The 2014 Crypto Tax Code Needs An Urgent Update

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The 2014 Crypto Tax Code Needs an Urgent Update: Navigating the Regulatory Wild West

The cryptocurrency landscape has exploded since the Internal Revenue Service (IRS) first addressed digital assets in its 2014 guidance. What was once a niche market is now a multi-trillion dollar industry, yet the outdated tax code struggles to keep pace. This discrepancy leaves taxpayers confused and vulnerable, highlighting the urgent need for a comprehensive update to the 2014 crypto tax code.

The 2014 Guidance: A Relic of the Past

The IRS's 2014 notice treated cryptocurrency as property, meaning transactions are subject to capital gains taxes. While seemingly straightforward, this classification fails to address the complexities of the modern crypto ecosystem. The rapid evolution of DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), staking, and airdrops has created a regulatory grey area, leaving taxpayers scrambling to understand their obligations. The lack of clear guidance on these newer developments leads to significant uncertainty and potential for costly errors.

Key Challenges with the Current Crypto Tax Code:

- Lack of Clarity on DeFi and NFTs: The decentralized nature of DeFi protocols and the unique characteristics of NFTs make it difficult to apply the 2014 guidance. Determining the tax implications of yield farming, staking rewards, and NFT sales remains a significant challenge for many.

- Reporting Complexity: Tracking every crypto transaction, including swaps, airdrops, and yield farming activities, can be incredibly complex, particularly for those with substantial portfolio holdings. The current reporting mechanisms are often insufficient for the complexities of modern crypto trading.

- Valuation Challenges: Determining the fair market value of cryptocurrencies at the time of transactions can be problematic, especially for less liquid assets. Fluctuating prices add another layer of complexity to accurate tax reporting.

- International Implications: The global nature of cryptocurrency transactions presents significant challenges for international tax compliance. Differences in tax laws across jurisdictions create further obstacles for taxpayers.

The Urgent Need for Reform:

The current system is not only confusing but also potentially unfair. Many taxpayers lack the technical expertise or resources to navigate the complexities of crypto tax reporting accurately. This can lead to unintentional errors and significant penalties from the IRS. A modernized tax code is essential to:

- Provide clear and concise guidance: The IRS needs to issue updated guidance that specifically addresses the nuances of DeFi, NFTs, and other emerging crypto technologies.

- Simplify reporting requirements: Streamlining the reporting process through improved software integration and clearer instructions would reduce the burden on taxpayers.

- Address valuation challenges: The IRS should establish clear guidelines for determining the fair market value of cryptocurrencies, particularly for less liquid assets.

- Enhance international cooperation: Collaboration with international tax authorities is crucial to address the cross-border nature of cryptocurrency transactions.

Looking Ahead: The Path to a Better Crypto Tax System

A comprehensive overhaul of the 2014 crypto tax code is not simply desirable—it's essential. Failure to adapt to the evolving crypto landscape will only exacerbate existing issues, creating further uncertainty and potential for disputes. Lawmakers and regulators must prioritize the development of a more transparent, efficient, and equitable tax system that reflects the realities of the modern cryptocurrency market. This requires a collaborative effort between government agencies, industry experts, and taxpayers to create a framework that fosters innovation while ensuring fair and accurate tax compliance. The future of crypto taxation hinges on this crucial update.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The 2014 Crypto Tax Code Needs An Urgent Update. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

