Tether's US Stablecoin Plans Hinge On Trump's Promised Financial Reforms

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tether's US Stablecoin Plans Hinge on Trump's Promised Financial Reforms

The cryptocurrency world is watching closely as Tether, the issuer of the largest stablecoin, USDT, waits on the sidelines of a potential US stablecoin launch, its plans heavily reliant on the promised financial reforms from former President Donald Trump. While details remain scarce, the implication is that a more favorable regulatory environment under a Trump administration could significantly impact Tether's strategic direction.

The potential launch of a US dollar-backed stablecoin by Tether has been a topic of much speculation. The company, known for its controversial history and past regulatory scrutiny, has long sought to expand its influence in the US market. However, navigating the complex web of US financial regulations has proven challenging.

Trump's Vision and Tether's Ambitions

Trump's repeated calls for deregulation during his presidency, particularly within the financial sector, have raised hopes within certain cryptocurrency circles. These promises, if fulfilled in a second term, could potentially ease the path for Tether to introduce its stablecoin within US borders. A less stringent regulatory landscape could lead to:

- Reduced compliance costs: Navigating the intricacies of US banking regulations and compliance requirements is expensive. A more lenient approach could significantly reduce Tether's operational burdens.

- Increased market access: A smoother regulatory process could allow Tether to access a larger pool of US investors and businesses, significantly boosting its market share.

- Enhanced credibility: Successfully navigating a less hostile regulatory climate could improve Tether's reputation and bolster confidence in its stablecoin.

However, the situation is far from straightforward. Even with a potentially more favorable regulatory environment, Tether still faces significant hurdles:

- Past controversies: Tether's history of controversies, including accusations of insufficient reserves backing its USDT, casts a long shadow. Rebuilding trust with US regulators will be crucial for any future success.

- Ongoing investigations: Several ongoing investigations into Tether's operations continue to loom large. The outcomes of these investigations could drastically alter the company's future trajectory.

- Competitive landscape: The US stablecoin market is already crowded, with established players like Circle's USDC and Paxos' PAX Gold holding significant market share. Tether will face intense competition.

The Uncertain Future

The connection between Tether's US ambitions and Trump's potential return to power is undeniable. However, the degree to which his promised reforms would actually materialize remains uncertain. Furthermore, the existing regulatory landscape, regardless of any potential shifts, presents substantial challenges that Tether must overcome.

This situation highlights the inherent volatility and uncertainty within the cryptocurrency market. Tether's plans serve as a potent example of how political developments can significantly influence the strategic decisions of major players within the industry. The coming months will be crucial in determining whether Tether's gamble on Trump's promised reforms will pay off. The cryptocurrency community will be watching intently.

Keywords: Tether, USDT, stablecoin, US stablecoin, Trump, financial reforms, cryptocurrency regulation, regulatory landscape, market access, compliance, Circle, USDC, Paxos, PAX Gold, cryptocurrency market, political influence.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tether's US Stablecoin Plans Hinge On Trump's Promised Financial Reforms. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Eu Ai Ban Throws Wrench In X Ai Merger And Groks Development

