Tether (USDT) Compliance Gaps: A Criminal Opportunity? On-Chain Evidence Exposes Risks.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tether (USDT) Compliance Gaps: A Criminal Opportunity? On-Chain Evidence Exposes Risks

The world of cryptocurrency is constantly evolving, and with it, the scrutiny of its underlying mechanisms. Tether (USDT), the world's largest stablecoin by market capitalization, has long faced questions surrounding its reserves and compliance practices. Recent on-chain evidence has intensified these concerns, raising serious questions about potential vulnerabilities that could be exploited for criminal activity. Is Tether's lack of full transparency inadvertently creating a haven for illicit finance?

The Shadowy World of Stablecoin Reserves:

Tether claims its USDT tokens are backed by a 1:1 ratio of reserves, primarily comprising commercial paper, cash, and other short-term investments. However, the lack of independent audits and the opaque nature of these reserves have fueled persistent skepticism. Critics argue that this lack of transparency creates significant risks, allowing for potential manipulation and misuse. The absence of readily available, verifiable proof of reserves leaves a considerable gap for illicit activities to thrive.

On-Chain Evidence: A Red Flag for Regulators:

Recent investigations utilizing on-chain analysis have unearthed worrying trends. Researchers have identified instances where large sums of USDT appear to be originating from, or flowing into, entities associated with known illicit activities, such as money laundering and sanctions evasion. This on-chain evidence suggests a potential breakdown in Tether's purported anti-money laundering (AML) and know-your-customer (KYC) protocols.

Key Areas of Concern Highlighted by On-Chain Data:

- Lack of Transparency in Reserve Composition: The precise breakdown of Tether's reserves remains shrouded in mystery, hindering independent verification of its claimed 1:1 backing. This opacity creates an environment ripe for manipulation and exploitation.

- Suspicious Transaction Patterns: On-chain data reveal unusual patterns of USDT movement, raising concerns about its potential use in facilitating illicit financial transactions, including those linked to ransomware attacks and darknet marketplaces.

- Weak AML/KYC Compliance: The apparent lack of robust AML/KYC measures raises questions about Tether's ability to effectively identify and prevent the use of its stablecoin in criminal activities. This poses significant risks for the broader cryptocurrency ecosystem.

The Criminal Opportunity:

The combination of opaque reserves and potentially weak compliance measures presents a significant opportunity for criminals. The relative ease with which large sums of USDT can be moved, coupled with the difficulties in tracing its origins, makes it an attractive tool for money laundering and other illicit activities. This undermines the integrity of the cryptocurrency market and poses a threat to the global financial system.

What Needs to Happen:

To address these concerns and mitigate the risks, several steps are urgently needed:

- Independent Audits: Tether must undergo regular, independent audits of its reserves by reputable accounting firms to verify the accuracy of its claims and build public trust.

- Enhanced AML/KYC Procedures: Strengthened AML/KYC protocols are crucial to prevent the use of USDT in illicit activities. This includes enhanced due diligence and real-time monitoring of transactions.

- Increased Regulatory Scrutiny: Regulators need to intensify their scrutiny of Tether and other stablecoins to ensure compliance with existing regulations and to close any existing loopholes.

The Future of Tether and Stablecoin Regulation:

The future of Tether hinges on its ability to address these concerns transparently and proactively. The on-chain evidence paints a concerning picture, highlighting the need for greater regulatory oversight and stricter compliance measures within the stablecoin market. The failure to do so could have significant ramifications for the wider cryptocurrency ecosystem and the global financial system. The question remains: will Tether adapt and reform, or will its compliance gaps continue to be a significant criminal opportunity?

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tether (USDT) Compliance Gaps: A Criminal Opportunity? On-Chain Evidence Exposes Risks.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Epl And Fa Cup Build Up Howe Arteta Glasner And Guardiolas Friday Pressers

May 17, 2025

Epl And Fa Cup Build Up Howe Arteta Glasner And Guardiolas Friday Pressers

May 17, 2025 -

High Refresh Rate Gaming Evaluating Samsungs First 500 Hz Oled Monitor

May 17, 2025

High Refresh Rate Gaming Evaluating Samsungs First 500 Hz Oled Monitor

May 17, 2025 -

Urgent Tesco Customers Report Widespread Account Lockouts On App And Website

May 17, 2025

Urgent Tesco Customers Report Widespread Account Lockouts On App And Website

May 17, 2025 -

Season 4 Renewal For Netflixs The Diplomat Announced

May 17, 2025

Season 4 Renewal For Netflixs The Diplomat Announced

May 17, 2025 -

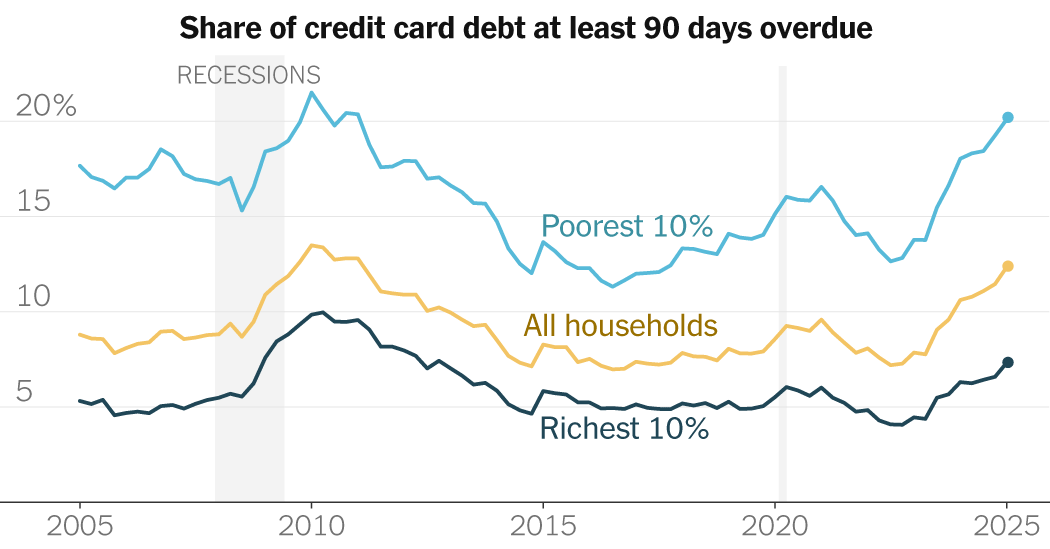

Economic Strain Mounts How Tariffs Are Affecting American Consumers

May 17, 2025

Economic Strain Mounts How Tariffs Are Affecting American Consumers

May 17, 2025