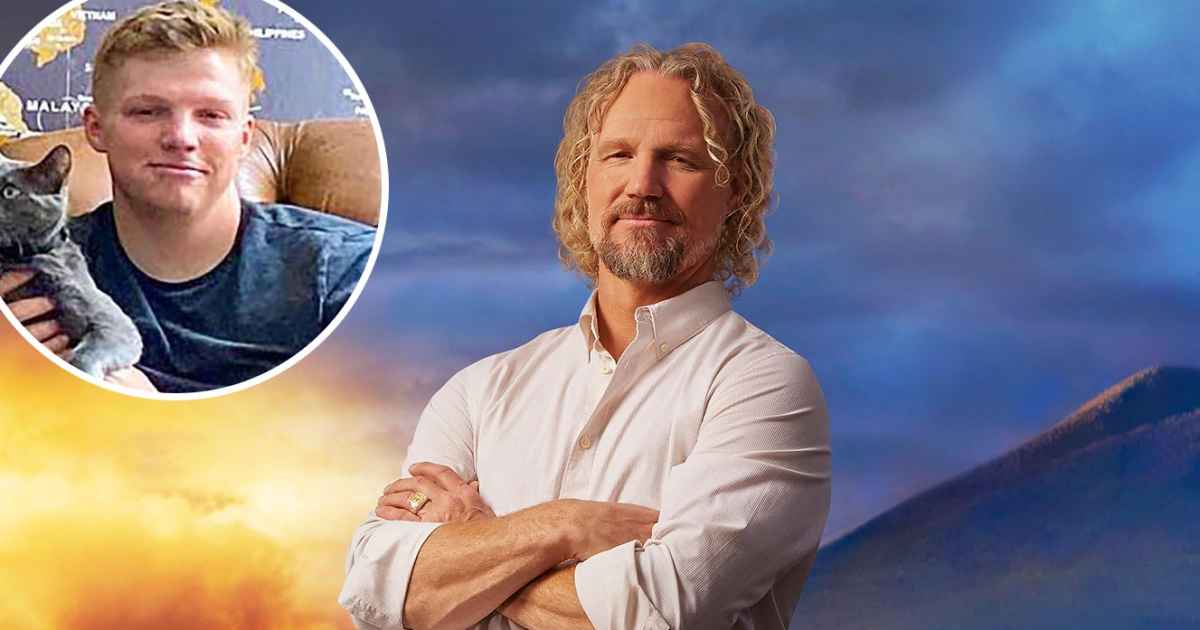

Sister Wives Season Finale Kody Reflects On Garrisons Death Expresses Regret

May 06, 2025

Sister Wives Season Finale Kody Reflects On Garrisons Death Expresses Regret

May 06, 2025 -

Budget Friendly Buys High Value Items You Ll Actually Love

May 06, 2025

Budget Friendly Buys High Value Items You Ll Actually Love

May 06, 2025 -

Monterrey Vs Pumas Analisis Completo Del Historial En La Liga Mx

May 06, 2025

Monterrey Vs Pumas Analisis Completo Del Historial En La Liga Mx

May 06, 2025 -

Follow The Action Pacers Vs Cavaliers Real Time Updates And Stats

May 06, 2025

Follow The Action Pacers Vs Cavaliers Real Time Updates And Stats

May 06, 2025 -

Antwerp And Home A Critical Mob Land Recap Of Rising Conflicts

May 06, 2025

Antwerp And Home A Critical Mob Land Recap Of Rising Conflicts

May 06, 2025

Latest Posts

-

Multiple Earthquakes Including A 5 9 Magnitude Quake Rattle Taiwan

May 06, 2025

Multiple Earthquakes Including A 5 9 Magnitude Quake Rattle Taiwan

May 06, 2025 -

Sister Wives Recap Kody Grapples With Garrisons Death Yearns For More Time

May 06, 2025

Sister Wives Recap Kody Grapples With Garrisons Death Yearns For More Time

May 06, 2025 -

Hartensteins Take Okc Thunder Center Reacts To Clippers Nuggets Playoffs

May 06, 2025

Hartensteins Take Okc Thunder Center Reacts To Clippers Nuggets Playoffs

May 06, 2025 -

Catizen And Animoca A Strategic Partnership To Revolutionize Web3 Gaming

May 06, 2025

Catizen And Animoca A Strategic Partnership To Revolutionize Web3 Gaming

May 06, 2025 -

Can Lu Dort Find His Shot Okc Thunders Second Round Depends On It

May 06, 2025

Can Lu Dort Find His Shot Okc Thunders Second Round Depends On It

May 06, 2025