Tesla Stock Soars: Key Price Levels To Watch After February Highs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tesla Stock Soars: Key Price Levels to Watch After February Highs

Tesla's stock price has been on a rollercoaster ride lately, and after hitting significant highs in February, investors are keenly eyeing the next moves. The electric vehicle (EV) giant has seen its share price surge recently, prompting renewed interest and speculation about future performance. But what key price levels should investors be watching? This article analyzes the recent surge, identifies crucial support and resistance levels, and offers insights for navigating this volatile market.

February's Highs: A Springboard for Growth?

Tesla's stock experienced a substantial rally in February, exceeding expectations and leaving many analysts scrambling to reassess their forecasts. This surge wasn't without its catalysts; strong Q4 earnings reports, increased production figures, and ongoing innovation in the EV sector all contributed to the positive momentum. However, the question remains: is this a sustainable trend, or just a temporary spike?

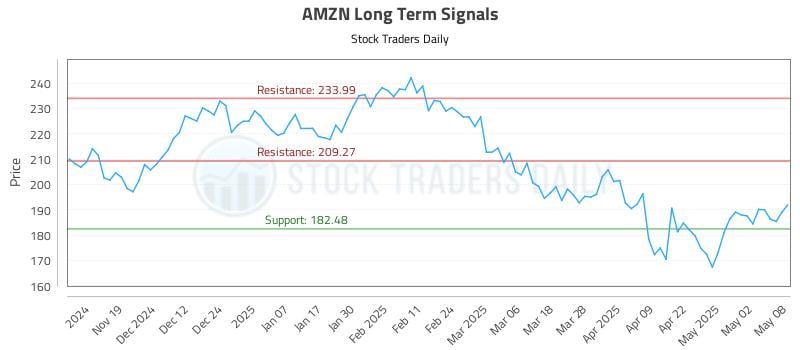

Key Price Levels to Watch:

Understanding key price levels is crucial for any investor attempting to navigate the complexities of the Tesla stock market. These levels act as potential support (where buying pressure may outweigh selling) and resistance (where selling pressure may dominate). Currently, several key levels are worth monitoring:

-

Support Level 1 ($180 - $190): This range represents a significant area of support based on recent trading patterns. A break below this level could signal a more substantial correction.

-

Support Level 2 ($160 - $170): A break below Support Level 1 could lead to a test of this lower support range. This level represents a psychologically important barrier and a potential buying opportunity for long-term investors.

-

Resistance Level 1 ($210 - $220): This range acted as strong resistance in the past. Breaking through this level convincingly could signal a continuation of the upward trend and potentially propel the stock to higher highs.

-

Resistance Level 2 ($240 - $250): This represents a more significant resistance level. Reaching and overcoming this would be a strong bullish signal, suggesting a major shift in market sentiment.

Factors Influencing Tesla Stock:

Several factors beyond the immediate price action contribute to Tesla's stock volatility:

-

Production and Delivery Numbers: Consistent increases in vehicle production and deliveries are crucial for maintaining investor confidence. Any significant setbacks in this area could negatively impact the stock price.

-

Competition: The EV market is becoming increasingly competitive. The performance of Tesla's rivals and the introduction of new competing technologies will influence Tesla's market share and stock price.

-

Regulatory Landscape: Changes in government regulations, particularly those related to EV subsidies and environmental policies, can significantly impact the company's profitability and future growth.

-

Elon Musk's Actions: Elon Musk's public statements and actions continue to heavily influence investor sentiment. His tweets and other public pronouncements can trigger significant stock price swings.

Investing in Tesla: A Cautious Approach:

While Tesla's potential is undeniable, investing in the company's stock carries significant risk. The stock's volatility and dependence on several external factors necessitate a cautious and well-informed investment strategy. Investors should conduct thorough due diligence and consider their own risk tolerance before making any investment decisions. Diversification is crucial to mitigate risk. Consulting a financial advisor is always recommended.

Conclusion:

Tesla's recent stock surge presents both opportunities and challenges for investors. By carefully monitoring the key price levels outlined above and remaining aware of the factors that influence the stock's price, investors can make more informed decisions and navigate the complexities of this dynamic market. Remember, investing in the stock market always carries inherent risks, and it's crucial to approach it with a long-term perspective and a thorough understanding of the company and the market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tesla Stock Soars: Key Price Levels To Watch After February Highs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nbc Leverages Ai To Reintroduce Iconic Nba Announcer Jim Fagan

May 12, 2025

Nbc Leverages Ai To Reintroduce Iconic Nba Announcer Jim Fagan

May 12, 2025 -

Cricket Legend Virat Kohli Retires From Test Matches Impact And Analysis

May 12, 2025

Cricket Legend Virat Kohli Retires From Test Matches Impact And Analysis

May 12, 2025 -

Casino Brawl To Octagon Ufc 318 Showdowns

May 12, 2025

Casino Brawl To Octagon Ufc 318 Showdowns

May 12, 2025 -

Whittaker Israel Rematch Confirmed The Reaper Returns

May 12, 2025

Whittaker Israel Rematch Confirmed The Reaper Returns

May 12, 2025 -

Liverpool Boss Slots Reaction To Alexander Arnolds Unexpected Move

May 12, 2025

Liverpool Boss Slots Reaction To Alexander Arnolds Unexpected Move

May 12, 2025

Latest Posts

-

Nvidia Stock Forecast Rebounding To 150 By December

May 13, 2025

Nvidia Stock Forecast Rebounding To 150 By December

May 13, 2025 -

The Papal Name Leo Xiv An Artificial Intelligence Connection

May 13, 2025

The Papal Name Leo Xiv An Artificial Intelligence Connection

May 13, 2025 -

2024 Amzn Investment Report Key Performance Indicators And Financial Outlook

May 13, 2025

2024 Amzn Investment Report Key Performance Indicators And Financial Outlook

May 13, 2025 -

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025 -

Darknet Laundering And Bybit Hack German Authorities Target E Xch Crypto Platform In E34 Million Seizure

May 13, 2025

Darknet Laundering And Bybit Hack German Authorities Target E Xch Crypto Platform In E34 Million Seizure

May 13, 2025