The Crypto Tax Conundrum: Outdated Laws And The Need For Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Crypto Tax Conundrum: Outdated Laws and the Need for Urgent Reform

The meteoric rise of cryptocurrency has left tax laws worldwide scrambling to keep pace. What was once a niche digital asset is now a multi-trillion dollar global market, yet many jurisdictions are grappling with outdated legislation ill-equipped to handle the complexities of taxing crypto transactions. This creates a significant crypto tax conundrum for both individuals and businesses, demanding urgent reform.

The problem isn't simply a lack of clarity; it's a fundamental mismatch between existing tax frameworks and the unique nature of crypto assets. Traditional tax codes were designed for fiat currencies and tangible assets, failing to account for the decentralized, borderless, and often anonymous characteristics of cryptocurrencies like Bitcoin, Ethereum, and countless others. This ambiguity leads to several key challenges:

H2: Key Challenges in Crypto Taxation

-

Defining Crypto Assets: The first hurdle is defining crypto assets themselves. Are they property, currency, or something else entirely? This seemingly simple question has profound tax implications, affecting capital gains tax, income tax, and even gift and inheritance taxes. Inconsistencies in classification across different jurisdictions further complicate matters.

-

Tracking Transactions: The decentralized and pseudonymous nature of blockchain transactions makes tracking them incredibly difficult. Traditional methods of tracking financial activity simply don't apply. This opacity increases the risk of tax evasion and makes enforcement challenging for tax authorities.

-

Valuation Challenges: The volatile nature of cryptocurrency prices presents significant valuation challenges. Determining the fair market value of crypto assets at the time of transaction, especially for frequent traders, is a complex and often subjective process. This lack of consistent valuation methods can lead to inconsistent tax liabilities.

-

Staking and DeFi: The emergence of decentralized finance (DeFi) and staking further complicates the picture. Income generated from staking rewards or lending through DeFi platforms often falls into a gray area, with unclear tax implications in many jurisdictions.

-

Cross-border Transactions: International crypto transactions add another layer of complexity. Determining which jurisdiction has the right to tax a particular transaction, particularly when involving multiple countries, is often ambiguous and contentious.

H2: The Urgent Need for Crypto Tax Reform

The current situation is unsustainable. The lack of clear guidelines leads to uncertainty for taxpayers, increased compliance costs, and potential revenue losses for governments. Urgent reforms are needed to:

-

Establish Clear Definitions: Governments need to establish clear and consistent definitions of crypto assets within their tax codes. This will provide much-needed clarity for taxpayers and streamline the tax assessment process.

-

Develop Robust Tracking Mechanisms: While maintaining privacy is important, governments need to explore and implement robust mechanisms for tracking crypto transactions. This could involve collaboration with blockchain analytics firms or the development of specialized reporting requirements.

-

Standardize Valuation Methods: A standardized approach to valuing crypto assets is crucial. This could involve adopting a specific valuation method or establishing a regulatory body to oversee valuation practices.

-

Address DeFi and Staking: Specific guidelines need to be developed to address the tax implications of income generated from staking and DeFi activities.

-

Promote International Collaboration: International cooperation is essential to address the cross-border challenges of crypto taxation. This could involve harmonizing tax regulations or establishing international agreements on the taxation of crypto transactions.

H2: Looking Ahead: A More Certain Future for Crypto Taxation?

While the path forward is challenging, the need for reform is undeniable. As cryptocurrency continues to grow in popularity and adoption, the existing patchwork of outdated laws simply won't suffice. A collaborative effort between governments, tax professionals, and the crypto community is crucial to developing a fair, efficient, and transparent system for taxing crypto assets. The alternative is continued uncertainty, compliance difficulties, and lost revenue – a scenario that benefits no one.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Crypto Tax Conundrum: Outdated Laws And The Need For Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

X Platform Elon Musks E41 8 Billion Gamble Pays Off After 874 Days

May 05, 2025

X Platform Elon Musks E41 8 Billion Gamble Pays Off After 874 Days

May 05, 2025 -

Revised Opening Hours For Aldi Stores During Early May Bank Holiday

May 05, 2025

Revised Opening Hours For Aldi Stores During Early May Bank Holiday

May 05, 2025 -

Budget Friendly Buys Great Value Without Compromising Quality

May 05, 2025

Budget Friendly Buys Great Value Without Compromising Quality

May 05, 2025 -

The Science Of Taste New Methods For Recording And Reproducing Flavor Profiles

May 05, 2025

The Science Of Taste New Methods For Recording And Reproducing Flavor Profiles

May 05, 2025 -

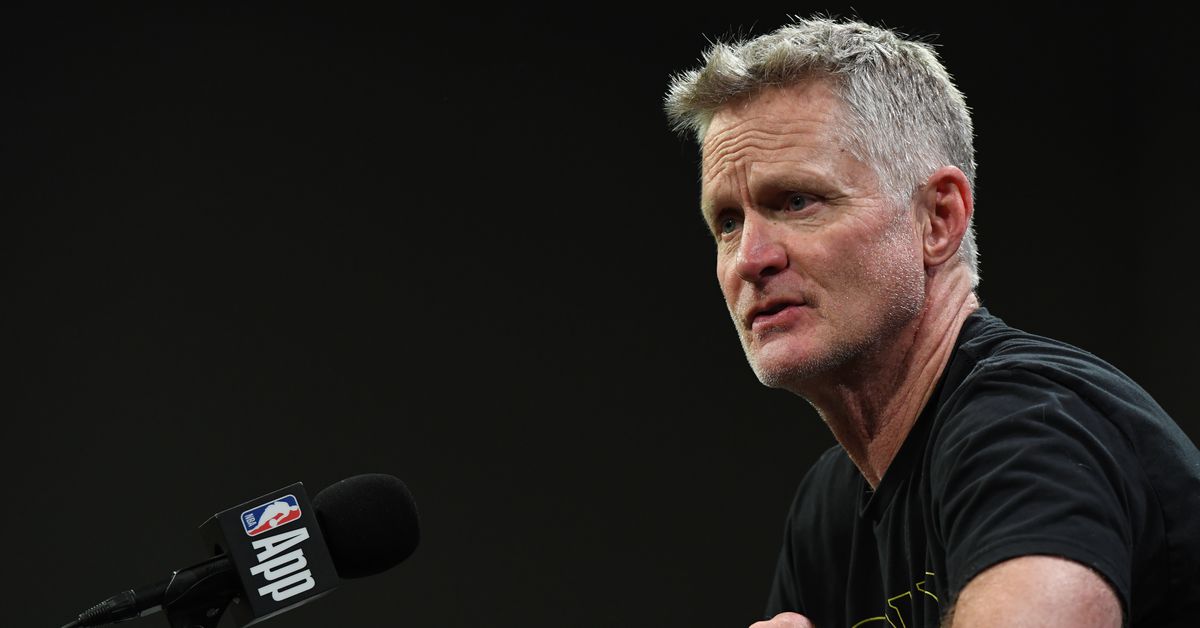

Golden State Warriors Game 6 Outlook Kerrs Assessment Vs Rockets

May 05, 2025

Golden State Warriors Game 6 Outlook Kerrs Assessment Vs Rockets

May 05, 2025