and potential reversals. Experienced traders may employ more complex technical indicators to refine their analysis and risk management strategies. Remember that technical analysis is not a foolproof prediction tool and should be used in conjunction with fundamental analysis.

Fundamental Analysis: Assessing the Long-Term Outlook

Beyond the technical indicators, a strong fundamental analysis is crucial. Factors to consider include:

- Competition: The increasing competition in the EV market from established automakers and new entrants poses a challenge. Tesla needs to maintain its technological edge and brand recognition to stay ahead.

- Supply Chain Issues: Global supply chain disruptions remain a potential risk that could impact production and profitability.

- Regulatory Environment: Government regulations and policies regarding electric vehicles and autonomous driving technology can significantly influence Tesla's operations and future growth.

- Innovation and R&D: Tesla's ability to continue innovating and investing in research and development is crucial for maintaining its competitive advantage.

What's Next for Tesla's Stock Price?

Predicting the future price of any stock is inherently speculative. While the recent rally is encouraging, investors should approach the market with caution and a well-defined investment strategy. Diversification, risk management, and thorough due diligence are essential. The future price of Tesla will depend on a combination of factors, including continued strong earnings, successful product launches, navigating the competitive landscape, and overall market conditions. Staying informed about industry news and company announcements is crucial for making informed investment decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tesla Price Action Analysis: Following The Recent Rally. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

India Elects To Bat First Womens Tri Series Final Toss

May 12, 2025

India Elects To Bat First Womens Tri Series Final Toss

May 12, 2025 -

Business Telecoms Reshaped Virgin Media O2 Daisy Merger Announced

May 12, 2025

Business Telecoms Reshaped Virgin Media O2 Daisy Merger Announced

May 12, 2025 -

Liberal Leadership Race Who Will Win

May 12, 2025

Liberal Leadership Race Who Will Win

May 12, 2025 -

How To Best View Mays Full Flower Moon

May 12, 2025

How To Best View Mays Full Flower Moon

May 12, 2025 -

Queensland Politics Rocked Labor Expels Brisbane Member In Unprecedented Move

May 12, 2025

Queensland Politics Rocked Labor Expels Brisbane Member In Unprecedented Move

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

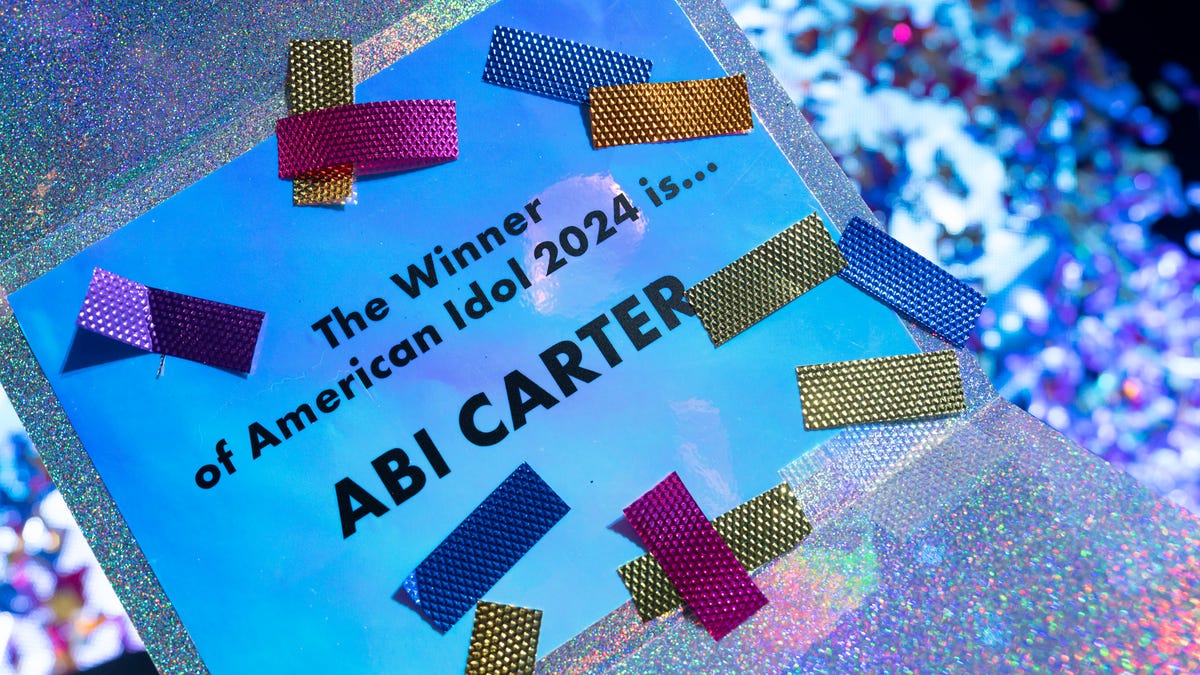

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025