Apr 08, 2025

Eu Ai Ban Throws Wrench In X Ai Merger And Groks Development

Apr 08, 2025 -

Shopifys Ceo On Ai Reshaping Performance Reviews And Talent Acquisition

Apr 08, 2025

Shopifys Ceo On Ai Reshaping Performance Reviews And Talent Acquisition

Apr 08, 2025 -

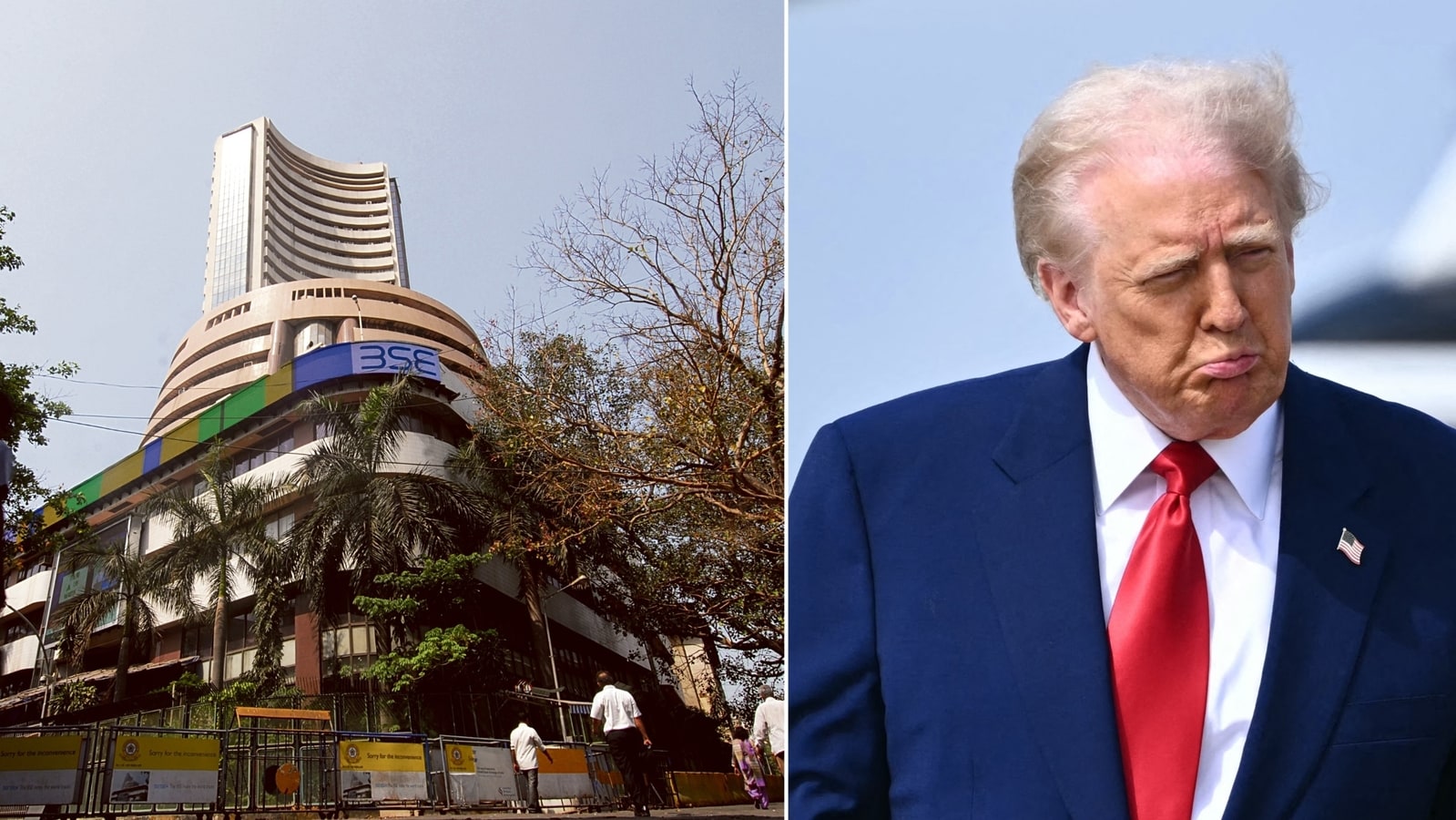

Indian Stock Market Down Today Analysis Of The Sensex And Nifty Drop

Apr 08, 2025

Indian Stock Market Down Today Analysis Of The Sensex And Nifty Drop

Apr 08, 2025 -

Best Tech Stocks Under 100 A 1 000 Investment Guide

Apr 08, 2025

Best Tech Stocks Under 100 A 1 000 Investment Guide

Apr 08, 2025 -

Bida Comments On Starlink A Critical Analysis Of Recent Remarks

Apr 08, 2025

Bida Comments On Starlink A Critical Analysis Of Recent Remarks

Apr 08, 2025