Tesla's Q[Quarter Number] Earnings: A More Concerning Picture Than Initially Presented

![Tesla's Q[Quarter Number] Earnings: A More Concerning Picture Than Initially Presented Tesla's Q[Quarter Number] Earnings: A More Concerning Picture Than Initially Presented](https://newsone.smadcstdo.sch.id/image/teslas-q-quarter-number-earnings-a-more-concerning-picture-than-initially-presented.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tesla's Q3 Earnings: A More Concerning Picture Than Initially Presented

Tesla's Q3 2023 earnings report initially appeared positive, showcasing record deliveries and revenue. However, a closer examination reveals a more complex and potentially concerning picture for the electric vehicle (EV) giant. While the headline numbers impressed, several underlying factors paint a less optimistic outlook for the future. This analysis delves into the key areas of concern that investors and analysts are grappling with.

Record Deliveries, but at What Cost?

Tesla delivered a record number of vehicles in Q3, exceeding expectations. This success, however, came at a cost. The company significantly increased its reliance on price cuts to stimulate demand, impacting profit margins. This aggressive pricing strategy, while boosting sales volume, raises questions about the long-term sustainability of Tesla's business model. Analysts are debating whether this is a short-term tactic to maintain market share or a sign of weakening demand.

Profit Margin Squeeze: A Worrying Trend?

The most alarming aspect of Tesla's Q3 earnings is the significant compression of profit margins. While revenue grew, the overall profitability decreased, largely due to the price cuts and increased production costs. This trend is worrying, especially considering the increasing competition in the EV market. Maintaining healthy profit margins is crucial for Tesla's continued growth and investment in future technologies.

Rising Competition and Market Saturation Concerns

The EV market is becoming increasingly crowded, with established automakers aggressively launching their own competitive models. Tesla's dominance is being challenged, and the price wars triggered by the company's own actions may be benefiting competitors more than Tesla itself. The saturation of the high-end EV market is also a concern, limiting growth potential for Tesla's premium vehicles.

Beyond the Numbers: Looking Ahead

- Production Challenges: Maintaining production levels while ensuring quality remains a critical challenge for Tesla. Any significant production hiccups could severely impact future earnings.

- Supply Chain Vulnerabilities: Tesla, like many companies, is susceptible to supply chain disruptions. Geopolitical instability and material shortages could further constrain profitability.

- Regulatory Hurdles: Navigating the complex regulatory landscape in different markets continues to pose a challenge. Government regulations and incentives can significantly impact Tesla's operations and profitability.

- Innovation Slowdown?: Concerns are growing about the pace of Tesla's innovation. While maintaining its technological leadership is paramount, competitors are quickly catching up.

Conclusion: A Need for Strategic Reassessment?

Tesla's Q3 earnings report presents a mixed bag. While the record deliveries are a positive sign, the declining profit margins and intensifying competition are serious concerns. The company's aggressive pricing strategy, while boosting sales in the short term, raises questions about long-term sustainability. A strategic reassessment of its pricing model, production efficiency, and innovation pipeline may be necessary to ensure Tesla's continued success in the increasingly competitive EV market. Investors will be closely watching Tesla's future moves to gauge its response to these challenges.

![Tesla's Q[Quarter Number] Earnings: A More Concerning Picture Than Initially Presented Tesla's Q[Quarter Number] Earnings: A More Concerning Picture Than Initially Presented](https://newsone.smadcstdo.sch.id/image/teslas-q-quarter-number-earnings-a-more-concerning-picture-than-initially-presented.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tesla's Q[Quarter Number] Earnings: A More Concerning Picture Than Initially Presented. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Agora Na Agora Cobertura Completa E Ao Vivo Da Reuniao Anual Da Berkshire Hathaway 2024 Pelo Info Money

Apr 25, 2025

Agora Na Agora Cobertura Completa E Ao Vivo Da Reuniao Anual Da Berkshire Hathaway 2024 Pelo Info Money

