Tether USDT Compliance Failure: A Gateway For Criminal Activity

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tether USDT Compliance Failure: A Gateway for Criminal Activity?

The cryptocurrency world is abuzz with concerns over Tether (USDT), the world's largest stablecoin, and its ongoing struggles with regulatory compliance. Recent reports and investigations paint a troubling picture, suggesting potential loopholes that could be exploited for illicit activities, raising serious questions about the stability and integrity of the entire cryptocurrency ecosystem. This isn't just about Tether; it's about the potential for widespread financial crime facilitated by a lack of robust oversight.

The Ongoing Saga of Tether's Compliance Issues:

Tether, pegged to the US dollar, has long faced scrutiny regarding the actual reserves backing its tokens. Critics have repeatedly questioned whether Tether truly holds a 1:1 ratio of USD for every USDT in circulation. The lack of complete transparency and consistent, independent audits has fueled suspicions of fractional reserve banking and even outright fraud. This lack of transparency creates a fertile ground for criminal elements.

How Compliance Failures Facilitate Criminal Activity:

The potential for misuse stems from several key areas:

-

Money Laundering: The opacity surrounding Tether's reserves makes it a potentially attractive tool for money laundering. Illegally obtained funds can be converted into USDT, obscuring their origin and making them difficult to trace. The decentralized nature of cryptocurrencies, coupled with weak regulation, exacerbates this risk.

-

Terrorist Financing: Similar to money laundering, the anonymity offered by Tether, particularly in jurisdictions with lax regulatory frameworks, could facilitate the financing of terrorist organizations. The ease of transferring USDT across borders poses a significant challenge for law enforcement.

-

Sanctions Evasion: The use of Tether to circumvent international sanctions is another significant concern. Countries under sanctions could utilize USDT to conduct transactions, avoiding traditional banking systems and regulatory scrutiny.

-

Darknet Market Transactions: The relative anonymity provided by Tether has made it a popular choice for transactions on darknet markets, where illegal goods and services are traded. This contributes to the growth of the illicit underground economy.

The Ripple Effect on the Cryptocurrency Market:

The ongoing compliance issues surrounding Tether aren't isolated. They cast a shadow over the entire cryptocurrency market, impacting investor confidence and potentially triggering broader instability. Regulatory bodies worldwide are increasingly scrutinizing stablecoins, recognizing their potential to be used for illicit purposes. This increased scrutiny could lead to stricter regulations and potentially hinder the growth of the crypto market.

What Needs to Happen?

To mitigate the risks associated with Tether and other stablecoins, several crucial steps must be taken:

-

Increased Transparency: Tether and other stablecoin issuers must provide complete, verifiable audits of their reserves, ensuring transparency and accountability.

-

Stronger Regulatory Frameworks: Governments and regulatory bodies need to implement robust regulatory frameworks for stablecoins, addressing money laundering, terrorist financing, and sanctions evasion. International cooperation is crucial.

-

Enhanced Due Diligence: Cryptocurrency exchanges and other financial institutions need to implement enhanced due diligence procedures to identify and prevent the use of Tether for illicit activities.

The Tether USDT compliance failure highlights a critical vulnerability in the cryptocurrency ecosystem. Addressing these concerns requires a concerted effort from regulatory bodies, cryptocurrency issuers, and financial institutions. Failure to act decisively could lead to severe consequences, undermining the integrity of the cryptocurrency market and potentially facilitating widespread financial crime. The future of Tether, and the broader cryptocurrency landscape, hangs in the balance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tether USDT Compliance Failure: A Gateway For Criminal Activity. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tesco Mobile App Issues Customers Report Login Problems

May 17, 2025

Tesco Mobile App Issues Customers Report Login Problems

May 17, 2025 -

Mainz Europacup Glueck Stolz Und Geheimer Partyplan Enthuellt

May 17, 2025

Mainz Europacup Glueck Stolz Und Geheimer Partyplan Enthuellt

May 17, 2025 -

Carlos Alcaraz Vs Lorenzo Musetti Rome Semifinal How To Watch And Prediction

May 17, 2025

Carlos Alcaraz Vs Lorenzo Musetti Rome Semifinal How To Watch And Prediction

May 17, 2025 -

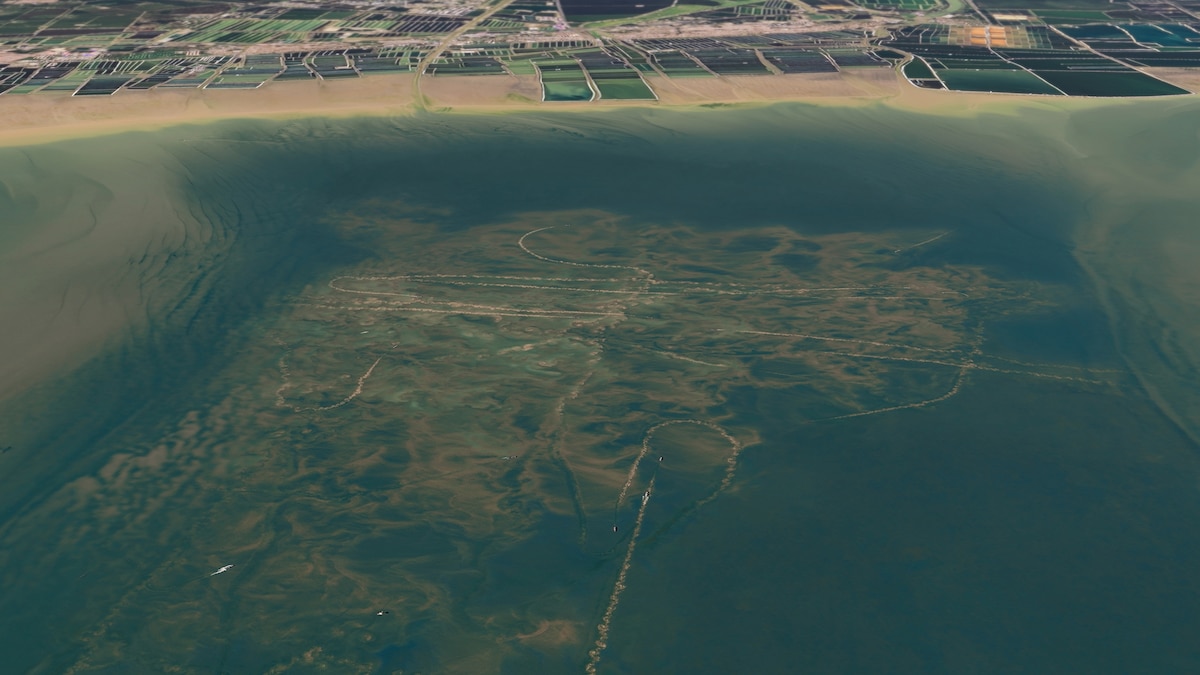

Urgent Call For Change Underwater Footage Shows Fish Fleeing Bottom Trawlers

May 17, 2025

Urgent Call For Change Underwater Footage Shows Fish Fleeing Bottom Trawlers

May 17, 2025 -

Cannes Film Festival 2024

May 17, 2025

Cannes Film Festival 2024

May 17, 2025