Apr 25, 2025 -

History In The Making Dolphins Broncos Rivalry Heats Up At Suncorp

Apr 25, 2025

History In The Making Dolphins Broncos Rivalry Heats Up At Suncorp

Apr 25, 2025 -

Can Liverpool Win The Premier League On Sunday A Draw Could Be Enough

Apr 25, 2025

Can Liverpool Win The Premier League On Sunday A Draw Could Be Enough

Apr 25, 2025 -

Newcastle Uniteds Striker Hunt Potential Signings To Fill Wilsons Boots

Apr 25, 2025

Newcastle Uniteds Striker Hunt Potential Signings To Fill Wilsons Boots

Apr 25, 2025 -

Climate Adaptation Strategies And Their Unforeseen Consequences For Arctic Birds

Apr 25, 2025

Climate Adaptation Strategies And Their Unforeseen Consequences For Arctic Birds

Apr 25, 2025

Latest Posts

-

Ge 2025 And Beyond Pm Wong Accuses Wp Of Irresponsibility Regarding Experienced Ministers Potential Departure

Apr 30, 2025

Ge 2025 And Beyond Pm Wong Accuses Wp Of Irresponsibility Regarding Experienced Ministers Potential Departure

Apr 30, 2025 -

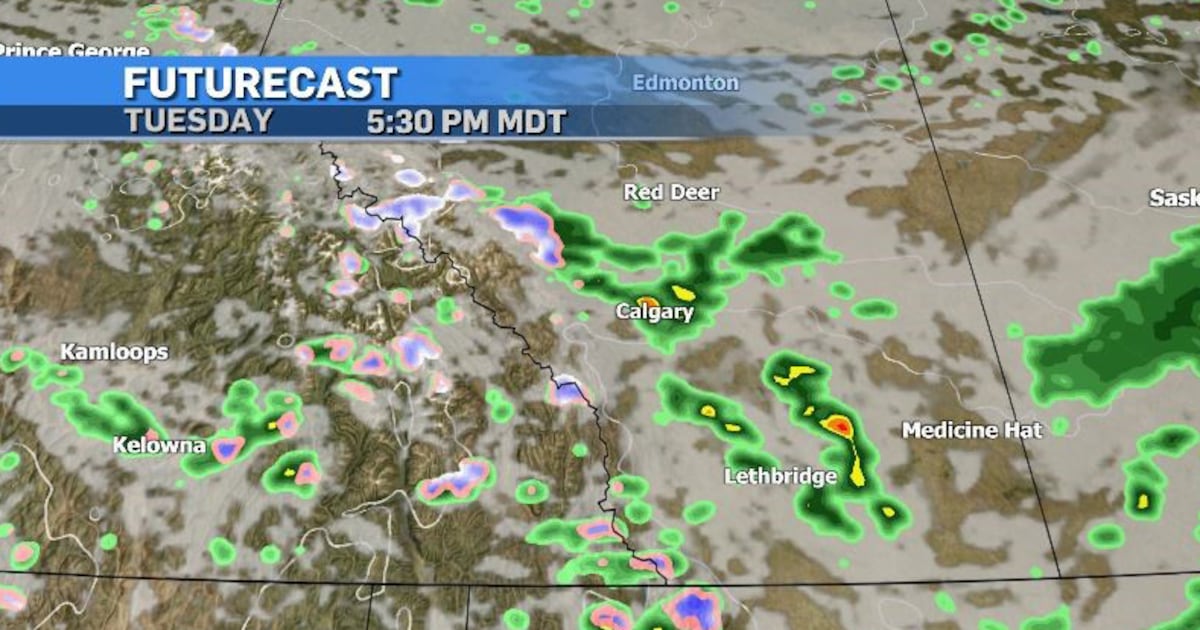

Windy And Cloudy Tuesday In Calgary Risk Of Thunderstorms Throughout The Day

Apr 30, 2025

Windy And Cloudy Tuesday In Calgary Risk Of Thunderstorms Throughout The Day

Apr 30, 2025 -

National Theatre Announces Star Studded Cast Mescal Wright Barbaro And Coughlan Lead

Apr 30, 2025

National Theatre Announces Star Studded Cast Mescal Wright Barbaro And Coughlan Lead

Apr 30, 2025 -

The Dangers Of Trusting Verified Accounts In Web3

Apr 30, 2025

The Dangers Of Trusting Verified Accounts In Web3

Apr 30, 2025 -

Presidential Candidates Poa And Tan Mutual Support In Singapores Election

Apr 30, 2025

Presidential Candidates Poa And Tan Mutual Support In Singapores Election

Apr 30, 2025